American crypto exchange Kraken has completed an ambitious tour of France with 21 stops across the country. Stated objective: move beyond major metropolitan areas to meet users in the regions. This unprecedented initiative reveals a deeper strategy for conquering the French market.

Crypto News

A BNB whale fell victim to a $13.5 million phishing attack on Venus Protocol. The platform paused operations, but the stolen funds were later recovered.

American crypto-focused prediction platform Polymarket has been granted operational greenlight after the U.S. Commodity Futures Trading Commission (CFTC) issued a no-action notice to two entities linked to the company. This action follows the application for regulatory relief in July.

The United States has leaped to the second spot on the Chainalysis 2025 Global Adoption Index due to regulatory clarity and increased ETF adoption. India retained its leading position as the third consecutive global leader, and Pakistan, Vietnam, and Brazil were the top five. This ranking reflects a broader trend, crypto adoption is expanding rapidly in both mature markets with clearer rules and emerging economies where digital assets address real financial needs.

The President of the European Central Bank steps up against dollar-backed stablecoins. During a conference in Frankfurt, Christine Lagarde demanded "firm" guarantees for any foreign issuer wishing to operate in the EU. A strong signal of European fears regarding the growing influence of the greenback in cross-border digital payments.

While bitcoin and Ethereum take center stage, Solana (SOL) quietly establishes itself as the new asset to watch. Driven by strong technical signals and record interest in derivative markets, the crypto is now assigned a target of $1,000. However, behind this bullish momentum lies a paradox: real activity on the network is collapsing. Between speculative frenzy and on-chain exhaustion, Solana intrigues as much as it questions.

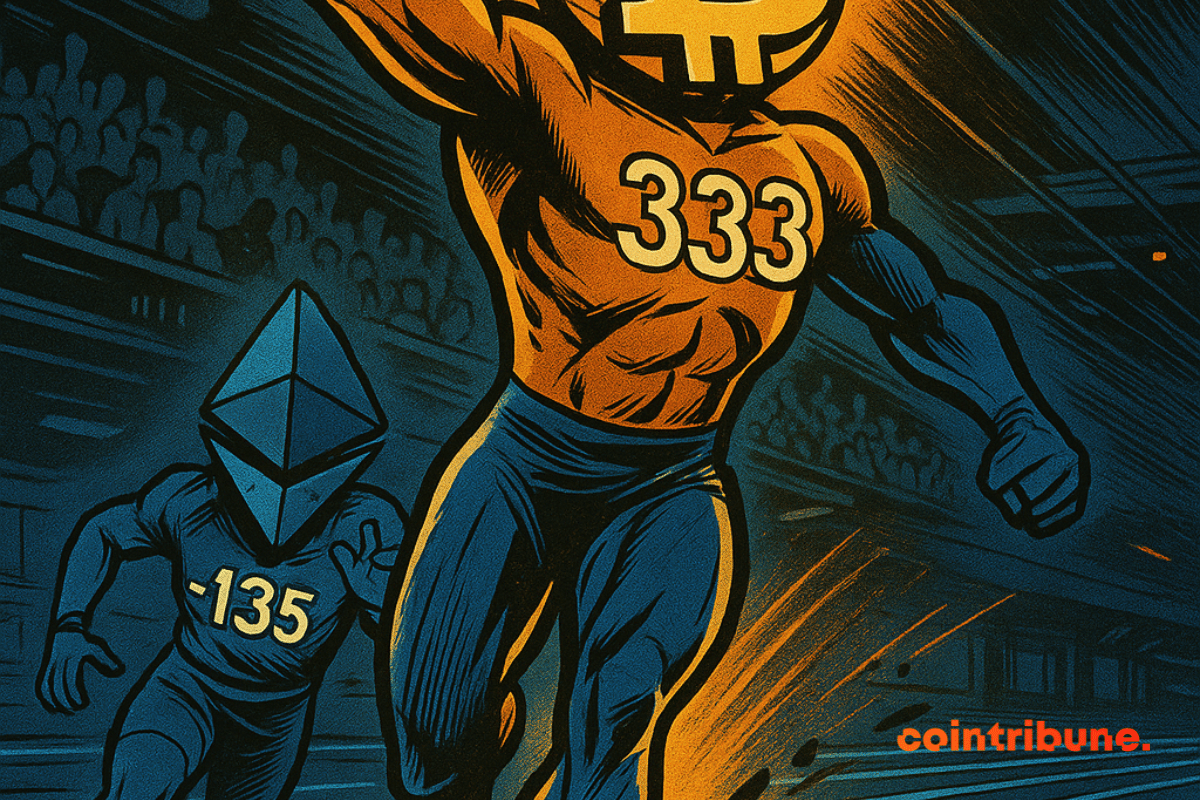

September starts with a marked contrast on crypto ETFs: Bitcoin captures $333M in inflows, while Ether suffers $135M in outflows. This movement confirms bitcoin's place as a safe haven, but the decline in overall volume ($3.93B) and net assets ($143.21B) highlights persistent caution in the crypto market. Crypto ETF flows reveal a clear divide between triumphant Bitcoin and struggling Ether. This crypto dynamic reflects a strategic repositioning by investors, strengthening confidence in Bitcoin despite the caution.

Bitcoin sulks, altcoins stir: 55% dominance and tokens lying in wait... But who will really take the pot by December?

September, long synonymous with a downturn for bitcoin, seems to be losing its curse. This historically unfavorable month for risky assets is starting, for the third consecutive year, a contrary dynamic. Supported by a flexible macroeconomic context and structuring institutional flows, the market is giving signs of maturity. The queen of cryptos no longer suffers the calendar: she redefines it.

Regulated exchange platforms can conduct spot cryptocurrency trading activities, according to a joint statement by the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) on September 2, 2025. This policy clarification marks a key regulatory step that could help drive crypto trading and promote investor protection.

In August, bitcoin miners generated revenues close to 1.65 billion dollars, a level almost identical to that of July. This maintenance reflects an impressive resilience of the sector, despite a context marked by rising costs and energy pressure. But behind this apparent stability lie structural vulnerabilities that raise questions: can the current mining model really hold in the long term?

Gemini has officially filed for its IPO, a step that could bring the decade-old platform to Nasdaq under the ticker symbol GEMI.

Bitcoin’s recent 12% pullback has drawn attention, but on-chain data indicates that this correction is a normal phase in the market. Analysts say the decline is within historical patterns and reflects a healthy reset rather than the end of the ongoing bull cycle.

SWIFT CIO Tom Zschach says resilience isn’t about surviving lawsuits. Banks prioritize trust, compliance, and governance over legal wins.

Despite a major update to version 23 of its protocol, Pi Network struggles to spark market enthusiasm. In a sector where every innovation is scrutinized to revive bullish momentum, the announcement of technical advances inspired by Stellar Protocol 23 and the integration of new functionalities were not enough to boost its token price. This dissonance between technological progress and stock market inertia raises questions about the project's ability to convert its evolutions into real value.

Since the beginning of September, bitcoin (BTC) and Ethereum (ETH) have captured the attention of a crypto market suspended between hope and concern. While Wall Street falters, the two leaders show intriguing resilience. Yet, behind this apparent calm, technical indicators reveal growing tension. Between contradictory signals and increasingly polarized forecasts, traders are preparing for volatility that could make September a decisive month for the market's future.

Solana is about to change dimension. On September 2, the network massively validated Alpenglow, an ambitious overhaul of its consensus protocol. Much more than a technical optimization, this update marks a strategic break: offering performance worthy of traditional finance while maintaining the foundations of Web3. In an ecosystem where every millisecond counts, Solana wants to take a lead over the competition and establish itself as the reference infrastructure for decentralized markets.

As September begins, crypto traders approach the market cautiously, with Bitcoin, Ethereum, and XRP showing varied performance.

Ethereum plays the tightrope walker: programmed drop, then theatrical rise. September trembles, October rejoices. Crypto traders? They might applaud... after getting trapped.

The market for tokenized gold has reached new all-time highs, crossing $2.57 billion in market cap, as spot gold itself approaches its April peak. The rally shows renewed demand for gold-backed crypto tokens as investors seek safe haven assets amid global uncertainty.

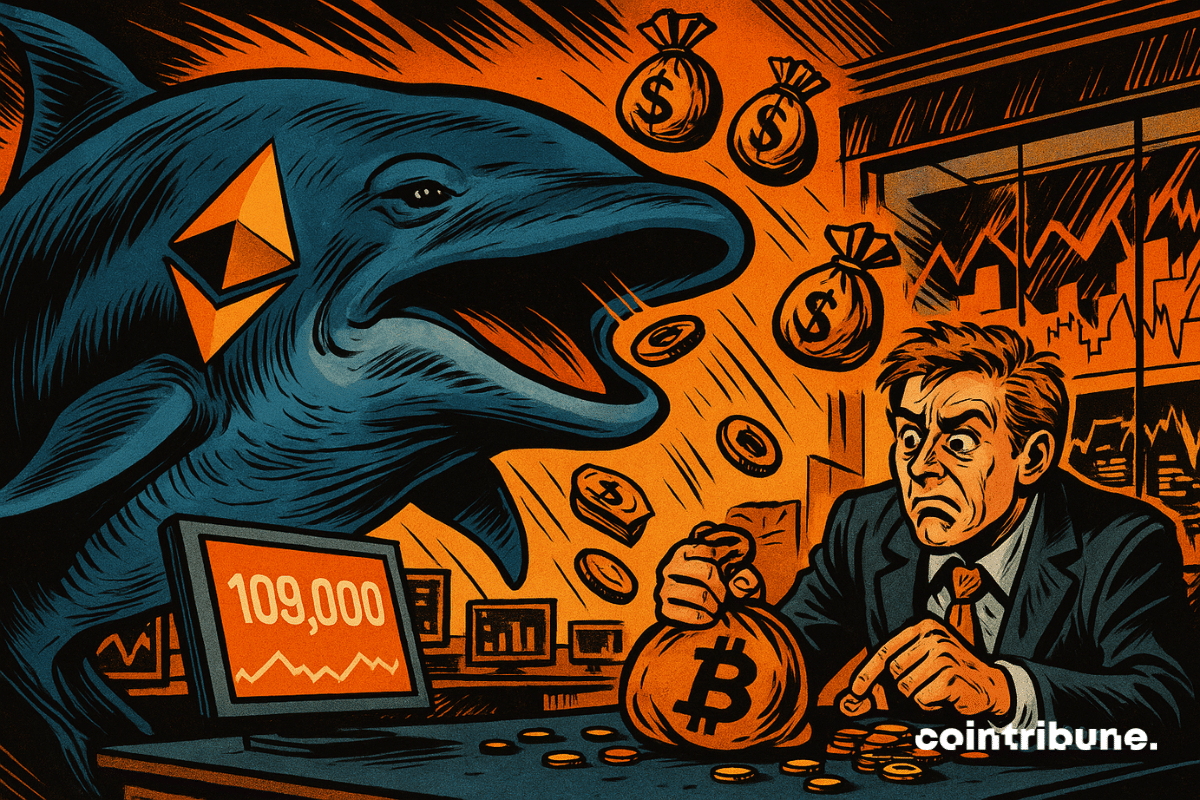

Bitcoin wavers below 109,000 dollars, caught between macroeconomic uncertainty and unfavorable technical signals. While investors scrutinize upcoming indicators likely to guide US monetary policy, the pressure intensifies. Institutional capital outflows, tensions in derivatives products, and weakened sentiment indicators increase distrust. The market freezes in anticipation, exposed to latent volatility.

Rumors are circulating about the possible kidnapping of a CEO of a crypto platform that allegedly took place this morning in Le Bourget in the 93. A video is circulating showing the kidnapping live. For now, no official confirmation has been given by police services.

This Monday, the World Liberty Financial (WLFI) project, supported by the president and his close associates, proceeded with the unlocking of 24.6 billion tokens. An operation that values their stake at nearly 5 billion dollars. Presented as a technical launch, this initiative fuels suspicions about Trump’s growing influence in a sector he now helps shape.

Ethereum takes the prize for the big players, Bitcoin clings to its throne. A duel of numbers, egos and billions: who will emerge victorious from this digital waltz?

While bitcoin's volatility worries some investors, Michael Saylor, a prominent figure at Strategy, is more confident than ever. For him, the crypto winter now belongs to the past and gives way to a new era. Can bitcoin really cross, one day, the mythical one million dollar threshold?

Solana has reached a decisive milestone with the massive approval of Alpenglow, an upgrade set to disrupt its operation. This decision paves the way for unprecedented acceleration of transactions, bringing the blockchain closer to the speeds of modern Internet infrastructure. Ecosystem players see this change as an opportunity to strengthen competitiveness against Ethereum and Bitcoin. Alpenglow thus marks the beginning of a new technological era for a network seeking to combine speed and reliability

The Japanese company Metaplanet, which holds one of the largest corporate bitcoin reserves in the world, sees its accumulation strategy threatened by the collapse of its stock price. With a 54% drop since June, the company must reinvent its funding mechanism to pursue its crypto ambitions.

Anthony Scaramucci, the founder of SkyBridge Capital, has projected a turbulent path for Bitcoin before it eventually climbs to half a million dollars. Speaking with Coinage, the veteran investor warned that the cryptocurrency could face a sharp decline of up to 40%, even as he maintains confidence in its long-term potential.

August was marked by two opposing signals in the crypto market. Ethereum reached an unprecedented peak of activity, confirming the growing interest of investors in its ecosystem. Conversely, Bitcoin suffered a brutal shock after the massive liquidation of 24,000 BTC by a single actor. This contrast is not just a technical divergence. It illustrates an ongoing rearrangement, between regulatory innovations, strategic repositioning of players, and the evolution of the balance of power between major assets.

Trump, crypto and millions at stake: WLFI unlocks its tokens, promises of a jackpot or a new speculative prank? Investors oscillate between euphoria and suspicion.