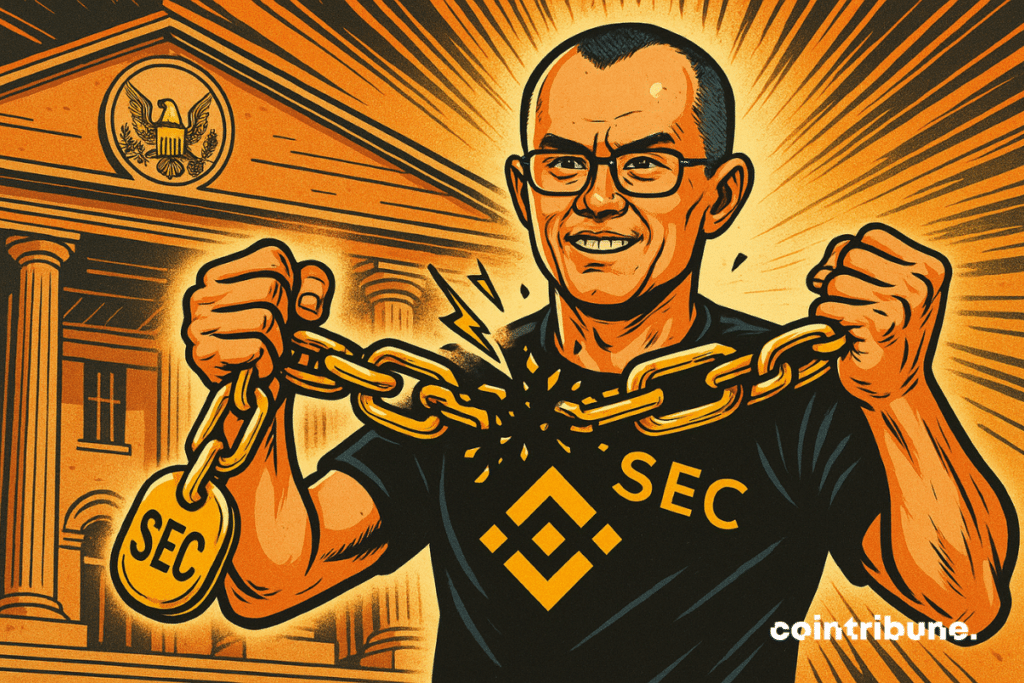

SEC Drops Binance Charges In Shocking Twist

The SEC turns the page on its showdown with Binance, ending an emblematic case of the Gensler era. By withdrawing its complaint against the exchange, its founder CZ, and Binance.US, the regulator sends a strong signal: the political center of gravity in Washington is shifting. This legal withdrawal goes beyond a simple legal framework and illustrates a strategic repositioning, as the lines of crypto regulation in the United States are being reshaped under the Trump administration.

In Brief

- The SEC officially drops its civil lawsuit against Binance, its founder CZ, and its U.S. affiliate Binance.US.

- The case, launched in 2023, accused the platform of selling unregistered securities and commingling customer funds.

- This decision ends a major legal battle, following $4.3 billion already paid in criminal penalties.

- Binance and Binance.US call it a “historic moment” and urge the industry to move forward and rebuild trust.

The End of a Major Legal Confrontation

A few days after finalizing a 50 million dollar settlement agreement with Ripple to close a dispute that began in 2020, the SEC continues on this path by easing pressure on the sector’s giants.

On Thursday, May 29, 2025, it officially filed a motion with the court to end its complaint against Binance, its founder Changpeng Zhao (CZ), and its American subsidiary Binance.US.

This civil proceeding, initiated in June 2023, accused the company of violating several fundamental securities laws. At the time, Gary Gensler, then SEC chairman, claimed :

Binance tried to evade U.S. securities laws by implementing facade controls that were ignored behind the scenes.

Among the most important elements of the case was an internal exchange cited in the complaint, where the platform’s COO stated: “we operate like a damn unlicensed securities exchange in the United States, my brother.”

The SEC’s accusations revolved around several major grievances :

- The sale of unregistered securities : the platform allegedly allowed trading of cryptos considered securities without prior registration ;

- Unauthorized access by U.S. customers to the platform by circumventing supposed geographic restrictions ;

- Mixing of funds : a commingling of client funds and company funds, presented by the SEC as a “web of deception” aimed at hiding the true financial flows ;

- Compromising internal statements: used by the regulator to illustrate the presumed awareness of executives regarding the potential illegality of their operations.

While the platform had already faced a heavy criminal sanction at the end of 2023, including the payment of 4.3 billion dollars to the Department of Justice and the resignation of CZ, the civil proceeding brought by the SEC still represented a major legal and reputational risk.

Its closure without trial marks a notable de-escalation and a turnaround in American regulatory strategy towards the sector.

The SEC Changes Its Tone Under Trump : Towards an Assumed De-escalation ?

The SEC’s decision comes in a totally reconfigured political context. Since Donald Trump’s return to power, the regulatory authority appears to be adopting a more conciliatory stance towards crypto actors.

Several highly publicized proceedings have been dropped, illustrating a marked retreat from the so-called “regulation by enforcement” strategy. Recognizing that innovation cannot thrive under intimidation-based regulation is a crucial step.

On its side, Binance.US welcomed the decision: “the SEC has fully dropped its charges against Binance.US, confirming what we have always known, that the company did not violate any securities laws in the United States.”

This development seems directly correlated with the directions of the current administration. Donald Trump explicitly campaigned in favor of crypto development and enjoys active support from several major figures in the sector.

This strategic realignment of the SEC could therefore reflect a political will to make the United States a jurisdiction more favorable to blockchain innovation, at a time when other regions are gaining the upper hand in terms of clear and attractive regulatory frameworks such as the MiCA framework in Europe.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.