S&P 500: JPMorgan Calls Strategy’s Rejection a Setback for Crypto Treasuries

The decision by the S&P 500 index committee to reject Strategy’s bid for inclusion has drawn reactions across the financial and crypto space. The company appeared to have met the necessary requirements, but the committee chose to leave it out. Analysts at JPMorgan were among those raising concerns, describing the outcome as a setback for companies that use Bitcoin as a central part of their treasuries.

In brief

- JPMorgan analysts led by Nikolaos Panigirtzoglou call S&P’s rejection of Strategy a setback for crypto treasury firms.

- The analysts added that other index providers might now review their treatment of Strategy and similar crypto treasury firms.

- Despite setbacks, Strategy bought 1,955 BTC in September, taking its holdings to 638,460 coins worth about $47.17 billion.

Robinhood Chosen Over Strategy

Last week, Strategy, the largest corporate holder of Bitcoin, was left out of the S&P 500 by the index committee, which approved Robinhood instead. For many observers, the choice came as an unexpected twist.

JPMorgan analysts, led by managing director Nikolaos Panigirtzoglou, said the decision is a setback not just for Strategy but also for other firms that have recently adopted similar crypto treasury models.

They explained that while eligibility criteria were formally satisfied, the committee’s authority remains discretionary. The decision, they added, highlights unease toward companies whose balance sheets and operations are closely tied to cryptocurrency.

Saylor Stays Patient as Analysts Warn of Wider Risks

Michael Saylor, executive chairman of Strategy, said in an interview with CNBC that the company did not expect immediate acceptance. He explained that inclusion in the index might happen in the future, but not right away.

The company has previously seen the benefits of index recognition. Its shares rose after inclusion in the Nasdaq 100, MSCI USA, MSCI World, and the Russell 2000. Those listings created steady demand from funds tracking the benchmarks, providing indirect exposure to Bitcoin for investors. The S&P’s rejection, however, signals limits to that channel. Without recognition, expansion into the broadest pool of portfolios may stall.

JPMorgan analysts warned that this could ripple outward. Other index providers could revisit whether to keep Strategy and comparable crypto treasury firms in their benchmarks. Any such move could add pressure on Strategy’s stock and weaken the strategy of using index listings to gain wider Bitcoin exposure.

Meanwhile, more obstacles are beginning to weigh on companies that keep large amounts of Bitcoin in their reserves.

- Nasdaq is said to have introduced a rule requiring firms with large crypto reserves to obtain shareholder approval before issuing new shares, making it harder for companies like Strategy to raise capital for more Bitcoin purchases.

- Companies following the “crypto treasury” model are facing growing skepticism, as investors increasingly view the approach as overcrowded and underperforming.

- JPMorgan analysts noted signs of fatigue, pointing to weaker share performance and a sharp slowdown in equity fundraising. They added that while debt issuance remains, it is coming at steeper costs.

Strategy Expands Bitcoin Holdings

Despite these setbacks, Strategy continues to add to its Bitcoin holdings. On September 8, the company disclosed a purchase of 1,955 BTC worth about $217.4 million, paying an average price of $111,196 per coin. It also reported a year-to-date yield of 25.8% in 2025.

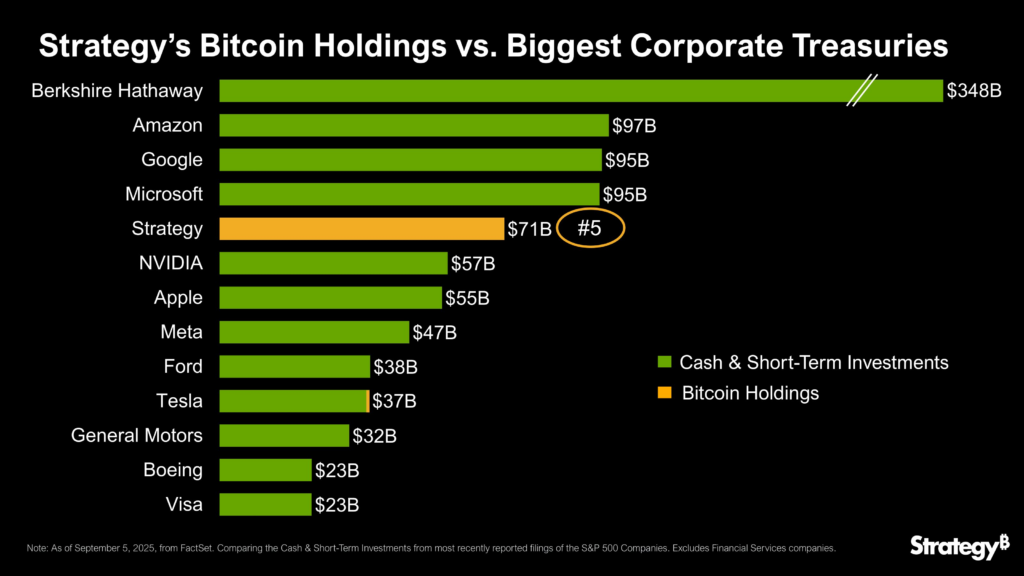

The acquisition brought its total to 638,460 BTC, purchased for about $47.17 billion at an average cost of $73,880 each. Meanwhile, in a separate update on X, the company noted that its treasury ranks fifth in size compared with firms already in the S&P 500.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.