#Chainlink CCIP is live on mainnet! Early adopters include @synthetix_io, which is using CCIP to secure its burn-and-mint model for cross-chain liquidity transfer, and @AaveAave, which is using CCIP to future-proof its multi-chain governance mechanism. https://t.co/SSh1k7t2JF

— Chainlink Today (@ChainlinkToday) July 17, 2023

A

A

Chainlink (LINK) rallies banks to blockchain

Wed 19 Jul 2023 ▪

3

min read ▪ by

Getting informed

▪

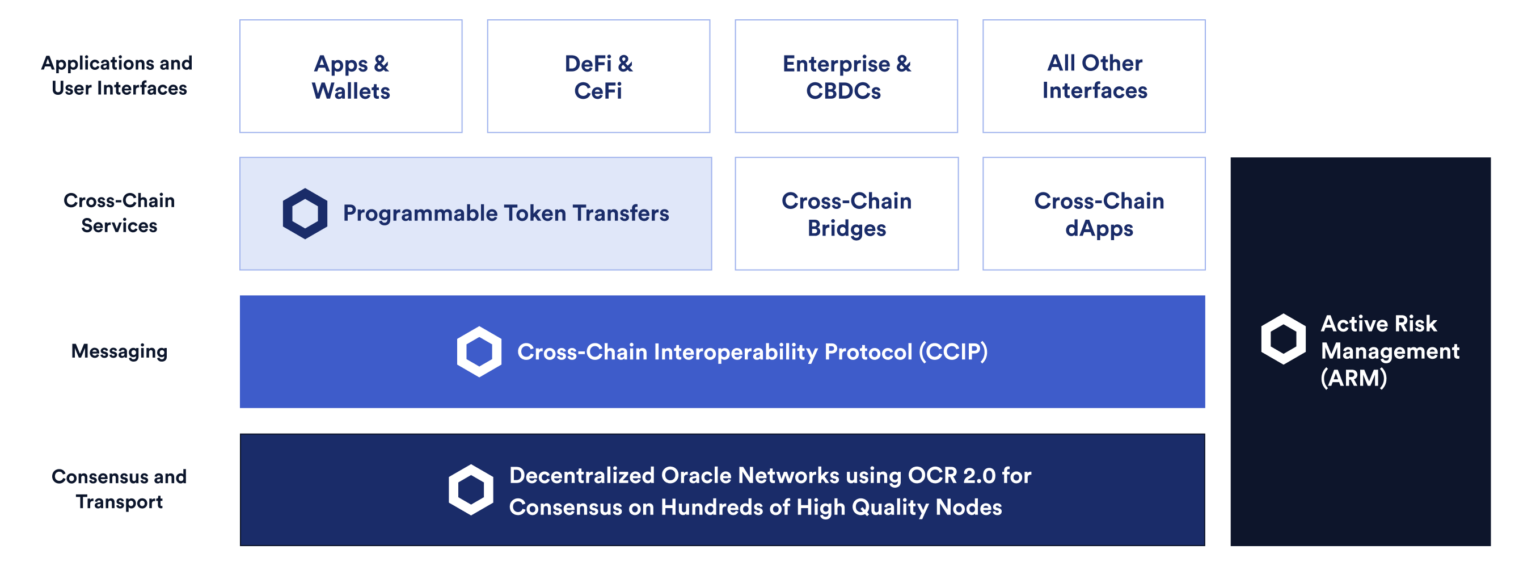

Blockchain enables many conveniences for people: not least the ability to control their assets and data. Connecting this technology with traditional finance (TradFi) is a challenge that Chainlink has set itself. To this end, the data provider has developed the Cross-Chain Interoperability Protocol (CCIP), which can be easily married with banking chains. Close-up!

Chainlink’s online CCTP

Like Circle, which successfully launched its Cross-Chain Transfert Protocol (CCTP) last April, Chainlink has also developed a similar protocol. Except that this one is more focused on interoperability.

So, thanks to this particular feature, Chainlink believes it has developed a standard conducive to connecting all blockchains with banking chains.

The official press release posted on Chainlink’s website states that CCIP, which is akin to a global cross-chain communication standard, is live on the following blockchains: Polygon, Ethereum, Avalanche and Optimism.

In addition, the same protocol will also integrate the Ethereum Sepolia, Arbitrum Goerli, Optimism Goeri, Polygon Mumbai and Avalanche Fuji testnets this Thursday, July 20.

A few details about CCIP

Aware of the multi-chain world in which we live, and the volume of transfers between chains ($170 billion according to the Chainlink blog), Web services leader 3 Chainlink (LINK) has decided to implement its protocol.

He defines CCIP as follows:

“The Cross-Chainlink Interoperability Protocol (CCIP) is an open-source standard for inter-chain communication that establishes a universal connection between any public and private blockchain. CCIP is designed to allow applications and user interfaces built on top of them to send arbitrary data, transfer tokens or transmit instructions with tokens between blockchains (i.e. programmable token transfers).”

Banking chains among the winners

As a reminder, the Society for Worldwide Interbank Financial Telecommunication (SWIF) had already shown an interest in Chainlink’s CCIP back in June. A test with several banks (BNP Paribas, Lloyds Banking Group…) was one of the clauses of their partnership at the time. In this way, the two giants will be able to establish the state of the art in blockchain interoperability for banks.

According to Sergey Nazarov (co-founder of Chainlink), his team created CCIP to “connect the fragmented landscape of public blockchain and the growing ecosystem of blockchain banking into a single Internet of contracts”.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.