Ethereum just experienced a historic purge: 6.4 billion dollars in leverage evaporated, causing its price to drop. Yet, whales are taking advantage to massively accumulate. Why this paradox? A crisis or an opportunity? Analysis of a decisive turning point for crypto.

Theme Altcoins

BitMine buys $70M of Ethereum in 3 days. Supercycle coming? Discover all the details of this massive operation.

Changpeng Zhao and his investment company YZi Labs come out swinging against the management of CEA Industries, accused of letting the BNC stock price collapse by more than 90%. This offensive marks a turning point for the future of this treasury company dedicated to BNB. Will shareholders follow CZ in this battle to regain control?

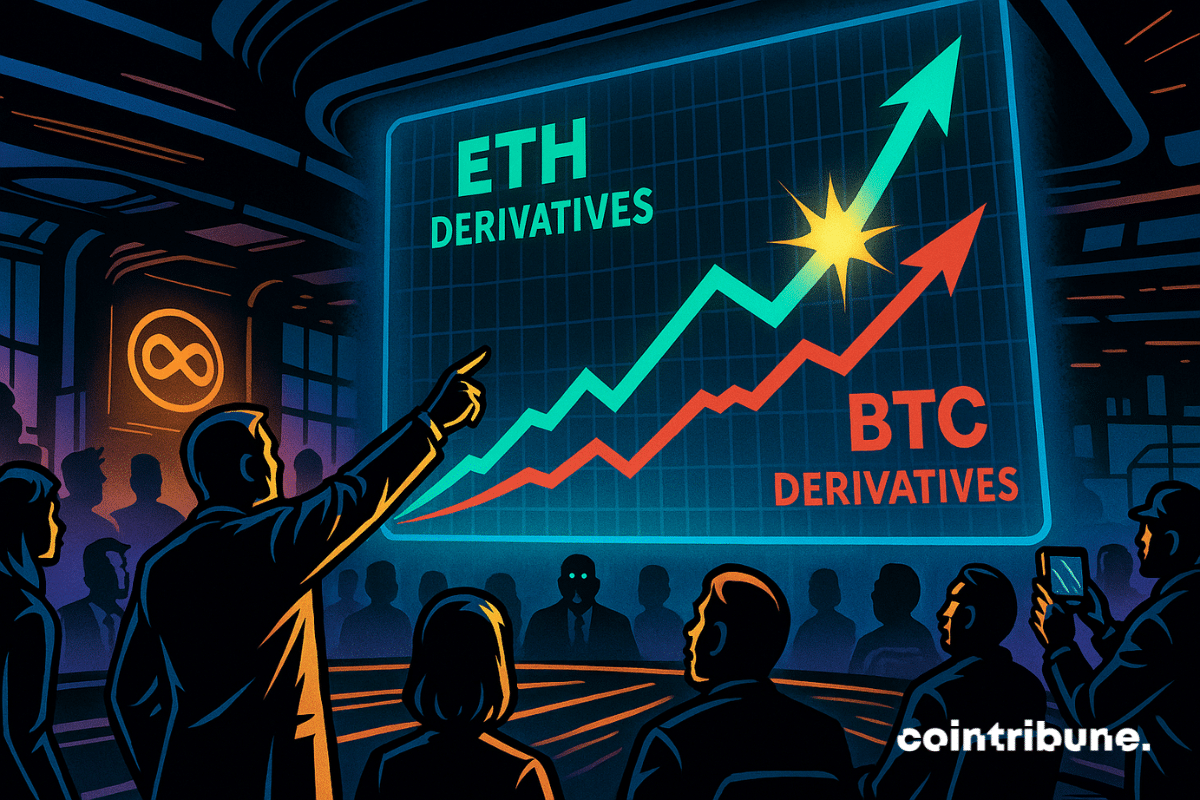

In the derivatives market, a milestone has just been reached. For the first time, Ether (ETH) futures contracts have generated more volume than those on bitcoin (BTC) on the Chicago Mercantile Exchange. This reversal occurs in a climate of high volatility, reflecting a marked repositioning of institutional players. Such an overtaking could then signal a deeper change in the balance between the two main assets.

What if Ethereum was worth much more than the market thinks? According to a study conducted by CryptoQuant, 9 valuation models out of 12 estimate that ETH is currently largely undervalued. For Ki Young Ju, CEO of the platform, these analyses reveal a significant gap between the current price of Ether and its real theoretical value. This finding rekindles the debate on how cryptos should be valued.

Solana is booming, but CoinShares is backing down: the ETF leaves the stage before entering. The crypto market, meanwhile, is still applauding... Go figure where the real show is.

Ethereum is about to revolutionize its network with a gas limit raised to 180 million. Anthony Sassano reveals how this update could reduce fees and boost scalability! A major breakthrough for the crypto ecosystem.

After 18 days in the extreme fear zone, the crypto market shows a first sign of relief. The Crypto Fear & Greed Index rises slightly, finally leaving its lowest level. This rebound occurs while November, traditionally favorable to Bitcoin, ends in uncertainty.

Do Kwon, former DeFi star, is now at the center of an unprecedented judicial scandal. Less than two years after the collapse of Terra-Luna, which swallowed $40 billion, he is trying to avoid a heavy sentence in the United States. His goal is to convince the court to limit his sentence to five years in prison. Two weeks before his hearing, this request reignites debates about the responsibility of crypto founders in the face of the devastating consequences of their projects.

Barcelona faces criticism after partnering with little-known crypto firm ZKP, raising concerns that fans could be exposed to high-risk digital tokens.

Monero (XMR) gained more than 23% this week, while Zcash (ZEC) dropped by nearly 25%. Such a gap highlights the high volatility of the privacy coins market, in a context of low activity related to Thanksgiving. This divergence between two key privacy assets raises questions about the internal dynamics of the sector.

XRP shows an increase of 0.85% at $2.22, but its trading volume collapses by 31.87%. A puzzling paradox that raises questions: Are crypto traders losing confidence despite rising prices? Analysis of the numbers and stakes to understand what is really at play behind this trend.

After a historic series of 18 flawless days, Solana ETFs have just marked their first halt. The 21Shares Solana ETF faced massive withdrawals, dragging the entire sector into the red. Does this sudden reversal mark the end of the euphoria around SOL?

Bhutan surprises by entering the Ethereum universe. This small Himalayan state staked 320 ETH, nearly one million dollars, via the Figment validator, thus asserting a clear strategy of integration into the blockchain. Far from a simple investment, this initiative is part of a broader technological shift, where digital sovereignty and public infrastructure meet on Ethereum. A rare approach at the state level, redefining the contours of national engagement in the crypto ecosystem.

An ETF on a privacy coin? Grayscale dares where no one has gone before. Discover how Zcash could shake the US market.

While Bitcoin nears the highs, XRP quietly courts Wall Street with its ETFs... What if the real crypto maneuvers are played far from the spotlight? To watch.

Growing confusion over Polygon’s token identity has prompted project leaders to reconsider a decision made just a year ago. Concerns from everyday users and long-time holders have reopened the discussion about whether the network should drop its current POL ticker and restore MATIC, the name many still recognize.

XRP just recorded one of its strongest on-chain activity spikes in months. A sudden 1.48 billion surge in payment volume pushed network usage to its highest level in weeks and coincided almost perfectly with an $8 million increase in market capitalization

Trump buys back his WLFI token relentlessly. Between crappy shitcoin and dwindling fortune, the family crypto empire is rocking hard. And to think they saw it as digital freedom...

MON token made a strong debut, surging soon after its mainnet launch and attracting backing from major industry players.

Massive cash-out: Pump.fun withdraws $436M in crypto and triggers a shockwave on Solana. All the details in this article.

Ethereum struggles to regain height after its recent correction, oscillating below major technical levels despite the loyalty of its long-term holders. The second largest crypto market capitalization tries to revive its upward momentum, but the demand engine runs at low speed. Without new capital inflows, the recovery remains fragile, dependent on the patience of long-term investors.

Franklin Templeton launched an XRP-backed ETF on NYSE Arca this Monday. This event marks a significant milestone in integrating altcoins into regulated markets. While attention is focused on Bitcoin ETFs, this initiative signals an expansion of institutional interest. After the litigation between Ripple and the SEC, this launch could pave the way for other cryptos previously sidelined by traditional markets.

Banned but coveted, China plays it cool and reconnects its bitcoin machines. Silence in Beijing, but business is booming in provinces where electricity costs nothing.

Grayscale’s DOGE and XRP spot ETFs have cleared NYSE approval, moving closer to hitting the U.S. market amid ongoing crypto volatility.

Two ETFs backed by XRP have just been listed on the NYSE, a first meant to propel Ripple to the rank of institutionalized crypto assets. However, the market sends an opposite signal. The crypto collapses below 2 dollars, down 35% for the quarter. Far from a bullish turning point, this regulatory advance reveals a persistent disinterest. The ETF effect, expected as a driver, seems to have had no tangible echo.

After recording spectacular gains exceeding 1,000% since January, Zcash is going through a turbulent phase marked by a sharp 24% drop in one day. But behind this sharp drop, conflicting signals emerge: some crypto investors see a buying opportunity, while the derivatives markets sound the alarm.

Solana has just recorded 18 consecutive days of positive net inflows on its ETFs, a first in the sector. Launched in early November, these financial products have already attracted over $500 million, triggering significant interest from institutional investors. In a market still overshadowed by the 2022–2023 bear cycle, this dynamic surprises and raises questions about Solana's repositioning in crypto portfolios.

The crypto market is going through an unstable period, marked by a sharp decline in the most speculative assets. In 24 hours, memecoins lost more than 5 billion dollars, bringing their capitalization to an annual floor. NFTs follow the same trajectory, reaching their lowest level since April. This plunge is part of a broader flight-to-safety movement, with investors massively deserting high-risk assets.

While Bitcoin and Ethereum endure massive withdrawals, two newcomers shake up the scene. Solana and XRP ETFs accumulate nearly 900 million dollars in net inflows despite a market in full collapse. Are we witnessing the emergence of a new hierarchy in the crypto ecosystem?