Seventeen years after the publication of the white paper by Satoshi Nakamoto, bitcoin is no longer a niche bet. It is a global asset worth 2 trillion dollars. Yet, on this October 31, the market turns the page on a thwarted "Uptober." October closes in red for the first time since 2018. A signal to be read carefully, without melodrama.

Crypto News

While institutional interest in cryptos is rising again, the decisions of major players capture all the attention. This November 1st, Ripple plans to unlock 1 billion XRP, which is more than 2.4 billion dollars at the current price, from its escrow accounts, as part of a mechanism established in 2017 to regulate the supply. A regular operation, but one that, in the current climate, raises questions about liquidity strategies and market balance.

Despite the paralysis of the federal government, Republican lawmakers are staying the course on their ambitious crypto schedule. Several key senators say they want to pass a landmark digital assets law before the end of the year. But will this promise hold against the budget deadlock blocking Washington?

The Basel Committee's rules on cryptocurrencies could change the game in 2026. Between bank adoption of stablecoins and crypto integration, a financial revolution is underway. Are banks ready to take the leap? The answer could change everything for your investments.

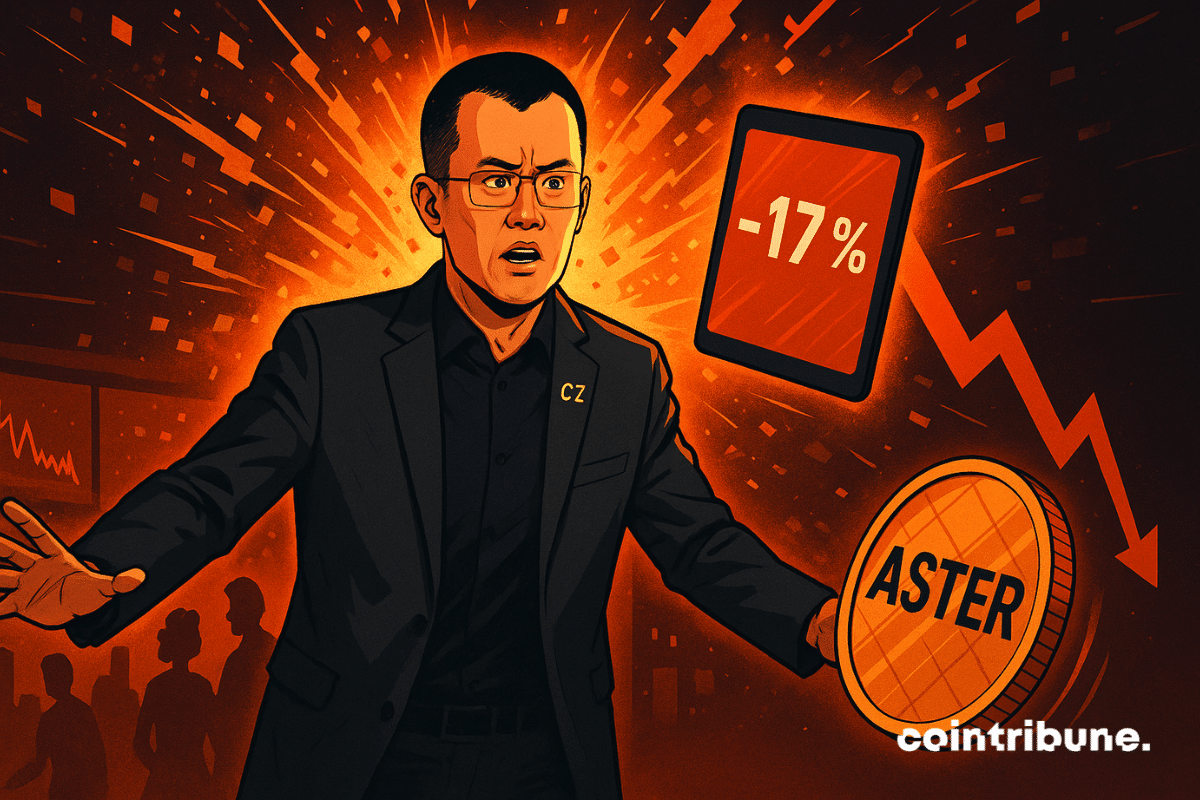

A false information involving Changpeng Zhao in an alleged massive sale of ASTER tokens triggered a real earthquake on the crypto markets. The token of the decentralized platform Aster plummeted sharply, dragging millions of dollars in liquidations behind it. But what really happened?

In October, the Bitcoin market confirmed its vitality despite a sharp price correction. Spot volume exceeded 300 billion dollars, a sign of a return to "cash" trading and a reduction in leverage usage. According to CryptoQuant, this dynamic reflects a healthier market, capable of withstanding volatility without a sudden collapse. In short, despite the drop in BTC, investors, whether retail or institutional, show renewed confidence in the spot market, marking a structural evolution of the market towards greater stability.

The crypto derivatives market has just reached a strategic milestone. XRP and Solana surpass 3 billion dollars of open interest on the CME, a threshold until now reserved for heavyweights such as Bitcoin and Ethereum. This rapid rise propels these two tokens to the frontline of institutional financial products, marking a silent but decisive repositioning in the crypto hierarchy.

With scammers growing more sophisticated, Binance outlines essential security measures to protect user accounts.

Bitcoin has once again shaken the market—dropping over 10% in just a few hours, dragging Ethereum and the entire market into a whirlwind of panic. Traders held their breath, and the age-old question echoed loudly once again:

In 2025, crypto breaks all records: entrepreneurs become billionaires in a few months thanks to spectacular fundraising and bold secondary sales. But behind these express fortunes hide major risks and burning questions. Who will withstand the test of time? Dive into the behind-the-scenes of this digital gold rush.

The crypto market, already known for its volatility, has just experienced another major shock. In just 24 hours, over $1.1 billion has been liquidated, revealing the ecosystem's fragility against increasingly influential macroeconomic forces. The fluctuations of bitcoin and altcoins have not escaped investors' attention, who saw their positions swept away by this wave of liquidations, increasing the risks associated with this uncertain market.

Seven Democratic senators raise concerns over Trump’s pardon of Binance’s CZ, citing possible connections to the Trump family and risks to law enforcement.

Visa is incorporating four stablecoins across four blockchains to enhance global payments and streamline transactions.

Mastercard is in late-stage negotiations to acquire stablecoin infrastructure provider Zerohash for an estimated $1.5 to $2 billion, according to a Fortune report citing five people familiar with the matter. The deal would position Mastercard among a growing number of global financial firms investing heavily in blockchain-based payment technology.

Michael Saylor sees bitcoin soaring to the skies, Wall Street is converting... What if the crypto guru was still right despite geopolitical turbulence?

Rising debt levels and growing concerns over financial stability are driving investors toward crypto and gold as safe-haven assets. BlackRock CEO Larry Fink described this shift as a response to mounting fears about government debt and the declining value of money.

For nearly ten years, the last week of October has been known to offer bitcoin a bullish surge, to the point of being nicknamed the "golden week." But this year, despite a promising Uptober month, the momentum is slowing down. The king of cryptos defies expectations, sowing doubt among investors accustomed to now weakened seasonal patterns.

While the European Union is preparing to fully deploy the MiCA regulation by the end of the year, Germany voices a dissenting opinion. The main opposition party, the AfD, has just submitted a shock motion to the Bundestag. It demands that bitcoin be recognized as a strategic reserve asset, distinct from other cryptos. This unexpected position questions the uniformity of the European regulatory framework and could pave the way for a revision of the institutional treatment of bitcoin within member states.

Bitcoin and Ethereum ETFs suffered massive withdrawals on Wednesday, October 29, totaling more than 550 million dollars in a single day. Fidelity, BlackRock, and ARK Invest are among the victims of this wave of redemptions that reflects a sharp change in sentiment. But is this a simple correction or the prelude to a deeper movement?

Gold has just suffered a staggering 10% drop in 6 days, a rare collapse that has occurred only 10 times in 45 years. Meanwhile, Bitcoin resists and shows surprising stability. Should this be seen as a warning sign? Are traditional safe-haven assets losing their crown?

The boundary between traditional finance and the crypto universe blurs a little more each day. After years of mistrust and volatility, the major Wall Street players are finally extending a hand to the blockchain ecosystem. In this opening context, ConsenSys, the company behind the famous MetaMask wallet, is about to cross a decisive step: its public offering. An approach that symbolizes not only the sector's growing maturity but also the official entry of crypto into the institutional capital sphere.

Crypto mogul Changpeng “CZ” Zhao is weighing legal action against U.S. Senator Elizabeth Warren after she accused him of corruption tied to his recent presidential pardon. Her social media remarks, posted after former President Donald Trump pardoned Zhao, have ignited a political and legal storm involving one of the most prominent figures in global cryptocurrency.

Circle opens access to its Arc testnet, enabling developers and enterprises to explore new applications in digital finance.

After three years of forced exile, the crypto prediction platform Polymarket could reopen its doors to American traders in the coming weeks. A major regulatory breakthrough that would radically transform the landscape of prediction markets in the United States.

Western Union enters the stablecoin arena with an announcement that shakes up the established order. The giant of cross-border transfers, founded in 1851, plans to launch its own dollar-backed token, USDPT, on the Solana blockchain in 2026. Facing increasing pressure from crypto fintechs, the company is making a strategic shift to modernize its payment rails. This project marks a key milestone in the reconfiguration of global financial networks, where speed, stability, and accessibility become essential standards.

A Democratic legislator launches heavy artillery against the US president's crypto activities. Ro Khanna proposes to purely and simply ban Donald Trump, his family, and all elected officials from trading cryptos and stocks. An initiative that rekindles the debate on conflicts of interest at the top of the US state.

What if the future of monetary reserves no longer relied on gold or fiat currencies, but on bitcoin? In France, a bill supported by the UDR party plans to create a national reserve of 420,000 BTC. A groundbreaking initiative which, although driven by a minority parliamentary group, challenges the foundations of monetary sovereignty. At a time when states are groping with cryptos, this project revives a major strategic debate.

Canada is working on a clear regulatory framework for stablecoins ahead of the November 4 federal budget, aiming to support domestic digital currency.

The market watches Solana like one watches for a spark in an already hot engine. The noise around SOL ETFs is amplifying, order books are thickening, and volatility is reclaiming its role as conductor. The challenge is not just a "pump" of +10%: it's the shift of SOL towards a more regular, more institutional, therefore more demanding demand.

Japan has entered a new phase of digital finance with the launch of its first yen-backed stablecoin, JPYC. Developed by Tokyo-based fintech firm JPYC, the token aims to bring the stability of traditional finance into the expanding digital asset market—offering Japanese consumers and businesses a secure bridge between fiat and blockchain-based payments.