Stablecoin Market Hits Historic $270.3 Billion Record

The future of stablecoins is taking shape in this colorful and often unpredictable world of cryptos. Records are breaking one after another, driven by massive adoption and piling innovations. And while some see it as a simple fad, others bet that this wave will not stop anytime soon. The numbers speak for themselves… and they have rarely been so eloquent.

In Brief

- Stablecoins reach 270.303 billion dollars in capitalization, with a weekly increase of 3.051 billion dollars.

- USDT holds 61.06% of the market, USDC largely dominates global DeFi transactions.

- American regulation propels TRON to 51% of USDT in global circulation.

- Ethereum keeps DeFi leadership, while Base and Solana quickly gain strategic importance.

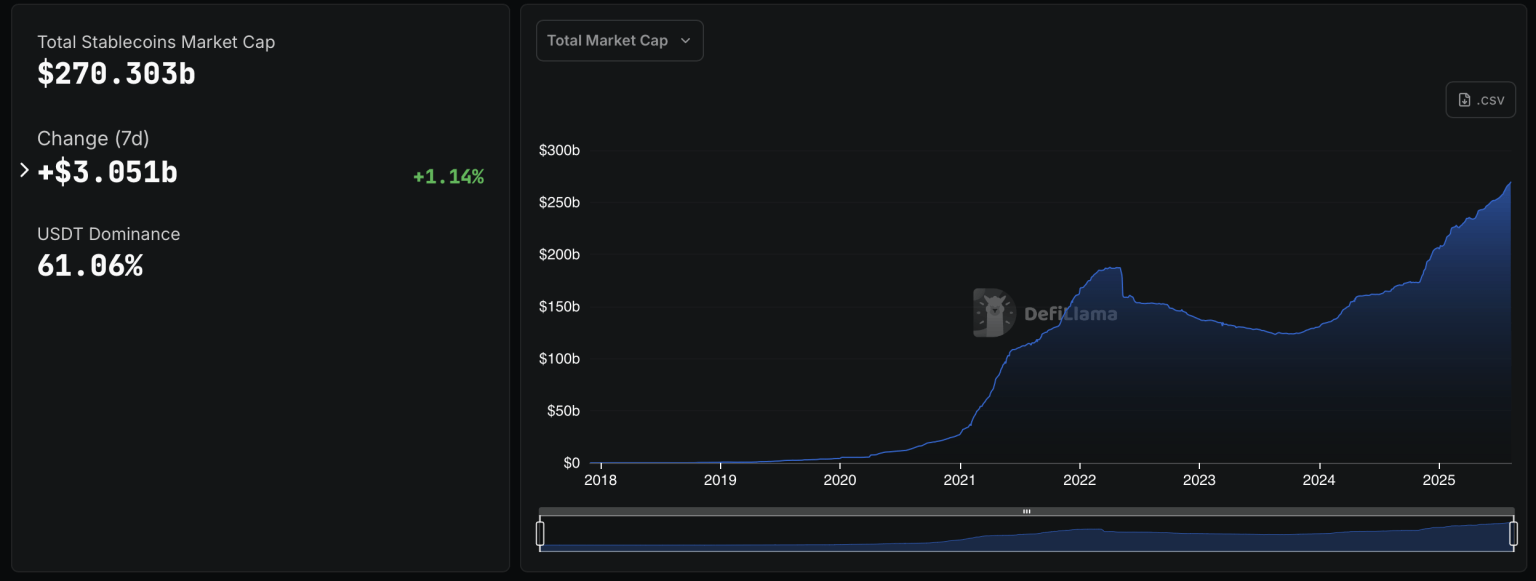

A historic peak that redefines the stablecoin market

For stable cryptos, a record was set in August 2024 in terms of market cap. 12 months later, the total capitalization of stablecoins reached 270.303 billion dollars according to DefiLlama, and 368 billion if the entire market is taken into account. In one week, 3.051 billion dollars were added to the tokenized money supply, +1.14%. Growth reflecting a worldwide adoption.

In detail, USDT maintains a clear lead with 61.06% market share. USDC follows closely but shines mainly in the DeFi universe where it captures 40 to 48% of transactions. This shift toward usage, rather than simple holding, tells a different story than just the volume battle.

The flows are colossal: 2.7 trillion dollars exchanged in 30 days, a level comparable to the Visa network and much higher than PayPal or classic international transfers. These movements come from 42.8 million active addresses over a month, spread across Ethereum, Tron, BNB Chain, Solana, Base, and Arbitrum.

Transaction geography shows dominance of North America and Asia, while Europe progresses. Latin America, Africa, and Southeast Asia remain vibrant markets, showing stablecoins are establishing themselves as a universal bridge between fiat and crypto.

American regulation: a springboard for stablecoins

July 2025 marked a turning point with the adoption of the GENIUS Act, establishing a clear framework for fiat-backed stablecoins. For institutions, it is an official green light. Investors, previously cautious, are now rushing into this class of digital assets.

The SEC added another stone to the building by recognizing some fully backed USD stablecoins as “cash equivalents” on company balance sheets. This status opens the doors to broader integration into traditional finance.

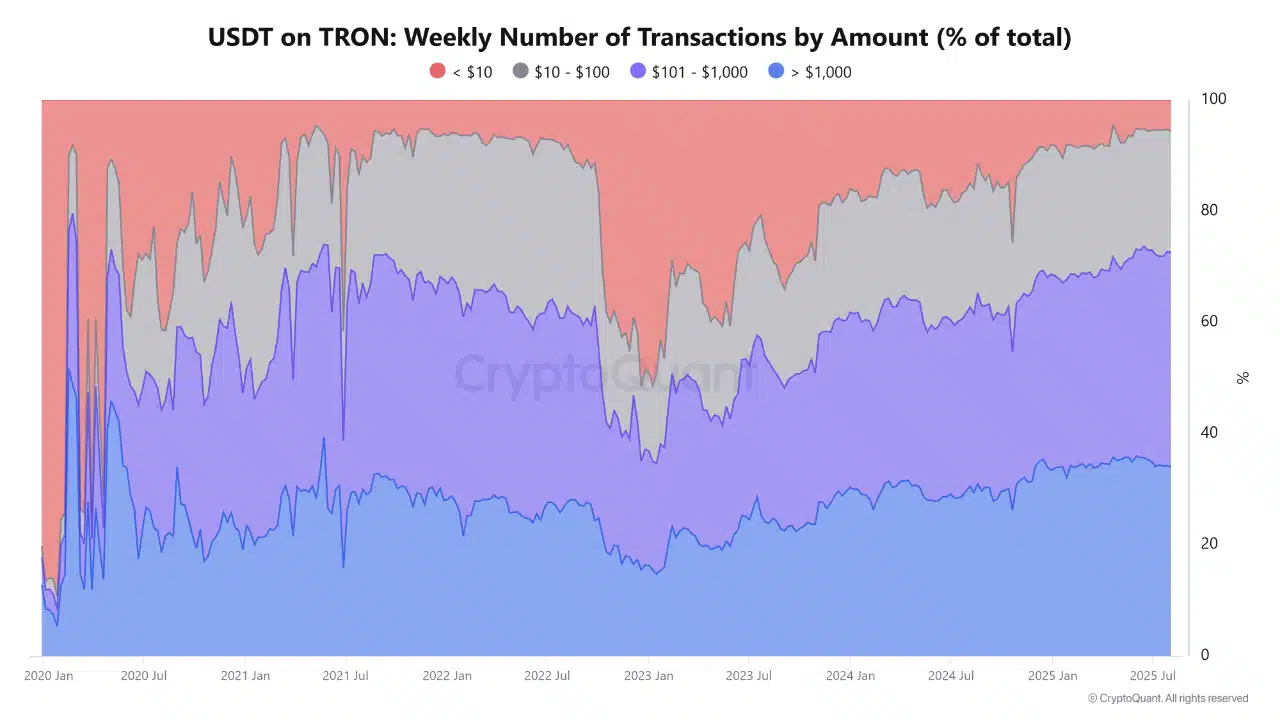

Immediate effect: TRON saw USDT issuance jump by 1 billion dollars in a few days, raising its share to 51% of all USDT in circulation, or 83 billion dollars. Justin Sun, founder of TRON, praised this performance in a post highlighting the speed and low cost of his network.

Usage changes: 38.66% of transactions on TRON are between 101 and 1,000 dollars. Freelancers, merchants, and SMEs adopt these fast, secure transfers. Micropayments (<10 $) decline, signaling professionalization of flows.

This new regulatory environment transforms stablecoins into real treasury tools, able to attract both Wall Street and emerging markets.

Boiling networks: Tron, Ethereum, and the volume war

In this technological battle, TRON and Ethereum trace parallel but complementary paths. TRON, with its 8.29 million weekly USDT transactions, establishes itself as the global hub for fast payments. Its formula: low fees, speed, and reliability.

Ethereum remains the stronghold of USDC and DeFi. Its TVL reaches 137.33 billion dollars, with a peak at 179 billion this year, supported by liquid staking and ETH flirting with 4,000 $. USDC volumes on Ethereum dominate the DeFi market, capturing most transactions.

Behind these two giants, Base and Solana accelerate their progress, offering alternative issuance grounds. Newcomers like USDe (+79.47% supply in one month) or USDf (+100%) shake the established order.

Some key numeric benchmarks:

- 270.303 Bn $ stablecoin “float” in 2025;

- 2.7 trillion $ exchanged in 30 days;

- 51% of USDT circulates on TRON;

- 42.8 million active addresses in one month;

- USDC = 40 to 48% of DeFi transactions.

These data show that the battle no longer plays only on capitalization, but also on usage, speed, and network diversity.

The United States sees in this stablecoin wave a lever to regain control of global digital finance. China, on the other hand, chooses a cautious and soft-step approach, reflecting a desire to master the digital monetary transition without rush. A strategy that could well redefine the global balance in the long term.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.