Binance has proven once again why they are the biggest scammers in crypto

— Cowboy (@CryptoCowboy_AU) October 11, 2025

During the recent market crash, they froze user accounts across the board, preventing traders from accessing their funds at critical moments. Limit orders and stop-loss functions were conveniently… https://t.co/2KACQ9Ns6B pic.twitter.com/BA08yzezwT

A

A

Suspicion Grows Around Binance Price Anomalies

Sun 12 Oct 2025 ▪

4

min read ▪ by

Getting informed

▪

Centralized Exchange (CEX)

Summarize this article with:

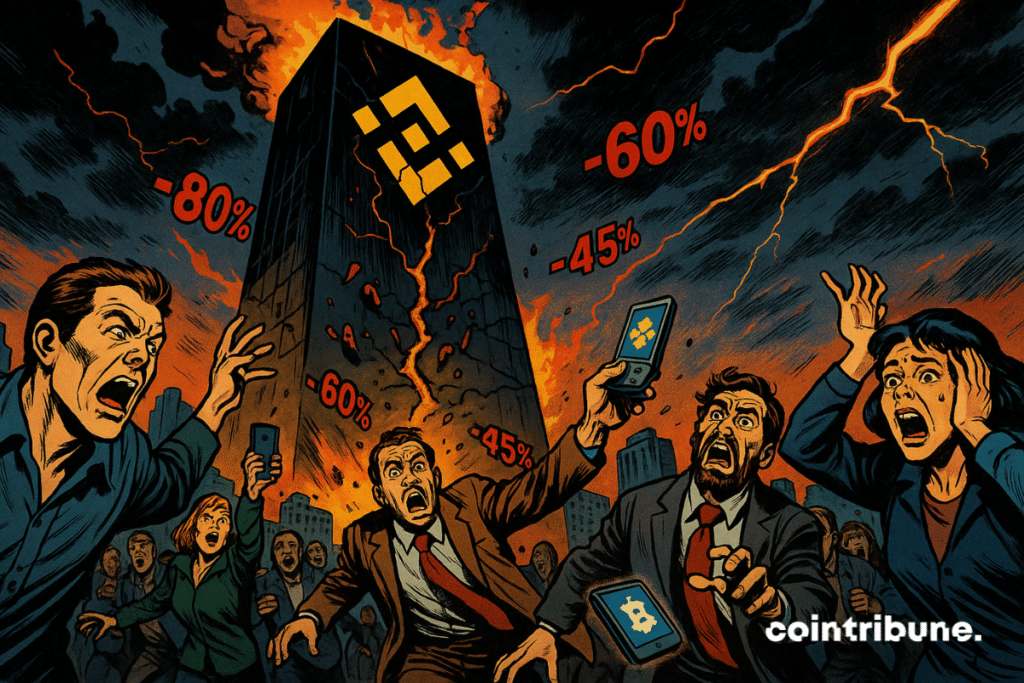

On October 10, as markets plunged following a shock announcement from Washington on tariffs targeting China, over 200 billion dollars evaporated in a few hours. However, beyond volatility, it was Binance’s behavior that crystallized tensions. The platform is accused of freezing accounts during the panic, preventing thousands of users from acting.

In Brief

- On October 10, a global crypto crash erased more than 200 billion dollars in a few hours.

- The panic originated from Donald Trump’s announcement of new 100 % tariffs on Chinese imports.

- Binance is accused by many users of freezing accounts and blocking essential order executions.

- Several tokens, including ENJ and ATOM, briefly showed prices close to zero on the platform.

Suspicions of Order Freezing and Accusations of Manipulation

While markets were undergoing a significant correction, many Binance users were suddenly faced with account blocks and inactive orders during a liquidation phase.

On social media, anger exploded : “Binance has once again proven that they are the biggest scammers in crypto”, denounces a user on X, CryptoCowboy_AU, accusing the platform of deliberately freezing accounts while losses were mounting.

During the most critical minutes of the crash, several assets, including Enjin (ENJ) and Cosmos (ATOM), briefly showed extremely low prices, down to $0.0000 for one, $0.001 for the other, before rebounding quickly. These price anomalies fueled suspicions of manipulation or, at the very least, serious system malfunctions.

Here are the most important facts reported by users :

- The inability to place or modify stop-loss and limit orders as markets were collapsing ;

- A temporary blocking of user account access, preventing any arbitrage or withdrawal ;

- Display of aberrant prices, notably on some altcoins like ENJ and ATOM, dropping to null or near-zero values ;

- The temporary freezing of order books : long and short positions were reportedly liquidated while interfaces remained frozen ;

- Minimal communication from Binance, which describes the situation as simple “overload issues” and assures that “funds are SAFU”, without offering compensatory measures at this stage.

Many actors denounce a situation that is not unprecedented. Binance had already been accused early this year of freezing orders during a previous massive liquidation episode. While other platforms like Coinbase or Robinhood also experienced technical slowdowns during the same event, it is Binance that faces most criticism, both for its central role in the market and for its lack of transparency.

A Tragic Death Shakes the Crypto Community

While investors were trying to absorb the crash losses, another piece of news further darkened the scene: Konstantin Ganich, better known as Kostya Kudo, was found dead in Kiev in his Lamborghini.

An emerging figure in the Ukrainian crypto scene, this trader and influencer had built a large community around his investment advice. According to some information, his death occurred at the peak of the crisis, in a context of extreme volatility and widespread disorientation.

The death was confirmed on his official Telegram channel and relayed by Cryptology Key, one of his content partners. The exact causes of his death have not yet been made public, but the circumstances raise questions.

Although no direct link has been established between the crash and this tragedy, the timing raises concerns about the intense psychological pressure experienced by sector players, especially those exposed publicly.

Ukraine, Ganich’s home country, has seen rapid crypto adoption in recent years amid a difficult economic climate. Actively promoting trading strategies, Kostya Kudo embodied this new generation of financial influencers, torn between ambition, media exposure, and growing responsibilities toward his community. The violence of recent market corrections may have exacerbated these tensions, especially among those whose image rests on an implicit promise of constant success.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.