Solana To Hit $250 In 2026 ? Bank Explains Why

The crypto market has just received a strong signal from traditional finance. By sharply revising its forecasts for Solana, the Standard Chartered bank caused a shock in the ecosystem. While SOL remains one of the most watched assets by institutional investors, the lowering of the target for 2026 contrasts with a spectacular long-term projection. This decision reveals a much more nuanced reading of the future of blockchain than simple price movements suggest.

In Brief

- Standard Chartered has lowered its price target for Solana by the end of 2026, causing a shockwave in the market.

- The bank explains this decision by the evolving activity on the blockchain and the gradual transformation of its uses.

- Despite this short-term caution, Solana retains strong potential in the institution’s long-term strategy.

- The forecasts up to 2030 outline a scenario of sustained growth, driven by payments and stablecoins.

The key facts related to the revision

In its update of February 3, 2026, Standard Chartered announced a significant revision of its Solana price forecasts for the end of this year.

Here are the facts as expressed by the bank’s analysts :

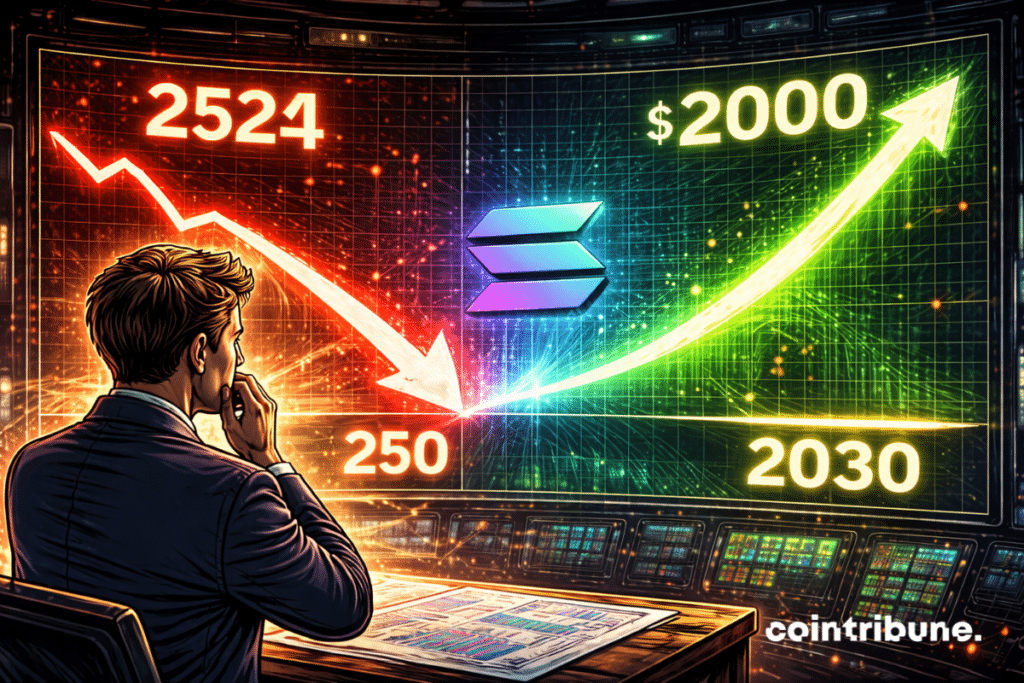

- The target for this year : “we have lowered our price target to $250 for the end of 2026”, stated the analysts led by Geoffrey Kendrick ;

- The change in trading volume composition : the bank observes a rotation of volumes towards SOL–stablecoin pairs, a sign of evolving blockchain activity ;

- A perspective on the technical advantages : although Solana maintains very low transaction fees, converting these advantages into sustained economic activity is proving slower than expected.

These elements fit within a context where markets cautiously evaluate the real activity of blockchains. The bank emphasizes that this adjustment should not be interpreted as a fundamental lack of confidence in Solana but rather as a response to the observed evolution of market participants’ behaviors.

The outlook related to this revision

In the same report, Standard Chartered projects a more pronounced upward trajectory beyond December, with price targets increasing significantly each year up to 2030.

According to these projections, SOL could reach $400 in 2027, $700 in 2028, $1,200 in 2029, peaking at $2,000 in 2030. This roadmap relies on on-chain data and the anticipated network capacity to attract real use cases such as very low-cost micropayments.

The bank notably highlights Solana’s role in high-speed, low-cost stablecoin transfers, which, according to them, could attract more sustained economic activity. In this context, the analysts state that “Solana is ideally positioned to capture the expansion of small-value payments”, a dynamic that could, ultimately, strengthen the network’s relevance in the decentralized financial ecosystem.

The Standard Chartered revision illustrates the new maturity phase that Solana is going through, balancing short-term caution and structural ambitions. While the Solana validator exodus raises questions about the network’s resilience, the long-term trajectory remains closely linked to its capacity to capture real and sustainable use cases in the digital economy.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.