21Shares aims to bring SEI to traditional investors with a proposed ETF, now filed with the U.S. Securities and Exchange Commission.

Crypto News

Bitcoin is currently undervalued according to JPMorgan. In a note signed by analyst Nikolaos Panigirtzoglou, the American bank estimates that BTC should reach 126,000 dollars by the end of the year, given its historically low volatility. As its risk-return profile approaches that of gold, bitcoin may be entering the most critical phase of its institutional adoption. This is a projection full of meaning for major capital allocators.

Since the beginning of the year, Solana (SOL) is clearly lagging behind Ethereum (ETH), which has returned to its highest levels. But behind this apparent underperformance, some analysts see a strategic opportunity for investors. Should we then take advantage of this moment to position ourselves on Solana?

Bitcoin stands at a crossroad as traders anticipate a number of forthcoming macroeconomic announcements. At the time of writing, the flagship cryptocurrency was trading around $112,787, a small gain of 0.30% per day, but a weaker performance over the week. Despite the resilience of Bitcoin, analysts are cautious that the short run direction of Bitcoin will rely on how investors will respond to major levels of support and resistance in the coming days.

Coinfest Asia 2025 transformed Bali’s Nuanu Creative City into the world’s largest crypto festival, attracting over 10,000 participants from 90+ countries. Across two days, the event combined 300+ speakers, 100+ sessions, and 100+ side events with immersive activities, live music, Balinese cultural showcases, and many more. More than a conference, Coinfest Asia felt like a crypto celebration—where innovation meets adoption and Web3 came alive on the island.

The custody of cryptos shifts to a new era. Indeed, exchanges, long dominant, are giving ground to Wall Street giants. BlackRock, through its Bitcoin and Ethereum ETFs, now establishes itself as an essential custodian, directly competing with Coinbase and Binance. This massive asset transfer illustrates the rise of traditional finance in the crypto ecosystem and raises questions about the future of historic platforms, facing a gradual loss of their central role.

Van Eck highlights Ethereum as a Wall Street token, positioning it at the centre of the growing stablecoin market.

Coinfest Asia 2025, the world’s largest crypto festival, officially opened at Nuanu Creative City in Bali, bringing together 10,000 attendees from more than 90 countries. With 300 speakers and 100 side events, the opening day underscored Southeast Asia’s role as a key driver of Web3 adoption, blending industry insights, culture, and community into one immersive experience.

The US Secretary of Commerce, Howard Lutnick, will publish economic data, starting with GDP, directly on the blockchain. Presented at the White House with Donald Trump, the initiative aims to strengthen trust and experiment with blockchain in public administration.

Dogecoin is once again at a critical stage, as its largest holders reduce their exposure, while market signals indicate further downside risk. DOGE, the meme coin that surged to a multimonth high earlier this summer, now faces strong selling pressure, declining network activity, and bearish technical patterns that could push its price much lower.

MetaMask now lets users send and receive Solana using human-readable .sol names, simplifying transactions and wallet access.

Metaplanet is raising $880 million through an overseas share sale, with $835 million earmarked to expand its Bitcoin holdings.

Coinbase’s Layer-2 blockchain Base has taken a big leap in the NFT market, securing the third spot in global 30-day NFT trading volume.

While the crypto market oscillates between euphoria and uncertainty, XRP is the subject of a serious warning. According to analyst Benjamin Cowen, the crypto could experience one last drop before reaching its cycle peak. This analysis, based not on promises but on historical technical signals, calls for caution.

Institutional-grade technology will enhance the integrity of the world’s second-largest cryptocurrency exchange. The surveillance platform combines advanced pattern analytics with comprehensive market data to meet MiCAR obligations.

Donald Trump Jr. joins Polymarket’s advisory board as the platform gains new investment and grows its role in prediction markets.

SharpLink Gaming has continued its aggressive Ethereum accumulation strategy, disclosing another major purchase of $252 million in ETH last week. The move brings its total Ethereum treasury to nearly 800,000 ETH, valued at around $3.7 billion, while leaving the company with $200 million in cash reserves for additional buys.

Bitcoin clears the space around it: small ones slip away, the big ones get richer. Meanwhile, the network coughs, fees drop, and ETFs flee.

The world's second largest crypto has achieved a historic feat by reaching a market capitalization of 500 billion dollars faster than any other major company or even Bitcoin. This achievement is accompanied by a doubling of gains for long-term holders. But how far can ETH climb before profit-taking rekindles volatility?

An exceptional technical show of force is currently shaking the crypto ecosystem. Qubic now controls 58% of Monero's (XMR) total hashrate during its marathon periods, setting a new record of computational power while simultaneously proving that technical innovation and responsibility can coexist. This remarkable performance illustrates the unique capabilities of the Qubic network and its revolutionary vision of Useful Proof of Work.

Meme coins tumbled as Dogecoin, Shiba Inu, and Pepe extended losses, with prices and open interest showing fading confidence.

A group of leading digital asset firms is preparing to form the largest Solana-focused treasury in the market. Galaxy Digital, Multicoin Capital, and Jump Crypto are reportedly working with Cantor Fitzgerald to raise $1 billion for SOL purchases, according to a Bloomberg report published on Monday.

B Strategy is launching a $1 billion BNB treasury to actively grow the Binance ecosystem, leveraging U.S. listing and Asia-Pacific support.

Ethereum’s liquid staking ecosystem has seen a serious surge over the past three months, with roughly 690,000 ETH, valued at $3.2 billion, entering protocols since mid-May. The rapid inflows highlight both investor demand for staking yields and the consolidation of power among leading protocols.

Onchain analytics platform Bubblemaps has published a detailed investigation suggesting that crypto figure Hayden Davis (also known as Kelsier) may have been behind a coordinated snipe of the newly launched $YZY token, allegedly generating $12 million in profits.

When bitcoin falters, whales sell, small holders pick up, and the Fed sneezes. Crypto, this monetary theater where everyone plays their part... often without knowing the script.

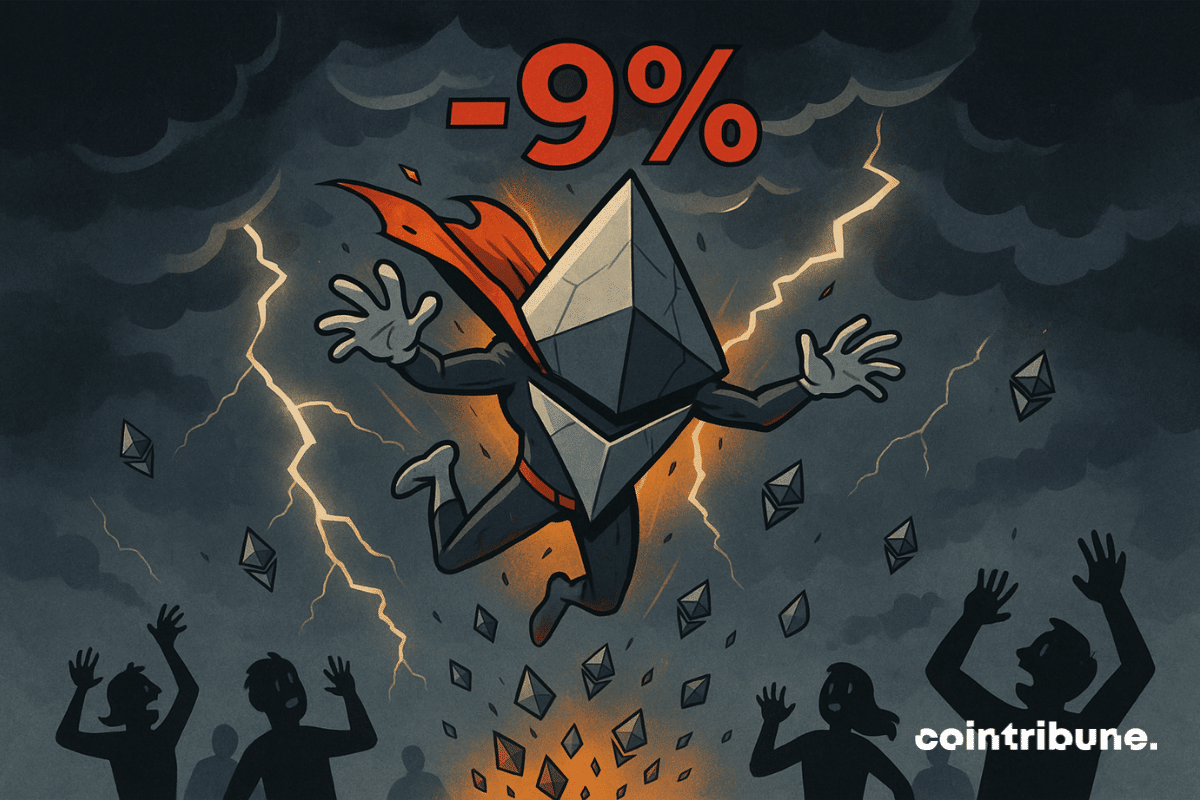

In a few hours, Ethereum went from euphoria to retreat. On August 24, the crypto reached an all-time high of 4,955 dollars before losing nearly 9% shortly after, with 60 billion dollars of capitalization going up in smoke. Such a brutal correction, occurring in an already fragile market, recalls the fragility of bullish rallies in an environment still largely driven by speculation.

While the crypto market is going through a summer lull, one asset draws attention: XRP. Trapped in a tight chart pattern, it is approaching a decisive breakout point. Technical analysis leaves little doubt. A major move is looming, either upward or downward. In a context of general uncertainty, all eyes turn to this crypto whose next few days could well redefine its path.

While bitcoin briefly fell back to 112,000 dollars, MicroStrategy seized the opportunity to increase its strategic stock. Michael Saylor, the largest public holder of BTC, maintains his bet on bitcoin despite now reduced acquisitions.

In August, Ethereum reached 14.98% dominance, its highest since September 2024, accompanied by a historic record. At the same time, Bitcoin fell to 58.2%, its lowest since January 2025. This shift reflects a capital reallocation within the crypto market: whales, notably on Binance, are now accumulating ETH, confirming that Ethereum is no longer a mere supporting actor but a real growth asset compared to Bitcoin, still seen as a safe haven.