Beneath its capricious star appearance, bitcoin hesitates, retreats, but watches for the perfect moment to bounce back better… What if the whales know something we don’t?

All Time High (ATH)

Altcoins may be positioning for a rebound after months of subdued price performance. Market data indicates that many tokens are trading above key support levels established in October. Analysts say these signals could point to a renewed appetite for risk across the broader cryptocurrency market.

If we start looking at the price of bitcoin from the perspective of "adjustment," aren't we simply recreating the same system? Aren't we, by thinking in terms of seasonal adjustments, becoming the new central bankers?

The trajectory of bitcoin is marked by cycles of rapid rises and dizzying falls. However, when will it reach its next peak? Peter Brandt, a recognized analyst, provides a bold answer: September 2029. His forecast reignites a crucial debate on the dynamics of crypto market cycles. However, beyond this deadline, the real question lies in the internal and external forces shaping these cycles. A thorough analysis of these factors is essential to understand bitcoin's future.

Grayscale shakes up certainties. In its latest report, the asset manager anticipates a new ATH for bitcoin by June 2026, breaking with the traditional four-year cycle. Against a backdrop of rising public debt, inflationary pressure, and a changing regulatory framework in the United States, this projection relies on clear macroeconomic signals. At a time when trust in fiat currencies is eroding, Grayscale sees bitcoin as a safe haven asset undergoing a structural transformation. Such a vision challenges and redefines market benchmarks.

BNB’s latest rally has pushed the token to new highs, sparking strong reactions from market leaders and investors. With growing adoption across DeFi, gaming, and on-chain trading, analysts view the rise as more than just a price move—it signals deepening network strength and credibility.

Bitcoin ended the week under pressure as investors rotated toward safer assets amid renewed US-China trade tensions and broader market weakness. Despite robust inflows into Bitcoin exchange-traded funds (ETFs), derivatives data suggest traders remain cautious about the sustainability of current price levels.

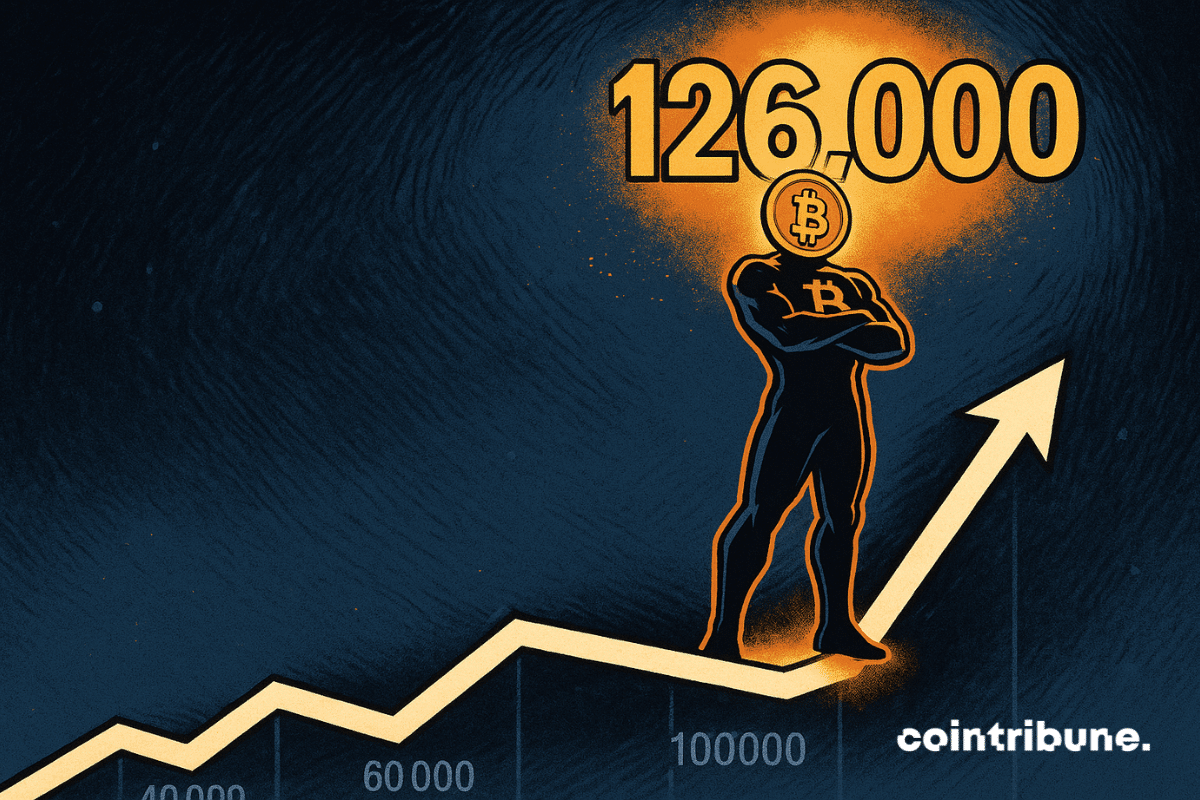

Bitcoin has just crossed 126,000 dollars, but the market remains surprisingly quiet. This ascent without frenzy, rare in a universe where spectacular rises often precede violent drops, intrigues analysts. Unlike usual cycles, the apparent calm of the metrics fuels both confidence and curiosity. Should we see in this the beginnings of a new paradigm for the flagship crypto asset?

Bitcoin (BTC) has once again surpassed its previous records, climbing to new heights above $126,000. Unlike earlier speculative rallies, analysts say this surge reflects a stronger market structure and increasing institutional participation. More so, on-chain and ETF data suggest that Bitcoin may be entering a more stable phase of growth.

While traditional financial benchmarks falter, bitcoin establishes itself as a new standard. Monday evening, the crypto crossed a symbolic threshold by reaching $126,069, after a first record at $125,000 the day before. This rapid rise occurs amid a climate of distrust towards traditional assets and against the backdrop of a declining dollar. More than just a peak, this movement reflects a fundamental dynamic that redefines the hierarchy of values in global markets.

Bitcoin is soaring, but enthusiasm is fading: what if artificial intelligence has already sensed the scam of an Uptober that will not explode?

As monetary benchmarks collapse, bitcoin establishes itself as the flagship asset of a new financial order. Surpassing $125,700, it reaches an unprecedented peak and propels its capitalization beyond $2.5 trillion. This rapid ascent occurs amid political tensions in the United States and dollar fragility, reshaping the power lines of global markets. This symbolic threshold signals a profound shift of confidence towards a decentralized alternative.

While some watch the Fed rates, bitcoin soars to 125,000 dollars. The crypto star climbs, but exchanges panic: will there be a shortage of coins?

BNB touches the heights while the US government stalls. Record, Kazakh investors and low-cost transactions: Binance fears neither shutdown nor speculation. A crypto that doesn't fall asleep!

At Pump.fun, yesterday's chaos becomes today's eldorado: a memecoin inflated with billions, crazy promises, and regulators grimacing at the show.

On September 13, Binance Coin (BNB) crossed a symbolic threshold by briefly surpassing the market capitalization of the Swiss bank UBS. Such an event illustrates the rising power of cryptos against traditional financial institutions. Changpeng Zhao, co-founder of Binance, immediately reacted, calling on banks to "adopt BNB". As the crypto reaches a new all-time high, this statement revives the debate about the integration of native tokens in banking strategies in the era of decentralized finance.

The co-founders of Glassnode predict a new peak for bitcoin, Ethereum and Solana within a month. This announcement contrasts with the prevailing caution and reignites the debate on the strength of the bullish cycle. Between on-chain data and uncertain macroeconomic context, this projection immediately attracted the attention of investors, dividing the community between hope for an imminent record and fear of excess optimism.

BNB surged to $909 following Binance’s collaboration with Franklin Templeton, as analysts anticipate further gains and strong market momentum.

Bitcoin sulks, altcoins stir: 55% dominance and tokens lying in wait... But who will really take the pot by December?

In a few hours, Ethereum went from euphoria to retreat. On August 24, the crypto reached an all-time high of 4,955 dollars before losing nearly 9% shortly after, with 60 billion dollars of capitalization going up in smoke. Such a brutal correction, occurring in an already fragile market, recalls the fragility of bullish rallies in an environment still largely driven by speculation.

While the asset has just broken its all-time high, Arthur Hayes, the founder of BitMEX, reignites the debate by putting forward a shocking prediction: Ethereum could reach between 10,000 and 20,000 dollars by the end of the bull cycle. A statement that, in a climate of strong monetary uncertainty, resonates as a strong signal for the crypto ecosystem, between personal conviction, macroeconomic reading, and very real market dynamics.

Nasdaq-listed SharpLink Gaming (SBET) has adopted a unique approach to maximize its shareholder value through a newly approved repurchase program. In a Friday statement, the Minneapolis-based firm outlined plans that would enable it to repurchase up to $1.5 billion worth of common stock to boost its Ethereum holdings.

While traditional markets seek new momentum, Ethereum confirms its central role in the digital financial ecosystem. This Friday, ETH crossed a historic threshold at 4,880 dollars, surpassing its 2021 record. This symbolic peak is part of a global crypto market rally, driven by a more accommodative tone from the Fed and renewed interest from institutional investors. The event marks a strategic turning point for Ethereum, now seen not merely as a speculative asset but as a pillar of future financial infrastructures.

While Bitcoin catches its breath, OKB burns 93% of its reserve, soars to the sky, flirts with a liver crisis… and quietly builds its kingdom on X Layer.

Ethereum races toward its all-time high, chased by three hungry altcoins. Between voracious whales and wild forecasts, the crypto world is stirring... and some are already counting their bills.

In a now structured market, each bitcoin record acts as a revealer of the deep tensions crossing the ecosystem: shortage of supply, institutional pressure and shifting macroeconomic climate. On August 14, by breaking 123,500 dollars, bitcoin not only broke its previous high. It confirmed the entrance into a new maturity phase, fueled by precise technical and financial dynamics. This movement is neither fortuitous nor purely speculative, but the product of a structured sequence of converging signals.

The next weeks could decide the market's future, as bitcoin trades above 117,000 dollars. Indeed, legendary trader Peter Brandt warns that the crypto queen approaches a pivotal moment, possibly a temporary peak. With over ten years of post-halving cycle analysis, he cautions against a scenario that could surprise even seasoned investors. This alert comes as some experts doubt the relevance of bitcoin's historical cycle.

While the spotlight seemed to be focused elsewhere, BNB surprised the entire market by setting a historic record at $851.48. The surge, which occurred over the weekend, triggered a series of massive liquidations, revealing the extent of leveraged exposure. This sudden spike places Binance's crypto at the center of the action, amidst rising activity on the BNB Chain and institutional players beginning to stake their positions.

While Bitcoin makes headlines, the discreet BNB is climbing quietly. An ATH that tastes of revenge? A crypto that works while others act like stars!

Bitcoin’s all-time high (ATH) trended on crypto social media this week, with nearly half of all mentions discussing the recent milestone achieved by the OG coin. Even as the coin posted a strong climb during this period, experts believe such a level of dominance may lead to a short-term top and usually precedes a brief retracement.