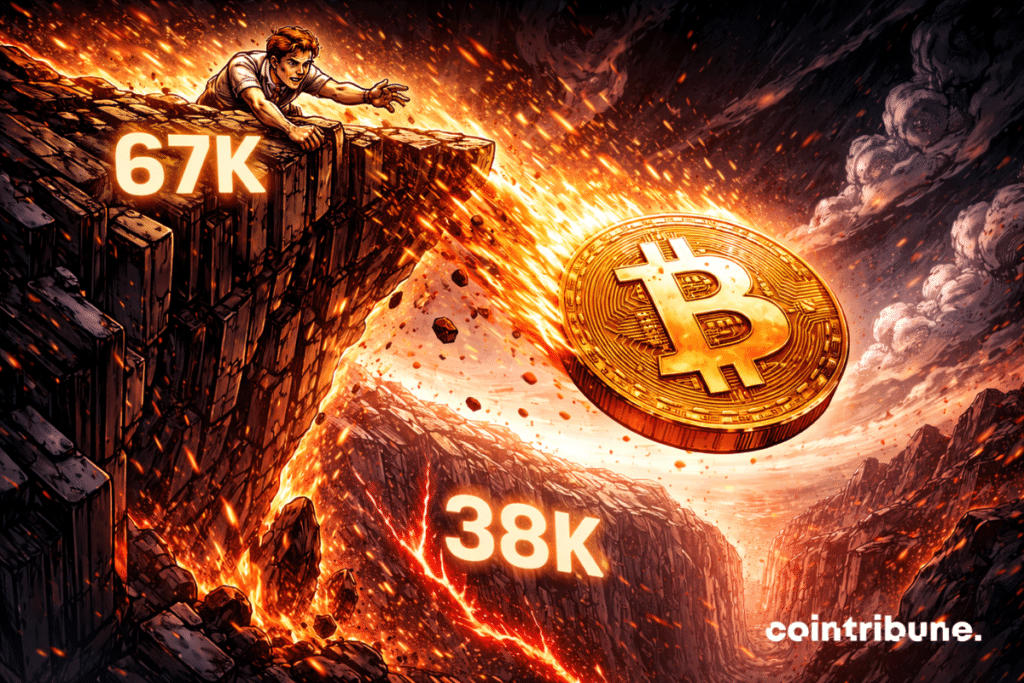

Stifel Predicts Bitcoin Slump Down To $38K

Bitcoin wavers below 67,000 dollars and concern is rising. In an already fragile context, Stifel bank issues a severe warning: a return to 38,000 dollars is now possible. Such a retreat, over 40 % decline, would far exceed usual corrections. This scenario, supported by technical and macroeconomic signals, brings crypto market volatility back to the forefront. And this time, it is no longer a mere warning.

In Brief

- Bitcoin briefly dropped below $67,000, reaching its lowest level since November 2024.

- Investment bank Stifel warns of a risk of a drop towards $38,000, a potential 43 % decline.

- This forecast is based on macroeconomic factors : restrictive monetary policy, regulatory uncertainties, liquidity decline.

- Significant outflows have been recorded on spot Bitcoin ETFs, intensifying downward pressure.

Stifel Sounds the Alarm

While whales become defensive, Bitcoin briefly dropped below 67,000 dollars this Thursday, logging its lowest value since November 2024. This retreat occurs in a tense context, amplified by a report issued by investment bank Stifel, which mentions a bearish scenario that could bring BTC down to 38,000 dollars.

“If this level is reached, it would represent an additional 43 % decline compared to current prices”, the Stifel document specifies.

The analysis advanced by the bank rests on a series of macroeconomic and market factors, identified as potential catalysts for a prolonged plunge :

- A restrictive monetary policy by the Federal Reserve, reducing investors’ risk tolerance ;

- Regulatory gridlock in the United States, which hampers visibility and institutional initiatives within the crypto ecosystem ;

- The contraction of overall liquidity, making the market more vulnerable to selling shocks ;

- Continuous withdrawals from spot Bitcoin ETFs, signaling a loss of institutional confidence ;

- A historical reading of the market cycle : after a peak at 126,000 dollars in October 2025, a correction phase is deemed likely by Stifel, consistent with previous cycles.

Technical Signals Turn Red

Beyond this fundamental-based reading, market observers like Walter Bloomberg warn of growing tensions within derivative instruments.

He mentions a phenomenon of “forced deleveraging”, meaning a rapid unwinding of leveraged positions that fuels additional selling pressure. This mechanism could amplify short-term volatility, especially if key technical levels were to fail.

The numbers are clear. Just on Thursday, Bitcoin ETF recorded net outflows of 7,925 BTC, approximately 533 million dollars. Over the past week, withdrawals total 19,090 BTC, equivalent to around 1.28 billion dollars, confirming a trend of institutional disengagement.

On the charting side, analyst MartyParty emphasizes the importance of the 68,000 dollar threshold, corresponding to the 200-week exponential moving average. He notes that failing to hold above this support could lead to a pullback towards the 200-week simple moving average, around 58,000 dollars.

Despite current pressure and alarming forecasts, the market remains attentive to its key levels. While uncertainties persist, some players maintain their confidence : Bitcoin remains a safe investment despite the crisis, supported by its historical resilience and the interest it continues to generate among long-term investors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.