Uptober fizzled out, November bleeds: $3.79 billion gone, Bitcoin stumbles, Solana rejoices… What if the BlackRock giant just pressed where it hurts?

Theme Altcoins

World Liberty Financial (WLFI), the Trump-backed crypto platform that describes itself as “community governed,” is again facing criticism over how it manages user funds. Recent wallet freezes and an upcoming asset redistribution have intensified long-standing concerns about centralized control. Users remain divided over whether WLFI’s intervention reflects responsible oversight or signals deeper governance problems.

Ether (ETH) dropped nearly 30% in one month, breaking the symbolic $3,000 threshold. This brutal setback endangers the finances of an entire segment of the crypto ecosystem. Behind the curve, companies exposed to ETH see a year of gains evaporate.

Solana saw over 200,000 new tokens launched last week, led by pump.fun, but most projects struggle to gain trading traction.

A new milestone has just been reached in the integration of cryptos into traditional markets. Bitwise filed the 8-A form for its XRP ETF on November 19, a clear signal of an imminent listing on the NYSE. The product, awaited by institutional players, could be launched in the next few hours, marking a strategic turning point for XRP and strengthening the legitimacy of cryptos with regulated finance.

VanEck's Solana ETF has just entered the scene, and it's not just another product on the altcoin shelf. We are witnessing a real flood of crypto funds on the stock market, with Solana and soon Dogecoin at the forefront. Between slash fees, integrated staking, and a race against regulatory time, a new battle is playing out far from traditional exchange platforms.

Behind the apparent rise of XRP, the technical signals turn red. While Ripple's crypto shows a sustained price, the on-chain data reveal a worrying fragility: a large share of recent investors are at a loss, exposing the market to potentially explosive selling pressure.

Global cryptocurrency markets are under heavy pressure after a sharp decline in Bitcoin's value damaged sentiment across the sector. Prices are now giving back most of the gains made earlier in the year, while smaller tokens are falling to multi-year lows. Investors are reassessing risk, trading volumes are shrinking, and several analysts warn that further declines remain possible.

Tom Lee says Ethereum is entering the same supercycle that propelled Bitcoin’s historic surge, noting the move will require holding through market ups and downs.

Ethereum faces steady ETF outflows, with investors viewing it as riskier than Bitcoin, signaling caution in the market.

Growing interest in digital assets is prompting investors to reassess which tokens deserve long-term attention. Recent shifts in sentiment around Solana, XRP, and other major networks reflect a market still trying to determine its next set of leaders.

Chainlink takes the lead in the RWA sector just as the crypto market corrects. Development data on GitHub shows a clear gap with Hedera, Avalanche and others, confirming that Chainlink establishes itself as the technical benchmark of the segment. For institutional investors, this code dominance, despite the price drop, becomes a signal hard to ignore.

CMC messes up, CZ takes a risk, Aster takes off... and the curious watch the screen. When an altcoin creates a rebound while the crypto universe collapses, should you believe it or flee?

At each ETF launch, the crypto market anticipates a price jump. For XRP, backed by the new XRPC fund from Canary Capital, the expected effect did not occur. Despite solid opening volume, the price remained frozen before dropping by 7%. A striking contrast with previous surges triggered by similar announcements. Why hasn’t XRP, despite being in the spotlight, benefited from this institutional momentum?

While crypto traders tremble at the thought of a crash, the charts whisper promises. Should you flee or buy? Breath-taking suspense in the token jungle.

While ETFs backed by SOL have recorded steady inflows for nearly two weeks, its price is plunging, reaching a five-month low. This striking paradox between institutional enthusiasm and spot market weakness raises the question: why does such a supported asset fall so sharply? Away from classic patterns, Solana reveals the deep, sometimes contradictory tensions currently affecting the crypto ecosystem.

XRPC, Canary Capital’s new XRP ETF, opened with record inflows as the crypto market weakened and the token dropped 6%.

Bitwise’s Chainlink ETF has appeared on the DTCC registry, showing progress toward launch, though SEC approval is still pending.

XRP is entering a crucial week. While the market is still digesting recent shocks, Ripple's crypto finds itself at a pivotal stage. On one side, a major technical support resists under pressure, and on the other, hope is reborn around an XRP ETF that could finally come to fruition. Between encouraging technical signals and fundamental catalysts, conditions for an explosive move seem to be met.

A former BlackRock executive has just thrown a wrench in the works. For him, Ethereum will not be just another blockchain. This network will actually become the digital backbone of all global finance. A bold vision as crypto has just lost a key support at 3,600 dollars.

Injective has just deployed its native EVM mainnet, marking a turning point in the evolution of layer 1 blockchains. This integration allows Ethereum developers to leverage the power of Cosmos without sacrificing performance. But will this technical feat be enough to reverse the downward trend of the INJ token, down more than 60%?

While the crypto market remains under pressure due to global economic uncertainties, XRP continues to disappoint despite concrete advances. Why such a discrepancy between its fundamentals and its price? For Versan Aljarrah, a recognized analyst and founder of Black Swan Capitalist, the answer is straightforward. As long as XRP remains correlated with bitcoin, it will remain trapped by chronic volatility. This statement reignites the debate on the strategic independence of Ripple’s flagship asset.

It was said to be gone, buried, burned... But here comes Shiba Inu barking again! A crypto building in the shadows, while others play disposable stars.

The crypto universe seems to be restarting: NFTs on fire, memecoins going wild! Discover why the market is exploding.

While the small ones sell, the big ones stuff themselves with ETH. A mysterious update named Fusaka might hide a tricky move... or a boon!

As the American shutdown crisis nears its end, another signal captures crypto investors' attention. No less than eleven ETFs backed by XRP have just appeared on the DTCC website, the key body of the American financial markets. While this registration does not signify regulatory approval, it demonstrates a concrete step toward a possible listing on U.S. markets. It is a major technical milestone for XRP, which could revive institutional interest in the asset.

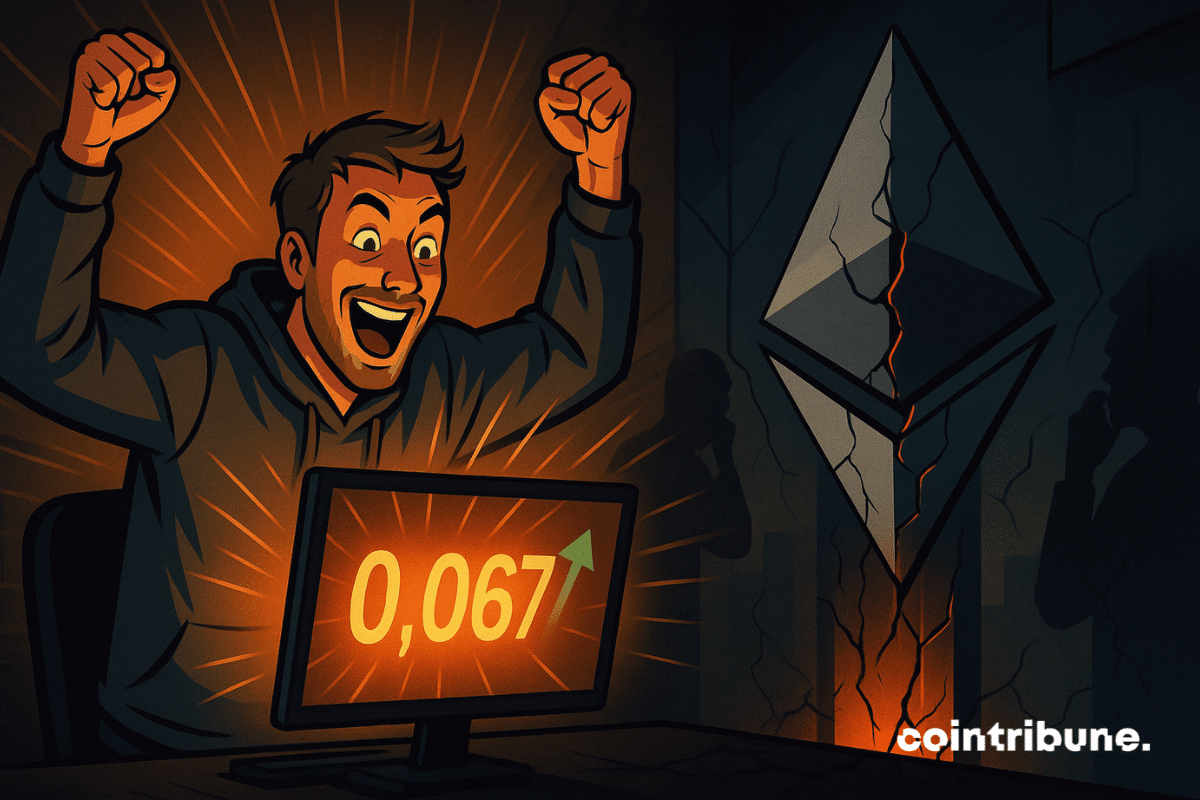

Making a transaction on Ethereum now costs only a few cents. This Sunday, gas fees plunged to 0.067 gwei, a level never seen in years. While traders praise this spectacular drop, it raises questions about the economic viability of Ethereum's model.

Ripple parades with Mastercard and Nasdaq, raises 500 million… but XRP collapses. In the crypto world, golden speeches do not always prevent wallets from lightening.

The countdown is on for an XRP ETF. Two asset management giants, 21Shares and Canary Capital, have initiated a legal procedure that could force the automatic approval of their funds within 20 days, unless the SEC explicitly vetoes it. In a climate where the institutionalization of cryptos is accelerating, this maneuver could propel XRP to the heart of regulated markets. This historic first places the American authority with a decisive choice or a silent deadline.

While Bitcoin and Ethereum flee wallets like the plague, Solana seduces the big players. What if the real crypto power was hiding behind well-structured staking?