Aave Labs founder Stani Kulechov has suggested sharing revenue from outside the protocol with token holders amid ongoing governance debates.

Aave (AAVE)

When the boss of Aave puts 15 million on the table, crypto wonders who really governs... and who votes without raising a hand.

Aave founder Stani Kulechov is facing growing criticism after purchasing a large amount of AAVE tokens ahead of a key governance vote, a move some community members say threatens fair decision-making within the DAO. The controversy has intensified concerns about the concentration of voting power and whether governance outcomes still reflect broad community interests rather than the influence of large holders.

Aave, a pillar of DeFi, is faltering under the weight of a controversial decision. Far from the technical debates about yield or innovations in smart contracts, it is governance that crystallizes the tensions. A rushed vote on the transfer of the protocol's brand assets to the DAO was launched without consensus, provoking a strong reaction within the community. Between accusations of forcing the issue and criticism of the transparency of the process, the crisis exposes the fragility of a model often cited as an example.

Aave enters a new growth phase after the SEC ends its investigation, planning V4, Horizon, and a mobile app to drive growth in 2026.

A major Cloudflare outage on Tuesday caused widespread disruptions across crypto platforms and several major websites. Service interruptions spread quickly as users struggled to load exchange portals, block explorers, and analytics tools. Early reports from affected firms indicated that Cloudflare error messages were appearing across front-end interfaces.

Aave Labs has taken a significant step toward regulated on-chain finance in Europe. The company has received authorization under the EU’s Markets in Crypto-Assets (MiCA) framework, allowing euro-to-stablecoin conversions at no cost. This places Aave among the first major DeFi projects cleared to offer compliant payment services across the European Economic Area.

Growing interest in Ethereum’s long-term outlook has pushed validator queues higher for both entry and exit. Recent data indicate that roughly 1.5 million validators are waiting to join the staking system, while approximately 2.45 million ETH are in the exit queue. These conditions mark a busy period for participants who choose native staking over liquid staking alternatives.

Aave steps up a gear. Its decentralized autonomous organization (DAO) has just unveiled an ambitious buyback program that could redefine its treasury management. The initiative would transform occasional buybacks into a permanent policy, funded by the protocol's growing revenues. But will this strategy be enough to sustainably support the token against fierce competition in DeFi?

Decentralized finance is about to reach a new milestone. Aave, a leading crypto lending protocol, is preparing to launch its V4 update by the end of 2025. After crossing the symbolic mark of 50 billion dollars in net deposits, the ecosystem is ready for a major transformation. But what will this new version concretely bring?

With renewed confidence in the crypto market following macroeconomic events, the decentralized finance (DeFi) niche is showing strong performance, as evidenced by its recent growth. The latest data now shows that the sector could be poised to touch the previous peak it reached nearly four years ago.

Crypto loans at their peak, manipulated volumes, vanished users: between incentive bubbles and invisible debt, has DeFi become a big bank... without counters or clients?

The boom of stablecoins and the crypto industry breathed a contrastive and lively breath. To some speculative frenzy responds the quest for efficiency of others. Amid this turmoil, Aave advances by leaps and bounds. Backed by $70 billion in aggregated deposits, the protocol expands its territory on Aptos, a non-EVM blockchain designed for performance. A disruptive strategy, designed to chase speed, security, and new liquidity flows all at once. A new chapter of DeFi is being written, between institutional ambitions and technical pragmatism.

Ethereum wavers between past profits and the cold sweats of summer: an explosive cocktail mixing variable rates, rapid predictions, and a DeFi that grits its teeth.

The decentralized finance giant Aave has just crossed a symbolic threshold by surpassing 50 billion dollars in net deposits. This historic achievement solidifies the protocol's position as the undisputed leader in DeFi lending. A major milestone that reflects both the maturity of the sector and its growing attractiveness to institutions.

DeFi is booming, billions are piling up, Aave rejoices, Maple innovates, Morpho asserts itself... What if crypto credit became the true banker of Web3?

Present since 2017 under the name EthLend, Aave reflects the transformation of DeFi. Indeed, five years after the DeFi Summer of 2020, during which decentralized finance emerged from its embryonic phase, this new economic sector has entered a new phase.

Like a rising tide, Aave is reshaping its economy: buybacks, redistribution, protection... The fragile balance of decentralized finance wavers under this bold overhaul.

DeFi protocols had promised a brighter future. The result? 500 million ETH evaporated, stunned investors, and a crypto market that wobbles like a tightrope walker without a net.

The Aave community is exploring new avenues to increase its revenue by considering Bitcoin mining. However, discussions on the Aave governance forum reveal some skepticism among token holders.

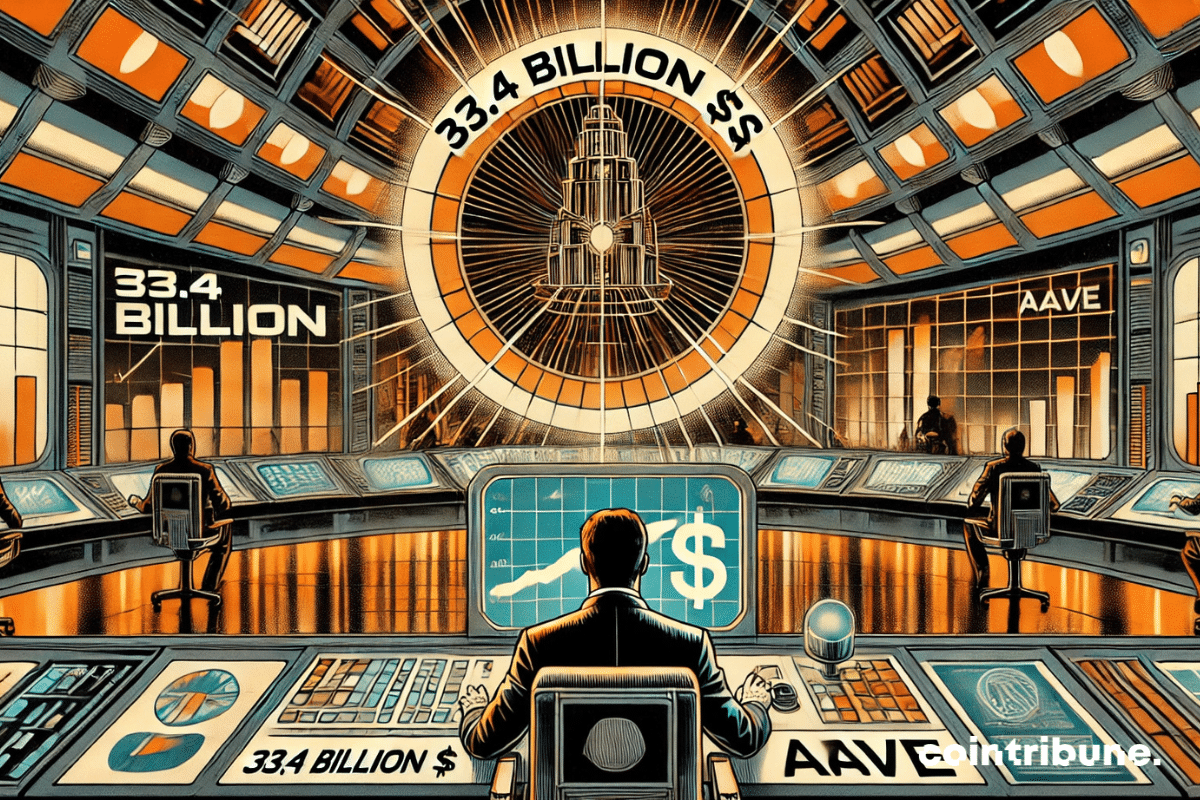

Decentralized finance (DeFi) continues to demonstrate its potential, and Aave is today one of the most eloquent examples of it. Indeed, the platform has reached $33.4 billion in net deposits, surpassing the record levels of 2021, which marked a major turning point for the crypto sector. This staggering figure is not just a simple statistic, but a reflection of an ever-evolving dynamic. The DeFi ecosystem, driven by technological innovations and growing adoption, is transforming into a credible alternative to traditional financial institutions. In this context, Aave is redefining standards by diversifying its markets and strengthening its offerings, attracting both investors and developers. This performance illustrates the platform's robustness, but also the growing maturity of a sector in search of expansion and security.

"Decentralized finance, Trump’s new craze! The sale of WLFI promises mountains and wonders to investors… or not."

Bernstein predicts DeFi returns exceeding 5%! A strong signal for the crypto market with the imminent drop in U.S. rates.

After two consecutive weeks of increase, AAVE undergoes a correction of more than 10%. Let's examine the future prospects for AAVE's price.

Cryptocurrencies are experiencing a rebound. 5 assets are standing out in particular. Details in this article.

DeFi loans hit a record high of 11 billion, with Aave V3 leading, thanks to Ether.fi and Ethena yield strategies.

Blockchain enables many conveniences for people: not least the ability to control their assets and data. Connecting this technology with traditional finance (TradFi) is a challenge that Chainlink has set itself. To this end, the data provider has developed the Cross-Chain Interoperability Protocol (CCIP), which can be easily married with banking chains. Close-up!