PBOC Reshapes Markets With Liquidity Boost

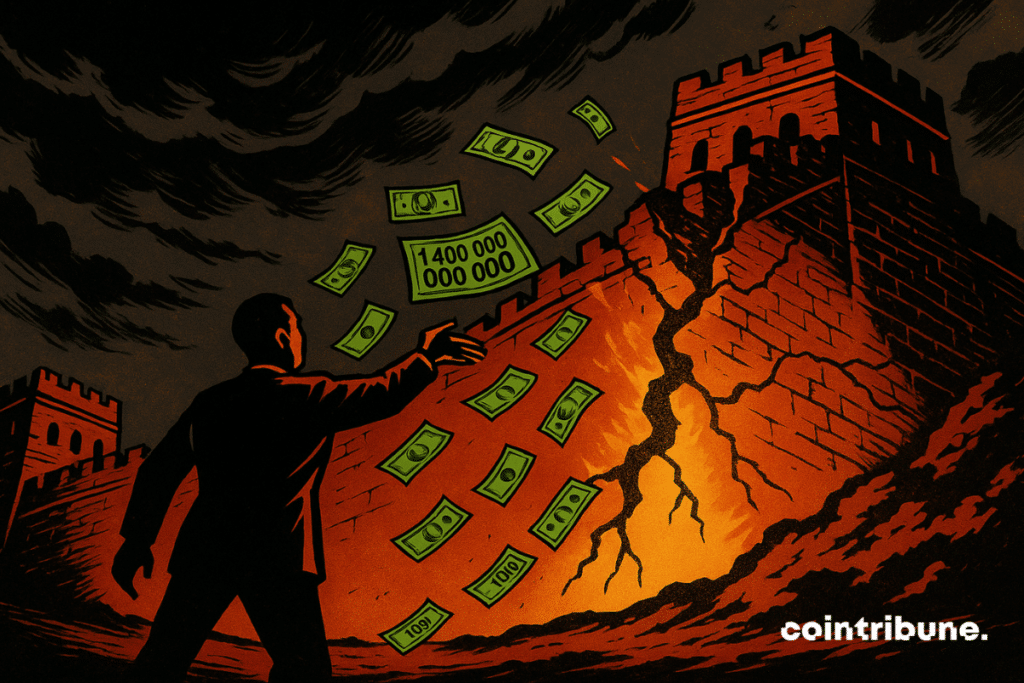

Faced with a wave of critical maturities on $4,000 billion of debt, Beijing launched an unprecedented monetary response. In August, the People’s Bank of China injected $1,400 billion to avoid the suffocation of its bond market. More than an emergency measure, this intervention marks a strategic turning point in managing Chinese financial flows. In a context of global tensions, this technical gesture speaks volumes about Beijing’s determination to maintain control over its economic cycle.

In brief

- The People’s Bank of China (PBOC) injected $1,400 billion to prevent a liquidity crisis linked to the maturity of $4,000 billion of short-term debt.

- This intervention is part of a defensive strategy, marked by a rate cut and a deliberate flattening of the yield curve.

- Targeted measures have been implemented to support SMEs and strategic sectors, notably tech and clean energy.

- Despite this massive support, some sectors remain fragile, particularly real estate, still weighed down by debt and unsold inventory.

A defensive monetary response to systemic risk

Faced with the massive $4,000 billion maturity of negotiable certificates of deposit (NCDs) expected this year, the People’s Bank of China (PBOC) opted for a large-scale strategy, while the country remains insensitive to threats and is getting rid of US debt.

It injected $1,400 billion into the financial system through reverse repo operations, while lowering the rate on these transactions to 1.4 %. This response aims to avoid a freeze in the interbank market and prevent any short-term funding disruption.

The central bank shifts from a reactive stance to preventive liquidity management. By acting upstream, Beijing intends to defuse any systemic instability that could weaken the core of its bond market.

This intervention is part of the continuity of a set of measures already launched in May, with quick and targeted effects on yields and the yield curve. The main levers mobilized by the PBOC include :

- A 0.5 point cut in the reserve requirement ratio (RRR) to free up bank liquidity ;

- A 10 basis point cut in benchmark rates, in a context of short-term debt tensions ;

- Sectoral refinancing lines, mainly oriented toward SMEs and strategic technology companies ;

- A marked flattening of the yield curve, with a tightening to less than 50 basis points between 1-year and 10-year bonds, reflecting the PBOC’s desire to contain volatility ;

- Normalization of credit spreads, restoring appeal to sovereign bonds and AAA-rated securities as low-risk carry assets.

This immediate stabilization strategy aims to restore confidence in short-term debt instruments while repositioning domestic bond assets as safe havens within the Chinese financial system.

A reallocation of capital and risky trades

Beyond immediate stabilization, the PBOC’s intervention has triggered significant movements in capital allocation. The MSCI China index has jumped 21.3 % since the start of support measures, driven by sectors targeted by Chinese industrial strategy.

Investment flows are clearly redeployed toward AI, semiconductors, and clean energy. This sectoral orientation is a strong signal: the PBOC uses its monetary leverage to direct flows toward long-term growth pillars, in a context of economic transition.

Meanwhile, new financial tools have been introduced to further ease markets: extension of the Bond Connect Southbound, authorization for rehypothecation, and development of cross-currency repos.

These instruments aim to strengthen liquidity on short-term securities and attract foreign investors. The DR007, 7-day interbank benchmark rate, remains stable around 1.4 %, consolidating the appeal of these low-volatility carries.

However, this dynamic masks another reality: non-sovereign credits, notably those from local government financing vehicles (LGFVs), continue to present high structural risks. Despite a 300 billion yuan refinancing program intended to facilitate the purchase of unsold homes, the real estate sector remains under pressure and poorly aligned with Beijing’s strategic priorities.

This PBOC intervention resonates on crypto markets, especially for bitcoin, often seen as an alternative store of value during monetary instability. Some analysts see an indirect signal : the more central banks inject, the more decentralized assets gain relevance against systemic risks.

By strengthening liquidity in strategically judged segments and favoring specific bonds, the PBOC redefines the rules of the game for investors, both local and international. In the short term, stability seems assured. However, this sophisticated monetary engineering, as was the case during the injection of 300 billion yuan into its banking system via an MLF operation, if it fails to restore structural balance in entire credit segments, could exacerbate imbalances between favored and fragile sectors in China.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.