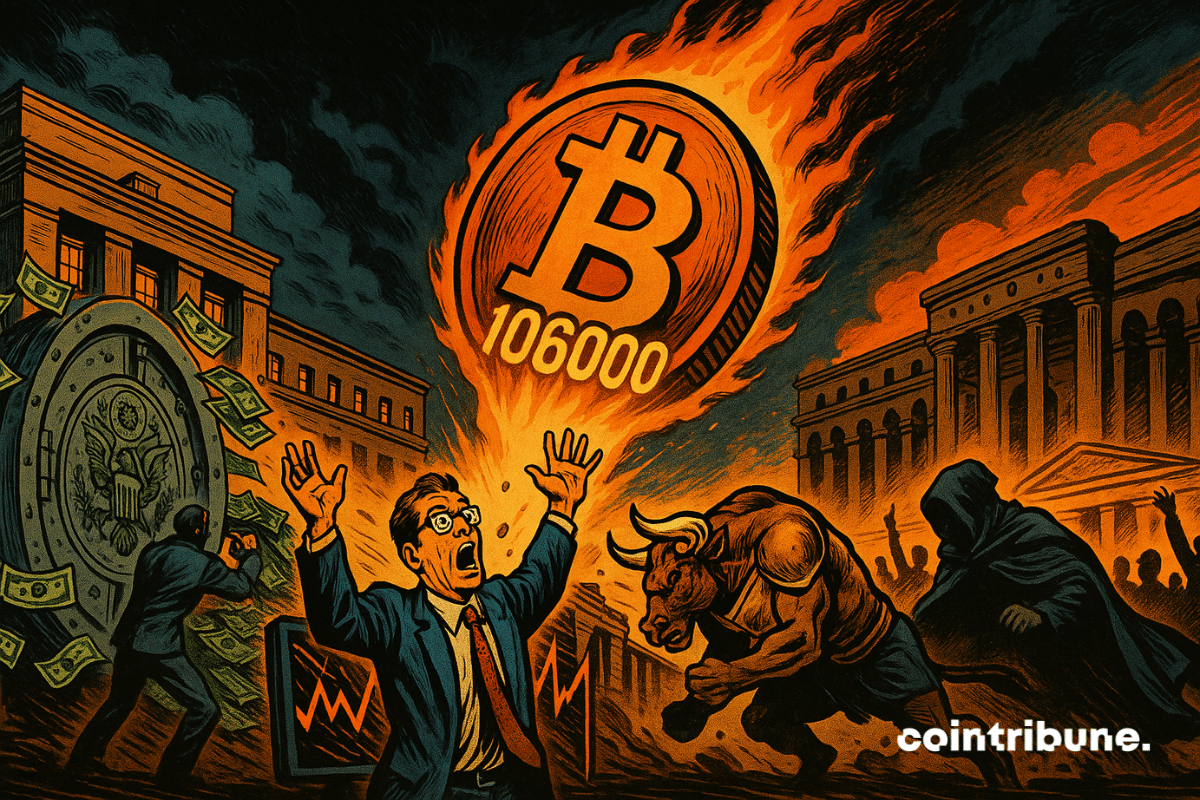

As the specter of a historic shutdown recedes in the United States, bitcoin has rebounded, surpassing $106,000. The Senate approved temporary funding, narrowly avoiding a prolonged paralysis of federal institutions. This political progress was enough to revive the appetite for risk, propelling the leading crypto into a bullish dynamic. In a market where Washington's decisions act as a catalyst, this return to stability strengthens the correlation between macroeconomic news and crypto investors' behavior.

Crypto News

As the American shutdown crisis nears its end, another signal captures crypto investors' attention. No less than eleven ETFs backed by XRP have just appeared on the DTCC website, the key body of the American financial markets. While this registration does not signify regulatory approval, it demonstrates a concrete step toward a possible listing on U.S. markets. It is a major technical milestone for XRP, which could revive institutional interest in the asset.

When crypto plays central banker, the Fed sweats under its suit. Stablecoins, hidden treasures, and plummeting rates: guess who really runs the world?

Bitcoin reaches $160,000 and may be ready to explode? In this article, discover why the crypto market is heating up again.

A recent token purge by Binance founder Changpeng Zhao (CZ) has brought unwanted memecoin drops back into the spotlight. His public donation address once again attracted developers seeking attention, and their deposits were removed in a decisive move signaling a firmer stance.

The CFTC is preparing to launch leveraged spot crypto trading as early as next month, introducing new oversight to protect investors and strengthen the market.

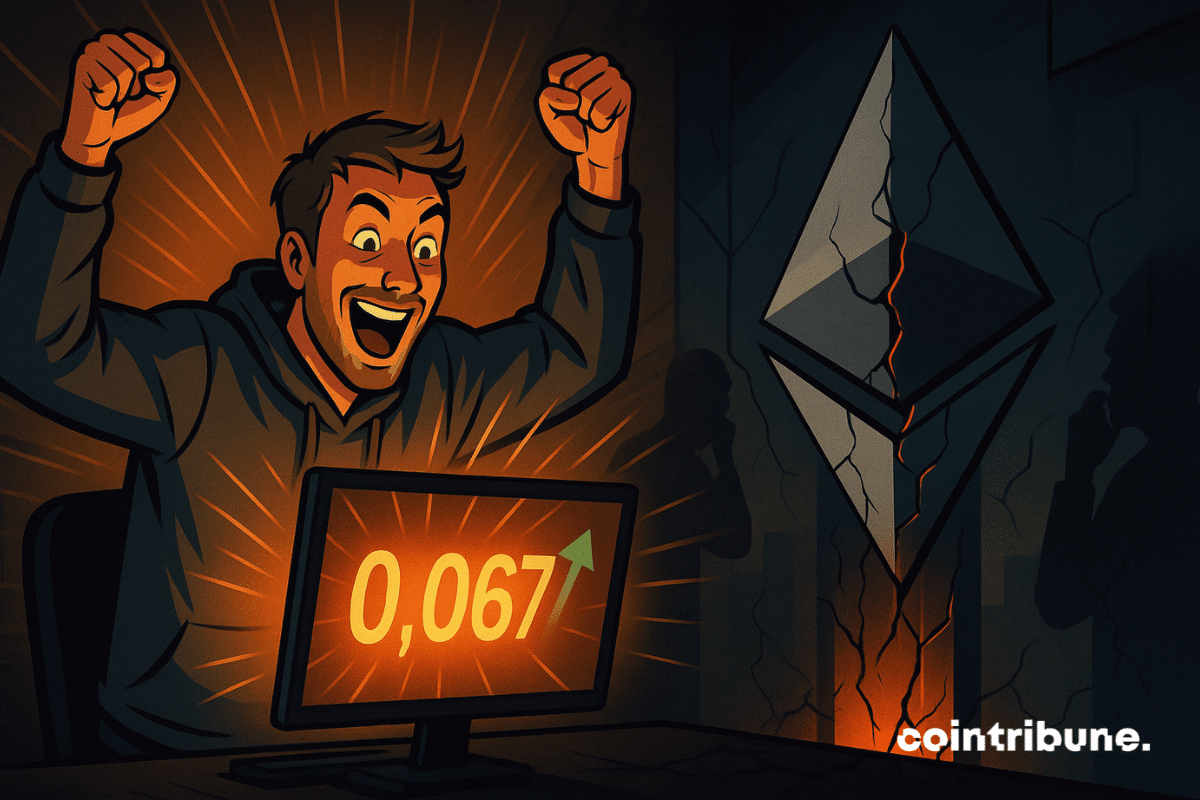

Making a transaction on Ethereum now costs only a few cents. This Sunday, gas fees plunged to 0.067 gwei, a level never seen in years. While traders praise this spectacular drop, it raises questions about the economic viability of Ethereum's model.

Facing growing economic tensions, Robert Kiyosaki announces strengthening his investments in bitcoin, gold, silver, and Ethereum. The author of "Rich Dad, Poor Dad" anticipates a major crash and states he is turning to tangible assets to preserve his capital. He once again criticizes U.S. monetary policy and makes strong forecasts for 2026: 250,000 dollars for bitcoin, 27,000 for gold.

Short shake, big signal. In one week, spot ETFs backed by ether recorded about $508M in withdrawals. At the same time, Bitcoin ETFs experienced notable outflows. The movement is not anecdotal. It says something about market sentiment, risk management... and how institutional investors are now calibrating their exposure to crypto assets.

Ripple parades with Mastercard and Nasdaq, raises 500 million… but XRP collapses. In the crypto world, golden speeches do not always prevent wallets from lightening.

Stablecoins are becoming the preferred cryptocurrency for illicit transactions, outpacing Bitcoin and drawing increasing scrutiny from regulators.

The countdown is on for an XRP ETF. Two asset management giants, 21Shares and Canary Capital, have initiated a legal procedure that could force the automatic approval of their funds within 20 days, unless the SEC explicitly vetoes it. In a climate where the institutionalization of cryptos is accelerating, this maneuver could propel XRP to the heart of regulated markets. This historic first places the American authority with a decisive choice or a silent deadline.

While Bitcoin and Ethereum flee wallets like the plague, Solana seduces the big players. What if the real crypto power was hiding behind well-structured staking?

In a crypto market marked by wait-and-see, Pi Network struggles to trigger a real recovery. Far from its promising beginnings, the asset now moves between consolidation levels and mixed technical signals. Some indicators show an improvement in flows but without a clear breakthrough of key thresholds. The momentum remains fragile, and the selling pressure latent. Between timid investor support and lack of a strong catalyst, Pi is going through a prolonged phase of uncertainty. The risk of technical deadlock persists.

Investors are cautious as crypto stocks face a rough week, with major firms seeing declines amid ongoing market and economic pressures.

Bitcoin wavers, and the market divides. While crypto suffers a drop of nearly 15% in a few weeks, a clear rift appears between small holders and institutional investors. While the former take advantage of the decline to strengthen their positions, the whales quietly liquidate thousands of BTC. This strategic gap, observed by the Santiment platform, could mark a decisive turning point in the market's evolution.

At JPMorgan, the message is clear: the appetite for bitcoin remains strong. In the third quarter, the bank stated it held 5.284 million shares of the iShares Bitcoin Trust (IBIT) as of September 30, an increase of 64% from the previous quarter. In value terms, this represented 343 million dollars at the end of September. The bet was accompanied by a bullish note: a target of $170,000 for bitcoin in twelve months. Let's talk numbers, flows, and the direction of the movement.

Dogecoin, the quirkiest crypto on the market, could soon enter institutional portfolios. Bitwise has filed a new spot ETF application with the SEC, removing the last administrative barriers. The green light could come within twenty days… triggering a new rush towards Elon Musk's favorite meme.

What if the promise of financial inclusion hides a major systemic risk? Popular in crisis-hit countries, stablecoins have become the preferred tool for millions of citizens to escape hyperinflation. However, behind this massive adoption, a growing concern: by channeling savings towards the digital dollar, these assets could weaken the most vulnerable economies. As their usage explodes, a dilemma arises: are stablecoins a bulwark for the people or a silent threat to states?

While bitcoin is bogged down in divisive institutional adoption, an old privacy token makes a spectacular comeback. In five weeks, Zcash (ZEC) went from obscurity to a +900% surge, reaching up to 735 dollars this Friday, an unprecedented high in nearly eight years. Stabilized around 666 dollars, the asset still shows a 74% increase over the week. This unexpected rebound shakes the market and revives the debate on crypto privacy.

While the crypto industry regains market confidence thanks to clearer regulation and growing interest from institutional investors, Ripple opts for an unexpected direction. Despite a legal victory against the SEC and a year of exceptional growth, the Californian company forgoes any public offering. A choice that contrasts with the ambitions of other industry players and raises questions about the company’s long-term strategy.

A milestone has just been reached. Addresses accumulating Bitcoin have purchased 214,069 BTC over 30 days and bring their aggregated stock to 387,305 BTC as of November 5. This surge is not due to chance: it relies on investors with a precise profile and on a market mechanism that has become, whether we like it or not, institutional.

Is Bitcoin losing ground where it was supposed to triumph? Cathie Wood, CEO of ARK Invest and a leading figure in crypto investment, has just lowered her most ambitious target for BTC. The reason is the rise of stablecoins in emerging economies, where they are establishing themselves as a new store of value. A strong strategic adjustment that questions the real role Bitcoin will play against these dollar-backed alternatives.

What if the role of store of value promised to bitcoin in emerging economies was slipping away? This is a hypothesis that Cathie Wood, founder and CEO of ARK Invest, now seems to take seriously. Known for her strong convictions about the potential of bitcoin, the investor now lowers her most optimistic scenario, citing an unexpected dynamic: the meteoric rise of stablecoins as an alternative to BTC in certain regions of the world.

The boundary between crypto and politics is becoming clearer. By now allowing the legal purchase of firearms with USDC, Circle brings the issue of financial neutrality to the forefront. This decision, praised by some and contested by others, reveals tensions between the promise of decentralization and institutional realities, while reigniting the debate on what crypto can or cannot allow within a legal framework.

The U.S. government is going through the longest shutdown in its history with 36 days of blockage. This unprecedented situation directly threatens the adoption of crucial cryptocurrency legislation. The results of the midterm elections further complicate negotiations.

Bitcoin remains below $105K as heavy selling keeps the market under pressure while traders watch the upcoming U.S. tariff ruling.

Robinhood delivered another strong quarter, posting sharp gains in revenue and profit as crypto activity surged. Markets pulled back slightly after hours, but the company’s year-to-date rally remains among the strongest in publicly traded fintech and crypto-adjacent firms.

Senators continue work on the crypto market structure bill and are set to discuss key details with David Sacks.

Prediction markets are about to disrupt crypto finance, and Gemini has just made the move. Between disruptive innovation, tense regulation, and Ethereum’s key role, this revolution could redefine investment. Analysis of the stakes and opportunities not to be missed.