MSTR’s business model relies on income-oriented funds buying its “high-yield” preferred shares. But those published yields will never actually be paid. Once fund managers realize this they’ll dump the preferreds & $MSTR won’t be able to issue any more, setting off a death spiral.

— Peter Schiff (@PeterSchiff) November 16, 2025

A

A

Schiff Challenges Saylor To Public Debate On Bitcoin

Mon 17 Nov 2025 ▪

4

min read ▪ by

Getting informed

▪

Bitcoin (BTC)

Summarize this article with:

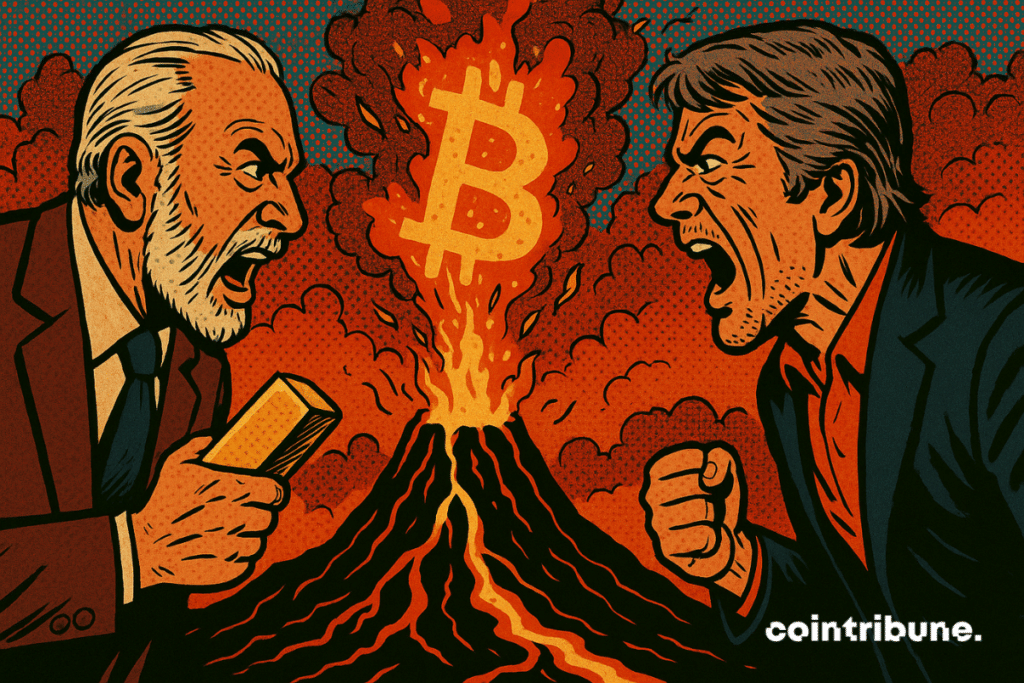

The debate between gold and bitcoin takes a new turn. Peter Schiff accuses Michael Saylor of steering Strategy according to a “fraudulent” model based on promises of illusory returns. He proposes a public debate during Binance Blockchain Week in Dubai, in December. In a volatile market, this confrontation crystallizes tensions around the integration of bitcoin into business strategies.

In brief

- Peter Schiff accuses Michael Saylor of building Strategy’s business model on a ‘fraud’, based on what he sees as fictitious returns.

- The pro-gold economist claims that Strategy’s preferred shares will not fulfill their promises, threatening the company’s viability.

- He challenges Michael Saylor to a public debate during Binance Blockchain Week, scheduled for December in Dubai.

- The decline of Bitcoin and the stable performance of gold fuel criticism of the ‘Bitcoin in business’ model’s strength.

Peter Schiff denounces a financial fraud mechanism

While Michael Saylor is preparing a new massive bitcoin purchase, Peter Schiff in a series of public statements has launched a frontal accusation against the company Strategy, claiming its business model is based on unstable and potentially misleading foundations.

On X, the pro-gold economist declared that the Strategy model “relies on income-oriented funds buying its high-yield preferred shares”. Furthermore, he claims that these yields will never actually be paid. For him, this profitability promise masks an unsustainable medium-term strategy.

Here are the main accusations made by Peter Schiff :

- A model based on issuing preferred shares : according to him, Strategy attracts investors with displayed high yields, but these would be illusory ;

- The risk of massive fund sell-offs : “once fund managers realize this, they will get rid of these preferred shares”, he claims ;

- A systemic danger for Strategy’s financial structure : Schiff warns that this dynamic could trigger a “death spiral”, making it impossible to issue new debt.

This verbal offensive did not stop there. Schiff proposed a public debate with Michael Saylor, founder and central figure of Strategy, at the Binance Blockchain Week in Dubai, scheduled for December.

He intends to confront his criticisms with Saylor’s arguments, in a face-to-face that could have repercussions on the overall perception of this model.

Market signals weakening Strategy’s model

Apart from Peter Schiff’s statements, several recent financial indicators highlight a form of fragility in Strategy’s current situation.

The mNAV (multiple on net asset value), a key indicator to assess the premium that markets give to the company’s Bitcoin holdings, fell below 1 in November, a symbolic level indicating a discount relative to its own reserves.

Although this ratio slightly rebounded to 1.21, it remains very far from the threshold of 2, generally considered healthy for this type of structure. Meanwhile, Strategy’s stock has lost over 50 % since July, stabilizing around $199, reflecting a clear lack of confidence from investors.

This valuation deterioration occurs in an unfavorable macroeconomic context for the crypto market, notably marked by a 20 % drop in the bitcoin price since its peak at $126,000 in October, itself followed by a crash on October 10.

Meanwhile, gold, the asset defended by Schiff, has followed an opposite trajectory. It has stayed above the psychological threshold of $4,000 an ounce, even reaching a record at $4,380. This dynamic indirectly strengthens Schiff’s credibility in the eyes of some traditional investors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.