The highly anticipated launch of the REAL token, backed by former UFC champion Conor McGregor, has faced a crushing failure. Despite significant media buzz, the sealed auction launched on April 5, 2025, did not meet the financial targets set. The project led by Real World Gaming (RWG) failed to raise the necessary funds, and the team is forced to reimburse the crypto investors.

Theme Blockchain

The storm is hitting crypto. On the night of April 7, 2025, Bitcoin collapsed below the symbolic threshold of $75,000, hitting an intraday low of $74,637! In just 24 hours, the leading cryptocurrency lost more than 10%, triggering a shockwave across the entire market.

The crypto market is experiencing one of its most violent crashes today. After resisting the Trump storm until now, it has finally given in! In just 60 minutes, over 200 million dollars have been liquidated, taking with them the hopes for a short-term rebound. As a result, the total market has fallen to 2.51 trillion dollars, showing a loss of more than 5% in less than 24 hours.

In an uncertain macroeconomic context, a clear trend is emerging: stablecoins are entering an independent bull market, according to the asset manager VanEck in its April 2025 report. While smart contract platforms like Solana and Ethereum are experiencing a significant slowdown, stablecoins are rapidly gaining ground in the crypto ecosystem.

Ultra, the one-stop destination for gamers, publishers, and developers, has completed a $12 million funding round led by Luxembourg-based multi-family office NOIA Capital through its NOIA Digital Assets fund.

Finally some good news! The Ethereum Pectra fork is confirmed for May 7th. We will deliver all the details in this article!

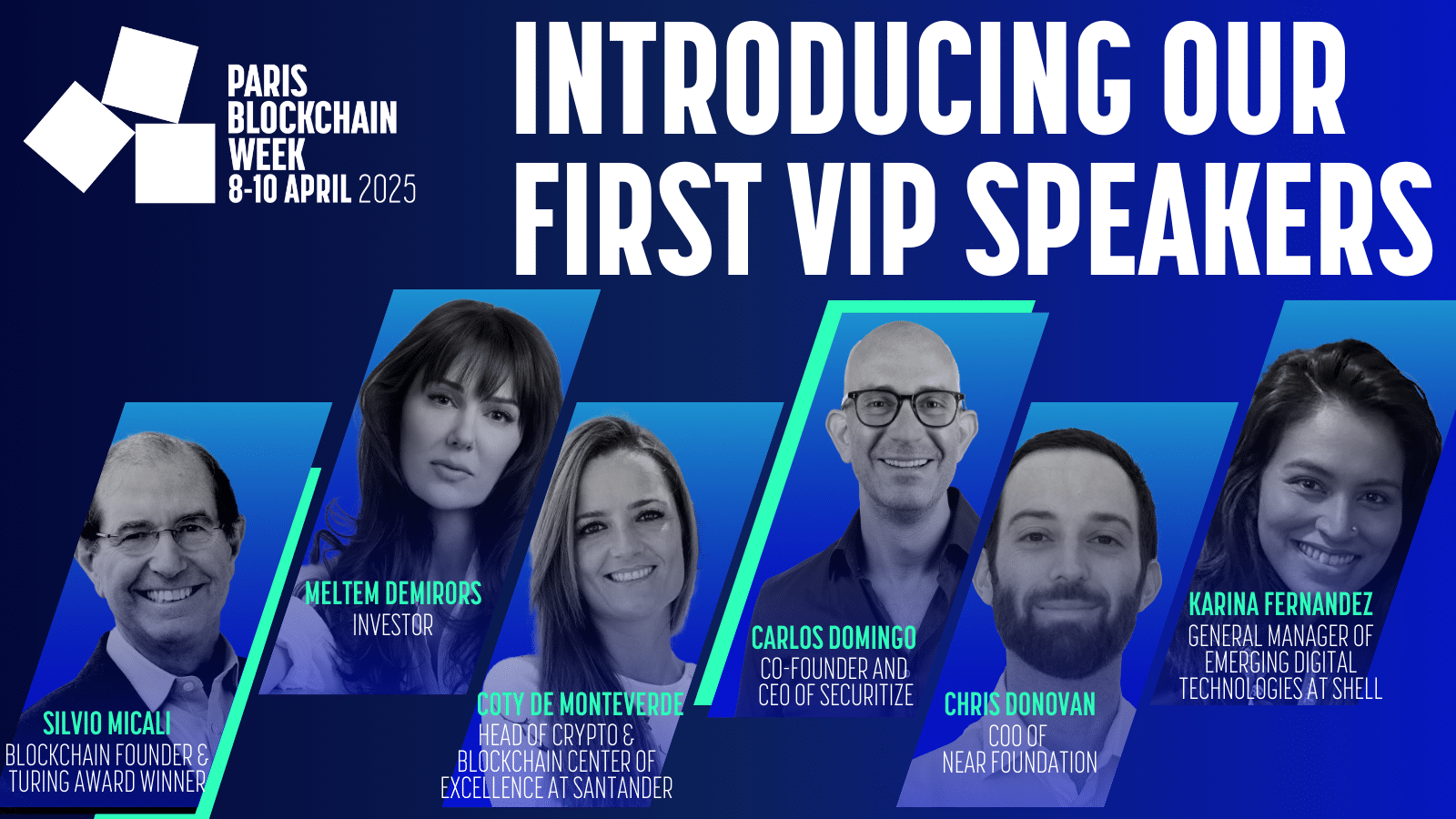

Paris, France – April 2, 2025 – Paris Blockchain Week (PBW), Europe’s flagship blockchain event, returns to the iconic Carrousel du Louvre from April 8–10 with its most ambitious edition to date. More than 10,000 delegates from across the globe will gather in the French capital to hear from over 400 speakers, including industry heavyweights such as Adam Back, Co-Founder and CEO of Blockstream, Charles Hoskinson, Founder of Input Output, and Monica Long, President of Ripple. They will address topics ranging from open finance to regulatory frameworks like MiCA, while other keynote speakers will explore CBDCs and enterprise Web3 adoption.

Ethereum is facing a dramatic drop in its revenue from blob fees, falling to its lowest levels since 2025. This 95% decrease raises major concerns about the economic future of the network…

The return of familiar patterns in the bitcoin market is intriguing. Just like in 2020, whales – those entities holding between 1,000 and 10,000 BTC – are starting to accumulate massively, despite the prevailing volatility. If history repeats itself, June could very well mark the beginning of a spectacular surge… ATH downloading?

Bitcoin begins the week against a backdrop of economic and technical uncertainties. While the symbolic threshold of $82,000 struggles to hold, investors are closely monitoring market signals. Amid geopolitical tensions, alarming technical indicators, and hopes for a bullish reversal, here are the 5 elements to watch closely this week.

The numbers are falling, dry and relentless. In one month, developer activity on Ethereum, a cornerstone of the crypto ecosystem, has dropped by 11.8%. A decline that is not isolated: BNB Chain, Polygon, Arbitrum… All are seeing their metrics crumble. Worse, according to Santiment, some networks are losing up to 25% of their activity. This gradual desertion of coders, the nerve of blockchain innovation, is not a simple fluctuation. It is a critical signal for a sector that once dreamed of being unstoppable.

The Shiba Inu ecosystem is about to reach a historic milestone. The Shibarium blockchain, a layer 2 solution dedicated to this crypto universe, is nearing the billion transactions mark. At the time these lines are written, the counter shows more than 992 million transactions, with a daily rate exceeding 3.8 million. Just a few more days, and Shibarium will make history.

Solana is experiencing an unprecedented surge in activity: 11.12 million active addresses. In a crypto market where actual usage now takes precedence over promises, this figure marks the return of a network that some said was losing momentum, now propelled by visible, measurable, and concrete adoption. This dynamic, more than symbolic, repositions Solana as a structuring player in the ecosystem, with clear signals of resilience and traction.

After months of waiting, the main creditors of FTX finally see the light at the end of the tunnel. The bankrupt crypto platform announced that repayments will resume from May 30, 2025. This is an announcement highly anticipated by large investors, especially those hoping for a return on their frozen assets.

Ethereum is dead. For several venture capitalists, Ethereum has ceased to be a relevant investment asset. Layer-2 solutions, poorly controlled inflation, loss of revenue... Ethereum seems caught in a downward spiral that challenges its long-term financial viability. Analysis of a major strategic shift.

While several media outlets report that Bitcoin's dominance has reached a peak of 58.8% on March 28, 2025 – a record since April 2021 – a more nuanced reality emerges. According to our data, BTC hit a dominance peak of 61.2% two weeks earlier. This figure, overlooked or ignored, actually reveals a decline in Bitcoin's market share. Thus, is this the harbinger of an Altseason comeback?

The NFT market begins 2025 on a bitter note, with a brutal 63% drop in sales. Sector icons, such as CryptoPunks and Bored Ape Yacht Club, are collapsing drastically! Yet, amid this chaos, some unexpected collections are emerging, redefining the rules of an ecosystem in full transition.

Bitcoin is taking a pause. While the flagship cryptocurrency struggles to sustainably break through the $86,000 mark, gold is smashing all records. This Thursday, the yellow metal reached a new historical peak of $3,059 per ounce, fueled by a tense macroeconomic context.

A French team secured third place at the prestigious Qubic 2025 Hackathon held in Madrid. Their project QuLang, which revolutionizes access to artificial intelligence on the Qubic blockchain, impressed the jury with its innovative approach to decentralized inference of large language models.

Ethereum has long embodied a technological fortress in the crypto universe. But today, the ship is rocking. As the network prepares to deploy its Pectra update, developers are navigating murky waters. Delays, unexpected bugs, sly attacks... Behind the promises of innovation lies a less glamorous reality: that of an exhausted team facing technical challenges that threaten to push back the long-awaited deadline. A stark spotlight on the backstage of an ecosystem in search of perfection.

Is Solana about to deliver a fireworks display for investors? After breaking an ultra-bullish technical pattern, SOL is taking off and now aims for 235 dollars. But the road is fraught with obstacles: mere excitement or the beginning of a real rally? An analysis of a high-stakes April.

The bitcoin market is moving, twitching, hesitating… and with it, the emotions of investors. Here are the 5 key points to absolutely know this week to avoid navigating blindly in this turbulent sea.

DIV Protocol opens its testnet next week, in collaboration with 15 selected private companies. For over a month, they will explore the capabilities of this innovative cloud, based on blockchain and post-quantum encryption. A major advancement for the cybersecurity of sensitive data in businesses. DIV Protocol launches its testnet reserved…

The hype has faded like a poorly minted NFT: the flamboyant tales of Bitcoin are fading away, leaving only the echo of a promise sold too soon.

Binance boosts its BNB Chain with turbo: with Pascal, crypto transactions zip by like arrows, leaving slow nodes on the sidelines of Web3.

Ethereum is collapsing, but reserves on crypto platforms are evaporating even faster. Is a historic rebound near? Analysis!

What if blockchain became the new safeguard of humanitarian aid? A persistent rumor is circulating in Washington: USAID, a pillar of international assistance, might undergo a transformation under the influence of Trump advisors. Their idea? To inject a dose of crypto into the bureaucratic veins of the agency. The stated goal: to track every dollar, eradicate leaks, and redefine transparency. A bold shift that combines technological innovation and political calculation.

Paris Blockchain Week, the premier global event for blockchain professionals, reveals the first six headline speakers for its sixth edition, which will take place from April 8-10th, 2025, at the Carrousel du Louvre.

Pump.fun, the wildest memecoin factory on Solana, has just shut the door on Raydium to launch its own DEX, PumpSwap. A break in a "thanks, but we'll do it without you" fashion, which smells of independence, strategy... and a hint of well-disguised panic.

Tether surpasses Canada and becomes the 7th largest buyer of US Treasury bonds. What are the implications for the crypto market?