Runbot: Secure Your Crypto Investments

The crypto market is known for its extreme volatility, making it both a lucrative and risky space for traders. In addition to market fluctuations, security threats like hacks, phishing scams, and human errors further complicate the landscape. For traders, safeguarding their crypto investments has become a top priority. Runbot offers a powerful solution by combining automation with advanced security measures. Designed to protect assets while enhancing performance, Runbot leverages cutting-edge technologies such as AI-driven risk management and blockchain transparency. With features like dynamic tools and immutable records, Runbot empowers traders to navigate the challenges of crypto trading with confidence and peace of mind.

The challenges of securing crypto investments

The crypto market presents traders with a unique set of challenges, ranging from extreme price volatility to cybersecurity threats and human error. To navigate this complex landscape effectively, it’s essential to understand these risks and how automation tools like Runbot can help mitigate them.

Market volatility

The crypto market is notorious for its constant price fluctuations, which can result in significant financial losses for traders.

Unpredictable swings

Unlike traditional markets, cryptocurrency prices can rise or fall dramatically within hours, or even minutes, due to factors like regulatory announcements, macroeconomic events or changes in market sentiment.

Impact on traders

Beginners often struggle to respond to these rapid changes, leading to impulsive decisions such as panic selling during dips or overleveraging during rallies. Even experienced traders face challenges in manually monitoring the market 24/7, making it difficult to consistently capitalize on opportunities or manage risks effectively.

Without proper risk management tools, volatility can quickly erode profits or deplete capital. This underscores the need for solutions that can provide real-time market analysis and timely execution, such as those offered by Runbot.

Security threats in crypto trading

The decentralized nature of cryptocurrencies, while revolutionary, also exposes traders to cybersecurity risks and fraud.

Cybersecurity risks

The crypto industry faces significant cybersecurity challenges, with hacking incidents being one of the most prominent threats. Crypto exchanges and wallets are frequent targets, resulting in billions of dollars lost globally due to unauthorized access and theft. Phishing scams further exacerbate the issue, as traders are lured into fake websites or emails designed to steal sensitive information, such as private keys or API credentials. Even reputable exchanges are not immune to vulnerabilities, with security breaches potentially exposing user funds to significant risk. Addressing these risks is essential to safeguarding assets and maintaining trust in the ecosystem.

Fraud prevention

Transparency is critical in crypto trading to prevent fraud and manipulation. Without clear visibility into how funds are managed or trades are executed, traders may unknowingly fall victim to scams. Platforms that integrate blockchain transparency to provide immutable records that ensure trust and accountability, significantly reducing these risks.

The role of automation in reducing risks

Manual trading, while traditional, is increasingly becoming inefficient in the fast-paced crypto market.

Limitations of manual trading

Manual trading is often hindered by emotional decision-making, where traders act impulsively based on fear or greed, leading to unnecessary losses. Additionally, the inefficiency of manual trading is a major drawback, as it is impossible to monitor the market 24/7. This limitation results in missed opportunities or delayed reactions to critical market shifts, reducing the overall effectiveness of trading strategies.

The need for reliable automation

Runbot addresses these challenges by offering a secure and automated platform that:

- Minimizes human error: by automating strategies, Runbot ensures trades are executed based on data-driven insights rather than emotional impulses.

- Provides real-time adjustments: AI-driven tools adapt to market conditions, adjusting stop-loss levels, take-profit thresholds, and trade volumes to protect user investments.

How does Runbot secure your crypto investments?

Runbot AI stands out as a highly secure automated trading platform, combining advanced technologies and robust protocols to protect crypto investments. By integrating AI-powered risk management, blockchain transparency and cutting-edge security measures, Runbot provides a comprehensive solution for safeguarding assets in the volatile crypto market.

AI-powered risk management

Runbot leverages sophisticated AI algorithms to dynamically manage risks, ensuring that users’ investments remain protected even during extreme market conditions.

Dynamic adjustments

Runbot’s AI tools continuously analyze market data to identify patterns and predict potential price movements. This allows the platform to adjust stop-loss and take-profit settings in real time, optimizing trade execution and minimizing losses.

- Stop-loss optimization: the AI adjusts thresholds based on current market trends, ensuring that trades exit at optimal points to protect capital.

- Take-profit optimization: similarly, the AI fine-tunes take-profit levels to maximize returns without exposing traders to unnecessary risk.

Capital protection

One of Runbot’s key strengths is its ability to shield users’ funds from excessive exposure during volatile periods.

- Volatility adaptation: Runbot reduces trade sizes or pauses operations when the market becomes highly unpredictable, minimizing the likelihood of significant losses.

- Risk diversification: automated strategies built into the platform encourage portfolio diversification, spreading investments across multiple assets to reduce risk concentration.

Advanced security protocols

Runbot employs state-of-the-art security measures to protect user data, trading operations, and integrations with exchanges.

Encrypted API connections

APIs are a critical component of automated trading, as they connect the platform to users’ exchange accounts. Runbot ensures these connections are secure by:

- Data encryption: all API keys are encrypted, preventing unauthorized access to user accounts.

- Access control: the platform restricts access to sensitive information, ensuring only authorized actions can be performed.

Secure exchange integration

Runbot integrates with leading exchanges while prioritizing user security during transactions. By working with reputable exchanges, Runbot minimizes the risk of trading on vulnerable or unreliable platforms. All trades executed through Runbot are protected by layers of security protocols, reducing exposure to potential breaches.

These security measures ensure that users’ funds and data remain protected throughout their trading journey.

Features that enhance security and performance

Runbot is equipped with advanced features that not only ensure the security of investments but also optimize trading performance. These include innovative indicators, tools for strategy development and optimization, and a collaborative marketplace that fosters transparency and innovation.

Advanced indicators for safer trading

Runbot offers a suite of advanced indicators designed to provide actionable insights, empowering traders to make informed decisions and minimize risks.

Harmonia AI

Harmonia AI is a suite of advanced tools driven by artificial intelligence, designed to enable traders to forecast market trends with exceptional precision. By leveraging both historical and real-time data, Harmonia AI excels in identifying potential price movements and emerging trends. Its tools, such as AI EMA (Exponential Moving Average) and AI RSI (Relative Strength Index), minimize risk and provide traders with the confidence to time their entries and exits effectively, reducing uncertainty and enhancing overall trading outcomes.

VeloData

VeloData offers a comprehensive focus on advanced market metrics, delivering deeper insights into market conditions. Its liquidity tracking feature pinpoints high-liquidity zones, ensuring trades are executed with minimal slippage, even in volatile markets. Additionally, VeloData’s analysis of open interest and premium trends provides a nuanced understanding of market sentiment, revealing opportunities for arbitrage and potential trend reversals.

Together, Harmonia AI and VeloData equip traders with a competitive edge, enabling them to implement safer, more efficient, and highly informed trading strategies

Strategy development and optimization

Runbot empowers users with tools to build, test, and refine trading strategies, ensuring reliability and effectiveness before live deployment.

Backtesting capabilities

Runbot’s backtesting tool empowers traders to evaluate strategies by simulating their performance under historical market conditions. This process allows for thorough validation before execution, helping traders identify potential weaknesses and refine their approaches. By providing clear evidence of a strategy’s reliability, backtesting enhances trader confidence and reduces the risks associated with deploying unproven methods.

Portfolio diversification

Runbot also offers tools designed to assist traders in diversifying their investments across multiple assets, mitigating exposure to single-market risks. Diversification spreads risk, minimizing the impact of volatility in any one asset. Additionally, Runbot allows users to customize their asset allocation preferences, tailoring portfolios to align with their unique risk tolerance and investment objectives.

These features work in tandem to enable traders to optimize their performance while maintaining a secure, balanced, and informed investment approach.

Collaborative marketplace

Runbot’s NFT-based marketplace promotes transparency and collaboration, creating a community-driven ecosystem where traders and developers can share innovative tools.

NFT-based strategies

Runbot enables traders and developers to tokenize their strategies and indicators as NFTs, making them available on a blockchain-based marketplace. This system guarantees that all listed tools are transparent, tamper-proof, and verifiable. By purchasing or renting these NFTs, users gain access to proven strategies and advanced insights developed by experienced traders, eliminating the need to create strategies from scratch.

Fostering trust and innovation

The NFT marketplace promotes collaboration and knowledge-sharing within the trading community. Traders contribute to an ever-expanding library of strategies, driving innovation and enhancing the platform’s overall value. At the same time, developers benefit from revenue opportunities by monetizing their expertise, offering their tools to the marketplace. This mutually beneficial ecosystem fosters trust, encourages innovation and ensures that all users have access to high-quality resources.

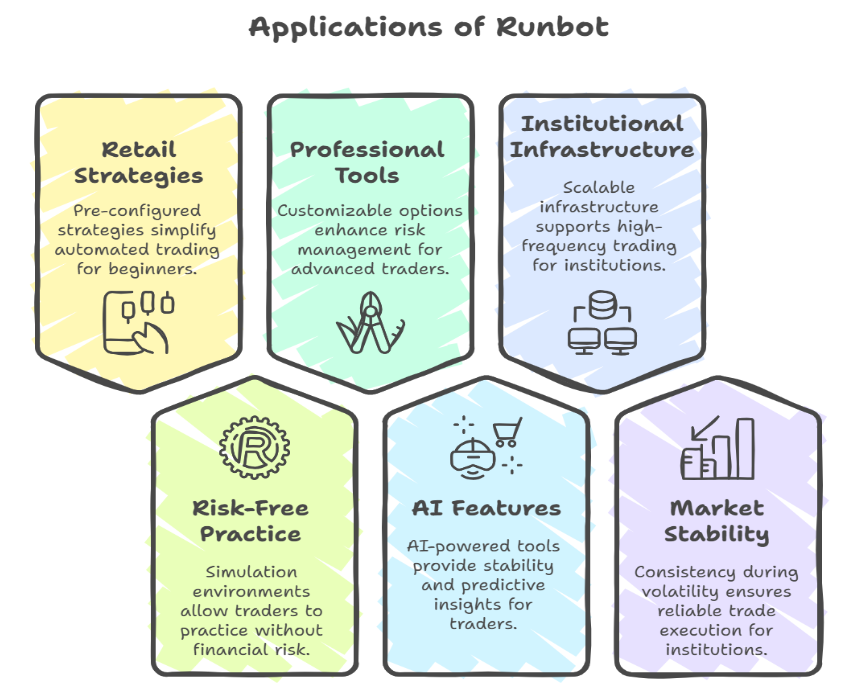

Real-world applications of Runbot for securing investments

Runbot is designed to meet the diverse needs of retail traders, professional investors, and institutions by providing tailored features and scalable infrastructure to safeguard crypto investments. Below, we explore how Runbot delivers practical solutions for these user groups, ensuring security and performance across varying trading levels.

For retail traders

Retail traders often face challenges such as a lack of technical expertise and limited access to advanced tools. Runbot bridges this gap by offering user-friendly features that simplify automated trading while prioritizing security.

Pre-configured strategies for ease of use

Runbot offers a library of pre-configured strategies crafted by experts to simplify automated trading for retail users. These strategies are specifically designed to eliminate the complexities of manual setup, enabling beginners to focus on execution without needing advanced technical expertise. Additionally, each strategy can be tailored to align with individual risk tolerance, providing users with confidence to navigate the volatile crypto market.

Simulation environments for risk-free practice

To further support retail traders, Runbot includes a simulated trading environment that allows users to practice without financial risk. This feature enables traders to test strategies in a realistic setting, gaining valuable insights before committing real funds. Simulations also help refine strategy performance by allowing users to optimize based on results, improving reliability when transitioning to live trading.

These tools empower retail traders to confidently engage in automated trading, even without advanced market or technical knowledge, ensuring a secure and user-friendly experience.

For professional traders

Professional traders require advanced tools and customization options to manage large portfolios and navigate volatile markets effectively. Runbot delivers the flexibility and precision they need.

Customizable options for advanced risk management

Runbot’s Strategy Composer empowers professional traders with the ability to design and fine-tune their trading strategies to suit their specific objectives. Users have full control over key parameters such as entry and exit points, stop-loss limits, and take-profit thresholds, enabling precision in execution. Additionally, the platform’s multi-exchange integration allows for trading across multiple exchanges, promoting portfolio diversification and reducing exposure to risks associated with single markets.

AI-powered tools for stability

Runbot’s AI-driven features enhance the management of high-value portfolios by offering advanced tools to navigate market complexities. Dynamic adjustments powered by AI adapt strategies in real time, mitigating risks during periods of heightened volatility. Predictive insights provided by indicators such as Harmonia AI and VeloData enable traders to anticipate market movements with accuracy, ensuring trades are executed with optimal precision.

With these advanced tools, professional traders can achieve greater profitability while maintaining a secure and stable trading environment.

For institutions

Institutional investors require robust infrastructure to support high-frequency trading and large-scale operations. Runbot’s scalable architecture ensures consistent performance and reliability for these demanding users.

Scalable infrastructure for high-volume trading

Runbot’s robust infrastructure is specifically designed to meet the rigorous demands of institutional trading. With high throughput capabilities, the platform processes thousands of trades per second, ensuring seamless execution even during peak market activity. Its multi-asset support allows institutions to diversify across asset classes such as cryptocurrencies, stocks, and commodities, enabling balanced and effective portfolio management.

Consistency during market volatility

Runbot delivers exceptional stability in volatile market conditions, ensuring reliable trade execution without delays or disruptions, even during sudden market swings. The platform’s enhanced risk management tools, including dynamic stop-loss and real-time monitoring, safeguard large portfolios against significant losses.

These features position Runbot as a trusted solution for institutional traders, empowering them to scale their operations securely and efficiently while maintaining confidence in volatile market environments.

Why is Runbot the ideal solution for securing crypto investments?

Runbot stands out as the ideal platform for safeguarding crypto investments due to its proven security, transparency and user-focused approach. By combining advanced technologies with real-world performance, it offers a secure and reliable trading environment for traders at all levels.

Proven security and reliability

Runbot’s ability to protect traders during market downturns and volatile conditions has been demonstrated through case studies and performance metrics.

Avoiding losses during downturns

Traders using Runbot’s AI-powered risk management tools, such as dynamic stop-loss and portfolio diversification, have reported minimized losses during significant market crashes.

Exceptional platform performance

Metrics such as near-perfect uptime and rapid execution speeds ensure users never miss critical trading opportunities, even during periods of high market activity.

Risk mitigation success

Runbot’s volatility adaptation tools dynamically adjust strategies to reduce exposure, further securing user investments. These features highlight Runbot’s commitment to providing a dependable platform in the unpredictable crypto market.

User-centric design

Runbot’s intuitive and flexible design caters to the diverse needs of its users.

Simplifying trading

Retail traders appreciate Runbot’s pre-configured strategies and user-friendly interface, which remove the complexities of automated trading.

Adapting to advanced needs

Professional and institutional users benefit from customization tools, advanced indicators, and multi-exchange compatibility, allowing them to tailor strategies to specific goals.

Testimonials

Positive feedback from users highlights how Runbot has streamlined their trading experience while ensuring robust security.

Runbot stands out as a secure and reliable platform, leveraging AI, blockchain, and advanced tools to safeguard crypto investments. Its innovative features, such as dynamic risk management and Elite Blockchain’s AI-enhanced mathematical trading indicators, allow traders to efficiently navigate volatile markets with confidence. Whether for retail traders, professionals, or institutions, Runbot offers tailored solutions to protect assets and enhance performance.

Explore Runbot today to experience its cutting-edge features and ensure your trading operations remain secure. As crypto trading evolves, platforms like Runbot are leading the way by combining security and innovation, empowering traders to thrive in an ever-changing financial landscape.

FAQ

Runbot’s AI-powered risk management tools dynamically adjust stop-loss levels, reduce trade sizes, and optimize portfolio allocation to shield traders from significant losses during volatile conditions.

Yes, Runbot offers pre-configured strategies and a user-friendly interface designed for beginners. These tools simplify the trading process, allowing users to benefit from automated trading without requiring advanced technical expertise.

Absolutely. Runbot maintains detailed and transparent records of all transactions and strategy executions. Your trade history can be reviewed through the platform’s secure and accessible transaction logs.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more