RWAs Show Strength with 13% Gain Despite Crypto Sell-Off

Over the past month, tokenized real-world assets (RWAs) have shown notable resilience, attracting growing interest even as the broader cryptocurrency market experienced a sharp sell-off. While many digital tokens declined, demand for tokenized financial instruments remained strong, reflecting both the sector’s stability and the increasing involvement of institutional participants.

In brief

- Tokenized RWAs rose over 13% in the past 30 days despite a sharp crypto sell-off with Ethereum, Arbitrum, and Solana driving most of the gains.

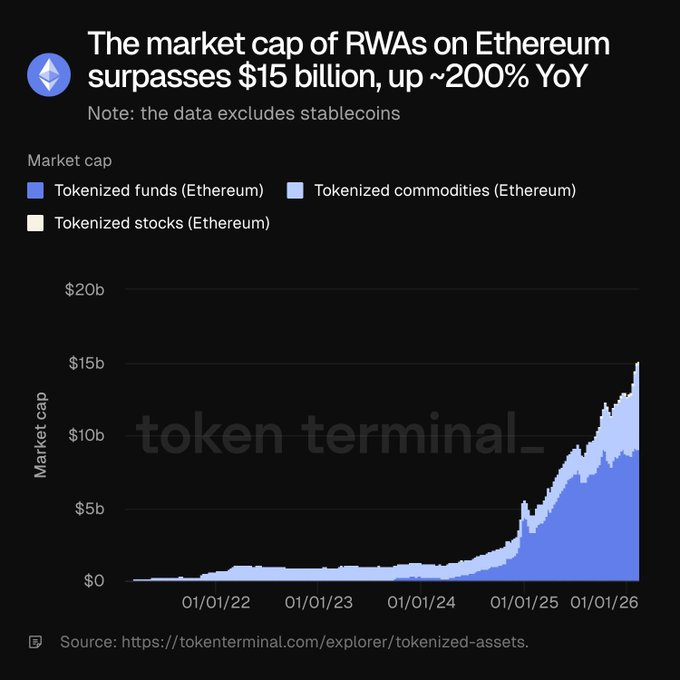

- Ethereum’s RWA market capitalization surpassed 15 billion dollars, showing a year-on-year growth of around 200%.

- Institutional adoption is deepening with tokenized money market funds being used for returns and as collateral in trading and lending.

Ethereum Leads RWA Expansion

Data from RWA.xyz shows that the total value of on-chain real-world assets rose by 13.47% over the past 30 days. This growth came alongside higher issuance of tokenized securities across public blockchains and a growing number of unique wallet addresses holding these assets. These trends suggest that participation is broadening and the on-chain RWA ecosystem continues to develop steadily.

Here is how the growth in RWAs unfolded over the past month:

- Ethereum led the expansion, recording roughly $1.7 billion in net value, with Arbitrum at $880 million and Solana around $530 million.

- Data from Token Terminal shows that Ethereum’s RWA market capitalization has risen above $15 billion, marking a roughly 200% year-on-year increase.

- Ethereum’s growth has been supported by major financial institutions, including BlackRock and J.P. Morgan, which are building tokenized versions of traditional financial products directly on the platform.

Dominant RWAs and Growing Institutional Use

Examining the breakdown, tokenized US Treasuries and government debt continue to hold the largest share of the RWA market, with total outstanding products exceeding $10 billion. Investment in these areas has stayed steady, and tokenized stocks and exchange-traded products have also grown over the same period. The continued strength of these categories shows that institutions are increasingly turning to public blockchains to issue and manage digital versions of traditional financial products.

Additionally, tokenized money market funds are serving dual purposes: generating returns and acting as collateral in certain trading and lending activities. Prominent institutions, including BlackRock, J.P. Morgan, and Goldman Sachs, are actively integrating these products into their operations, demonstrating deeper institutional adoption. Recently, BlackRock listed its USD Institutional Digital Liquidity Fund (BUIDL) on Uniswap, marking its entry into decentralized finance.

Market Contrast and Investor Sentiment

This rise in RWAs comes as the broader cryptocurrency market faces heavy pressure, having lost roughly $1 trillion over the past month. Over the past 24 hours, the market has remained mostly steady, moving just 0.2%, according to CoinGecko. Much of this stress stems from derivatives, particularly following a large-scale deleveraging event in October that caused widespread losses.

The Crypto Fear & Greed Index now sits at 10, signaling extreme fear and continued downside pressure. Meanwhile, equities remain strong, highlighting the growing divergence between investor sentiment in crypto and traditional markets.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.