Donald Trump granted a pardon to Changpeng Zhao, former CEO of Binance, reigniting debates on the links between political power and the crypto industry. In a context of increased regulation, this act raises questions about the growing influence of platforms in the public sphere. The decision, confirmed by the White House, triggered an immediate market reaction and revived tensions around conflicts of interest between the political sphere and financial technologies.

Exchange News

By pardoning Changpeng Zhao, Donald Trump not only signs a legal act but sends a strong signal to the crypto industry. The founder of Binance, convicted in 2023 for violations of anti-money laundering legislation, regains his freedom by a decision that contrasts with the hardline stance of the Biden administration. In a tense climate around crypto regulation, this gesture repositions Trump as a strategic ally of the sector and could breathe new life into Binance’s American ambitions.

BNB, Binance's flagship crypto, finally makes its debut on two of the largest American platforms: Coinbase and Robinhood. Long excluded from the mainstream US markets, often for compliance reasons, the asset crosses a major strategic threshold. Now listed on platforms accessible to millions of investors, BNB gains formal recognition that contrasts with its past as an asset confined to the Binance ecosystem. This shift says a lot about the evolution of the American crypto market and the gradual normalization of certain long-controversial assets.

The American exchange platform Kraken has just introduced a new feature called "Bundles", allowing users to purchase a diversified basket of cryptocurrencies grouped by theme in a single transaction. Officially launched in September 2025, this service targets both beginner and experienced investors who want to gain exposure to multiple digital assets without having to manually compose a portfolio.

Bitcoin reserves on exchange platforms have just fallen to their lowest level in more than six years. This massive, discreet but significant movement comes as the price falls below a key technical threshold. Is this a silent accumulation or a sign of mistrust? The indicator reignites the debate as volatility persists and positions on BTC weaken.

In Brussels, a subtle power struggle is shaping the future of crypto regulation in Europe. France, at the forefront, intends to influence the implementation of the MiCA regulation and establish itself as the center of gravity for platform oversight. While the Union enters a critical phase of harmonization, Paris toughens its rhetoric and actions towards industry giants. Binance, a flagship among targeted exchanges, becomes a symbol of a strategic showdown.

Coinbase is preparing to list BNB, the flagship token of its historic rival Binance. Such an unexpected gesture contrasts with past tensions between the two giants. In a climate of enhanced regulation and strategic repositioning, this decision could mark a turning point in the power dynamics of the sector. Calculated opportunism or signal of appeasement? This rapprochement intrigues as much as it raises questions.

Binance announces a $45 million BNB airdrop following a crash that led to over $20 billion in liquidations. The measure aims to compensate losses of thousands of memecoin traders. This decision comes as the platform faces pressure over its crisis management, marked by technical problems and criticism concerning transparency.

Bybit EU offers a promotional campaign with 63,750 USDC, 5 portions of 0.3 ETH, 10 Ledger Stax, 20 Samsung Galaxy Tab A9+, 40 Shokz OpenDots ONE and 80 JBL Grip. Launched shortly after obtaining its MiCA license in Austria, this initiative is part of a strategy to acquire European users. But beyond the attractive numbers, what are the real mechanisms? What traps to avoid? This article analyzes the "Autumn's Lucky Times" campaign rigorously.

On October 10, as markets plunged following a shock announcement from Washington on tariffs targeting China, over 200 billion dollars evaporated in a few hours. However, beyond volatility, it was Binance's behavior that crystallized tensions. The platform is accused of freezing accounts during the panic, preventing thousands of users from acting.

The speculative euphoria driving memecoins on the BNB Chain was abruptly interrupted. Within a few hours, several popular tokens saw their value plunge by more than 30%, causing a widespread retreat and cascading liquidations. This sudden correction, which occurred amid tension surrounding the launch of Meme Rush by Binance, caught part of the market off guard and rekindled questions about the long-term viability of these volatile assets.

On the BNB Chain, a few days were enough to turn modest bets into lightning-fast fortunes. Driven by meme coins launched in a chain and propelled by social virality, a new speculative wave is shaking the ecosystem. Between dizzying returns and community excitement, the episode reveals both the excesses and the attractiveness of a network that has become the favorite playground of traders.

BNB has just shaken up the crypto market hierarchy. By surpassing XRP, Binance's native token settles in third place worldwide, just behind Bitcoin and Ethereum. This rapid progression intrigues as much as it impresses. While the figures confirm a strong momentum, this rise raises questions about its legitimacy and sustainability.

Coinbase dreams of being the Robin Hood of crypto: $12,000 for poor young people, a banking license behind the scenes... and the future of banks shaking to the rhythm of stablecoins.

Three years after the FTX collapse, Sam Bankman-Fried breaks his silence again from his cell. The fallen former billionaire, convicted for massive fraud, delivers an unexpected confession. His biggest mistake, according to him, was not the reckless management of funds... but entrusting the leadership of FTX to John Ray III, just before the bankruptcy. A choice he now considers the point of no return in the collapse of his crypto empire.

Samsung and Coinbase join forces to take a leap in crypto adoption. Asset purchases are now accessible directly via Samsung Wallet on Galaxy smartphones. From this initial phase, over 75 million American users will be able to access crypto without going through third-party interfaces. An unprecedented integration between a mobile giant and an exchange platform, which could foreshadow a global rollout and redefine the role of smartphones in the decentralized financial ecosystem.

As airdrop valued at 600 million dollars approaches, the decentralized platform Aster faces a crucial strategic choice. To avoid a collapse in the price of its ASTER token, the team is considering imposing a vesting on the beneficiaries. A decision that could redefine the balances within the highly contested sector of derivative product DEXs. Between loyalty, speculation and stability, Aster plays a decisive card for its short and medium-term future.

VIENNA, September 24, 2025 — On September 24th, Bybit EU, the MiCAR-licensed crypto-asset service provider headquartered in Vienna, announced the launch of its first automated trading tools for European users: the Dollar-Cost Averaging (DCA) Bot and the Spot Grid Bot. Starting September 24, eligible users across the European Economic Area (EEA) can access these features directly on Bybit.eu, breaking down barriers for millions across Europe to safely trade and invest in crypto using AI-powered automation.

In this complete guide, we detail the registration process on Bybit EU, the KYC (Know Your Customer) verification steps, and the exclusive promotional campaigns available in September 2025.

SwissBorg launches a revolutionary cashback system allowing up to 90% savings on crypto trading fees.

This month could finally initiate a concrete turn in the endless FTX saga. Indeed, the FTX Recovery Trust plans to release 1.6 billion dollars for the creditors, marking the third wave of reimbursements since February. In a climate still imbued with distrust, this massive redistribution crystallizes hopes for a credible recovery. However, as payments progress, pressures intensify on the crypto industry, urged to close the chapter of the scandal and restore widely eroded trust.

Less than a year after a record $4.3 billion settlement with the US Department of Justice, Binance seeks to turn the page. The platform, a pillar of the global crypto ecosystem, is negotiating the lifting of the monitoring imposed by the authorities under the agreement. This move raises questions about the evolution of the balance of power between regulators and major players in the sector.

On September 13, Binance Coin (BNB) crossed a symbolic threshold by briefly surpassing the market capitalization of the Swiss bank UBS. Such an event illustrates the rising power of cryptos against traditional financial institutions. Changpeng Zhao, co-founder of Binance, immediately reacted, calling on banks to "adopt BNB". As the crypto reaches a new all-time high, this statement revives the debate about the integration of native tokens in banking strategies in the era of decentralized finance.

Gemini makes its debut on the Nasdaq under the symbol GEMI. The Winklevoss brothers' crypto platform successfully launched its IPO at 28 dollars per share, a price set beyond initial expectations. This listing comes as the crypto sector tries to regain market confidence in a climate still marked by regulatory uncertainties and the quest for profitability.

Pump.fun rejoices, Solana celebrates: PumpSwap dethrones its rivals. Crypto record at $878M, but already, criticisms and rug pulls darken the memecoins sky.

The crypto platform Finst officially enters the French market on September 9, 2025, promising to shake up cryptocurrency investing with ultra-competitive rates and a transparent approach. Founded by former DEGIRO executives and regulated by the Dutch Financial Markets Authority (AFM), this Dutch platform aims to democratize access to crypto-assets in France.

SwissBorg has just suffered one of the most striking hacks of the year. In a few hours, 193,000 SOL, or 41 million dollars, were siphoned off via a flaw in the Kiln validator API, a provider responsible for staking on Solana. It was not SwissBorg's infrastructure that failed, but that of a third-party partner. The incident reignites the debate on the security of external integrations in a sector where the slightest failure can be enough to bring down the entire chain.

In the crypto arena, Binance sits like a central banker: 67% of stablecoins under lock. Historic record, guaranteed concern, and dry powder ready to explode.

After trailing Bitcoin for most part of a decade, Ethereum has toppled the OG crypto in monthly and weekly spot trading volume on centralized exchanges. Market data ties this trend flip to recent trends, including increased institutional adoption of Ether, as well as capital rotation from BTC to ETH.

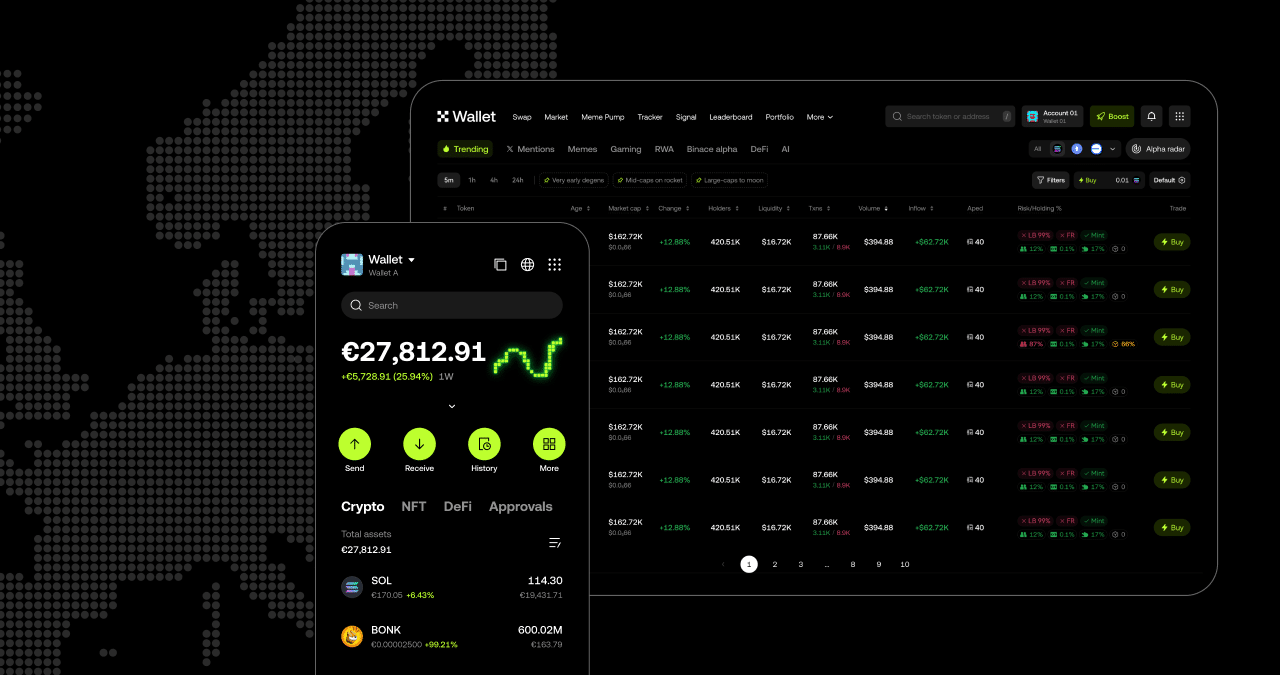

Just a few years ago, stepping into onchain felt overwhelming. Managing private keys was intimidating, moving assets across chains was risky, and earning yield was something only advanced users could figure out. For most people, the onchain world was out of reach. That’s why we started building the OKX Wallet—with one mission: to make onchain simple, secure, and open to everyone.