While Bitcoin continues to dominate headlines and attract capital, an old rival is waking up with rare intensity: XRP. This Ripple token, long stuck in a corridor of indifference, has just slammed the door on the technical status quo. And this time, the offensive is taking shape against Bitcoin.

Crypto News

Tether is taking down its posters of abandoned blockchains to better align with crypto stars: while some lament Omni, others are already celebrating on Ethereum and Tron.

With the institutional crypto community increasingly focused on token efficiency, reports indicate that Shiba Inu has seen its burn rate surge by more than 10,700% in recent days. This sets the stage for an even larger single-day burn event.

In just a year and a half since the launch of the first U.S. spot Bitcoin ETFs, institutional investors have poured over $50 billion into crypto through regulated financial products. The message is clear: Bitcoin is going mainstream, and it's happening fast.

BlackRock’s iShares Ethereum ETF led a major surge in ETH fund inflows this week, signalling rising institutional demand.

While traditional markets struggle to gain momentum, bitcoin reaches a new all-time high. Fueled by a wave of regulatory optimism in Washington, the crypto sphere is excited. This surge is not just a simple technical rebound or an isolated influx of capital. It coincides with a major political turning point: the House of Representatives is set to review a set of laws that could reshape the contours of the crypto sector in the United States. The market is anticipating, and prices are soaring.

The discreet transfer of 10,000 ETH by the Ethereum Foundation to SharpLink Gaming, at a price below market value, raises eyebrows. This private deal, concluded before a spike in the price above $3,000, raises questions about the strategic management of Ethereum's reserves. In a context of record inflows into Ether ETFs, this operation may signify a turning point: ether is no longer a speculative asset; it is becoming a financial lever integrated into the treasuries of influential companies.

While Wall Street counts its points, Bitcoin takes the prize, ridicules the S&P 500, and shoots at full speed into the coffers of a stunned BlackRock. Who would have believed it?

Crypto is at a crossroads. Under the cold neon lights of the Capitol, the fate of a digital world is being decided with ink and calculations. Starting from July 14, Washington begins its "Crypto Week": a decisive parliamentary sequence where three major bills will be debated. Three texts, three possible directions for the future of digital assets in the United States.

The crypto markets are gearing up for a decisive day with the simultaneous expiration of over 5 billion dollars in Bitcoin and Ethereum options. This massive expiration comes as Bitcoin reaches new historical highs beyond 118,000 dollars. But what do these data reveal about investor sentiment, and what movements should we anticipate?

Bitcoin surpassed the 118,000 dollar mark this Friday morning, just two days after setting a historical record above 112,000 dollars.

Ethereum has climbed back to $3,000, driven by rising institutional purchases and increased futures market activity, signaling renewed bullish momentum.

It is no longer just a sudden rise; it is a controlled explosion: bitcoin has just reached $118,000, driven by an institutional appetite rarely seen in the history of crypto. Meanwhile, Ethereum exceeds $3,000, like a second wind in this dizzying ascent. But how far can this madness go?

The American giant Coinbase has just formed a partnership with Perplexity AI, the search engine powered by artificial intelligence. This collaboration promises to transform access to real-time crypto market data. An advancement that could well redefine trading practices in the era of AI robots.

The CEO of Bitwise is extremely bullish. He aims for $200,000 for a bitcoin by the end of the year and $1 million by the end of the decade.

Bitcoin continues to defy predictions. While some declared it to be out of breath after its recent peaks, the market shows clear signs of a resurgence. This is no longer just fevered speculation: on-chain data paints a much more nuanced, yet terrifically optimistic picture. Heading towards $130,000, the indicators proclaim. The inflection point is approaching, and the signals are clear: Bitcoin is far from having said its last word.

"While the dollar plays the tightrope and Trump brandishes his tariffs, Washington unveils a crypto-crutch: stablecoins, a techno remedy or a digital mirage of a wavering empire?"

As Bitcoin sets a new record, an unexpected segment of the crypto universe reasserts itself: memecoins. Once regarded as mere speculative curiosities, they now attract massive trading volumes and unprecedented media attention. Digital irony becomes the engine of the market, sometimes eclipsing so-called serious projects.

Bitcoin has just crossed the $116,000 mark, reaching an unprecedented peak that triggered massive liquidations in the derivatives market. This meteoric rise exposes the extreme vulnerability of short positions, swept away by the strength of the bullish movement. Beyond the technical shock, this historical crossing raises concerns about market balance and the new power of institutional flows.

While Trump dreams of tariffs and inflation recedes, Bitcoin rises... but how far? At $113,804, the oracles are stirring and the short-sellers are biting their nails.

The first half of 2025 saw massive crypto liquidations driven by market shocks and policy shifts, but recovery signs are now surfacing.

The crypto market is entering an important phase, with Shiba Inu, Ethereum, and Dogecoin all showing serious volatility. Traders are closely watching these coins as technical patterns hint at potentially explosive price moves, if the right conditions line up.

American online NFT marketplace OpenSea has taken a major leap toward becoming an “on-chain everything app.” In a Tuesday disclosure, the NFT platform announced the purchase of Rally, a mobile-driven Web3 platform, thus bringing token and NFT trading to the doorstep of mobile phone users.

No one bets on a campfire when the rain is falling. Yet, NFTs continue to crackle, even in the downpour. While trading volumes shrink quarter after quarter, sales are holding firm: $2.82 billion collected in the first half of 2025. Fewer dollars per transaction, but more hands are reaching out. The market is no longer frantic; it breathes differently, calmer, denser. And that might be the best news crypto has had in months.

Jack Ma's financial empire is regaining momentum. Ant International, the international branch of the Chinese giant Ant Group, formerly a subsidiary of Alibaba, is preparing to integrate Circle's USDC into its blockchain. A strategic move that could reshape the landscape of the global digital payment ecosystem.

SharpLink is making bold moves with Ethereum—growing its holdings, staking all assets, and drawing investor attention as ETH gains momentum.

On July 9th, the queen of crypto shattered its previous record by briefly surpassing 112,000 dollars, sweeping away doubts about a fatigue in the bullish cycle. This symbolic breakthrough, occurring amidst geopolitical pressures and massive movements in the derivatives markets, reignites speculation about entering a new phase of expansion in the crypto market.

According to data from Token Terminal, over $6 billion worth of tokenized assets now live on the Ethereum blockchain. That’s not theoretical DeFi liquidity, but real-world funds, from some powerful names in global finance.

As market attention swings between innovations and institutional strategies, XRP has made a significant move this week with a 12% increase. This surge is not insignificant, as Ripple has just appointed BNY Mellon, a cornerstone of American finance, as the custodian of its stablecoin RLUSD. In an environment where institutional adoption of cryptocurrencies is intensifying, this strategic alliance could redefine XRP's role in the crypto economy and strengthen its position against giants like Ethereum.

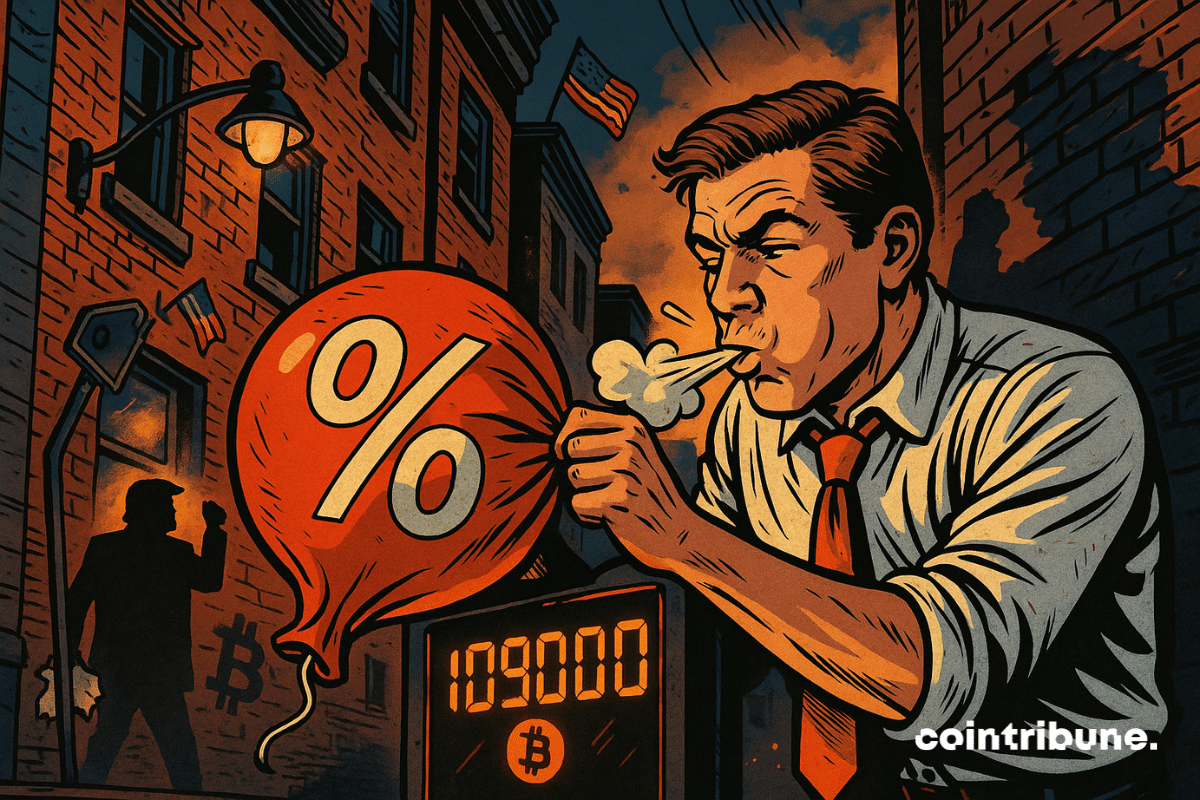

Less fear around inflation: Bitcoin rises to $109,000, supported by calmer economic forecasts. More details here!