Price Up, Revenue Down: Ethereum’s 44% Drop Highlights Diverging Trends

Ethereum’s price has been climbing in recent months, reaching a new all-time high in August. At the same time, institutional investors have shown increased interest in the token. However, the network’s revenue and fees paint a contrasting picture. While the price rises, ETH’s revenue from its fee-burning mechanism fell sharply in August, raising questions about the network’s long-term financial strength and sustainability.

In brief

- Ethereum sees falling fees and revenue despite ongoing institutional interest.

- ETH revenue drops 44% from $25.4M in July to $14.1M in August.

- Network fees fall 19% in August, from $49.6M to $39.7M.

Revenue Down 44% as Ethereum Fees Drop

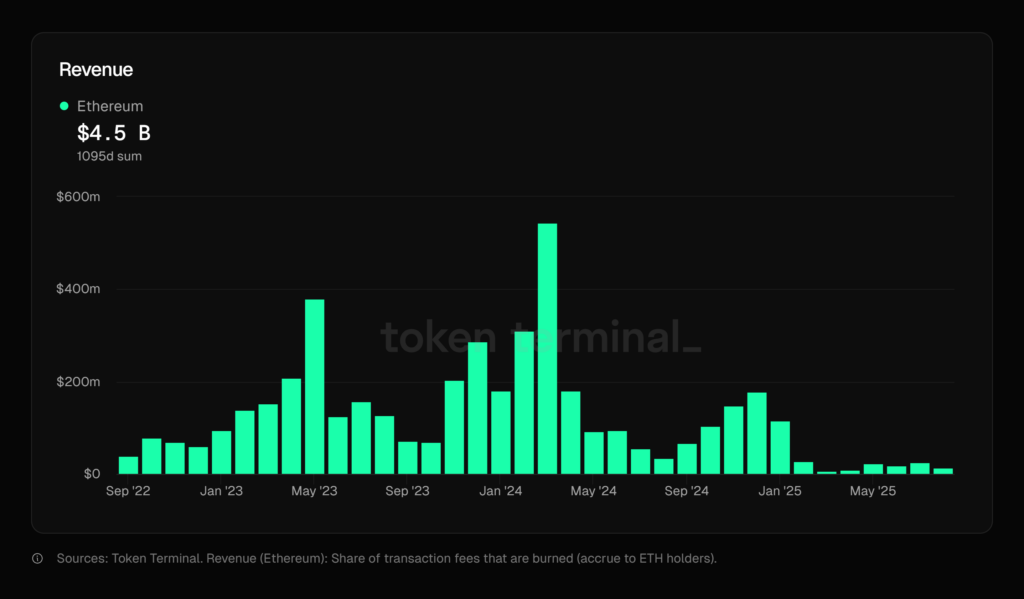

Data from Token Terminal shows that Ethereum’s revenue fell from $25.366 million in July to $14.139 million in August, a decline of about 44.3%. Total network fees also dropped, from roughly $49.6 million in July to $39.7 million in August, a decrease of around 19%.

The decline in revenue and fees came even as Ethereum’s price continued to rise. ETH has climbed more than 245% since April, hitting a record $4,953 in August, according to CoinMarketCap. This shows a clear divergence between Ethereum’s market value and the income generated by network activity.

In March 2024, the Dencun upgrade was implemented, leading to a drop in Ethereum’s network fees. The upgrade reduced costs for layer-2 networks, making transactions more efficient and cheaper. However, lower fees also meant that less ETH was burned each month, resulting in smaller rewards for ETH holders. As a result, revenue from user transactions on Ethereum’s base layer decreased.

Growing Institutional Investment in Ethereum

Despite the decline in revenue, Ethereum has seen a new wave of institutional investors accumulating the token in recent months. Companies such as Bit Digital, BitMine Immersion Technologies, Inc., and SharpLink Gaming are among those adding ETH to their balance sheets.

In September, Etherealize, a PR and advocacy firm promoting Ethereum to publicly traded companies, announced it had raised $40 million. The firm’s mission is to reshape Wall Street’s infrastructure by bringing institutional trading, settlement, and privacy infrastructure onto Ethereum.

Yield Potential Drives Institutional Interest

Part of the growing institutional interest in Ethereum is driven by its yield-bearing potential. Matt Hougan, Chief Investment Officer of Bitwise, said that staking ETH turns it into a yield-generating asset. He explained that “If you take $1 billion of ETH and you put it into a company and you stake it, all of a sudden, you’re generating earnings. And investors are really used to companies that generate earnings.”

This perspective aligns with VanEck CEO Jan van Eck, who described Ethereum as the “Wall Street token,” reflecting its growing recognition among institutional players and supporters who see the network as essential infrastructure for the future of finance.

Meanwhile, Ethereum is showing contrasting trends. Fee revenue has fallen, but institutional interest and staking activity are on the rise. Together, these trends show that the network is undergoing change. While lower fees have reduced traditional revenue, the growing adoption and staking of ETH point to ongoing confidence in the network’s future.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.