Metaplanet Reignites Its Bitcoin Frenzy With 1,004 New BTC

Metaplanet intensifies its bitcoin accumulation strategy with the purchase of an additional 1,004 BTC. This initiative strengthens its position among the world’s largest holders. In Asia, its approach surprises and intrigues, marking an unprecedented strategic turning point for a publicly traded Japanese company.

In brief

- Metaplanet buys 1,004 BTC and becomes the first publicly traded Asian company by bitcoin volume.

- Metaplanet pursues a rapid accumulation strategy with a BTC yield above 300%.

- Metaplanet’s goal: to reach 1% of the global bitcoin supply relying on structured financing.

Metaplanet surpasses the boundaries of traditional investment with bitcoin

In just a few months, Metaplanet has gone from a confidential technology player to an essential strategic investor in bitcoin. To date, the company holds 7,800 BTC, worth over 807 million dollars in digital assets. A position that places it tenth worldwide among publicly traded companies holding the most bitcoins.

In Asia, it now outranks all its competitors, clearly displaying its regional leadership ambitions. This radical shift towards bitcoin represents an unprecedented turn for a listed Japanese company, in a country historically cautious about digital assets.

Bitcoin: accelerated accumulation, impressive yields

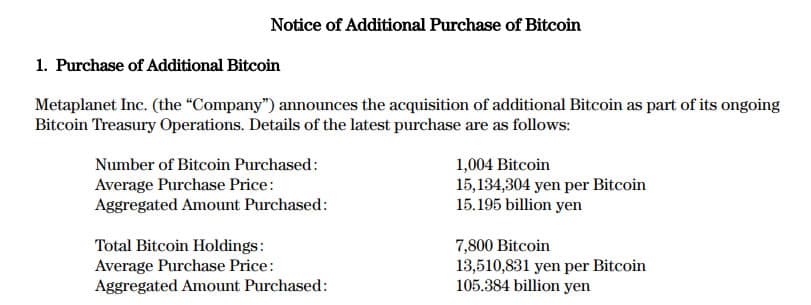

Metaplanet’s strategy is based on intensive bitcoin accumulation, with two major acquisitions in May 2025: first 1,241 BTC, then an additional 1,004 BTC for 15.2 billion yen. This second transaction, carried out at an average price of 15,134,304 yen per BTC, brings its total investment to over 105 million dollars. The company now aims for Galaxy Digital’s 8,101 BTC to move into the world’s top 9.

This purchase pace is accompanied by remarkable performance. The BTC yield reaches 309.8% in Q4 2024, 95.6% in Q1 2025, and already 47.8% in Q2 2025. Metaplanet does not just buy: it optimizes and rigorously monitors its performance using proprietary indicators like BTC Gain and BTC ¥ Gain to assess the real profitability of its strategy.

Subscription warrants and Asian dynamics

To support its bitcoin expansion, Metaplanet adopts structured financing based on the issuance of subscription warrants. This approach offers a double advantage:

- raising capital quickly without resorting to traditional debt;

- maintaining maximum exposure to bitcoin’s potential upside.

The company issues diversified series of warrants, allowing it to:

- limit dilution for existing shareholders;

- precisely calibrate its needs based on market opportunities.

This bold, yet rigorous strategy attracts the attention of Asian markets, still unaccustomed to financial models so exposed to cryptocurrencies. Drawing inspiration from Strategy, Metaplanet creates a Japanese version of bitcoin investment that is more cautious but equally ambitious.

With a sustained accumulation strategy, Metaplanet now surpasses El Salvador in bitcoin volume held and aims to reach 1% of the global supply. This unique positioning disrupts Asian financial standards. But can this approach become a sustainable model or does it remain a bold exception in the crypto ecosystem?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.