Bitcoin is nearing $105,000, but this surge fuels both enthusiasm and division. While some analysts anticipate the exhaustion of the bullish cycle, others see it as a simple step towards new records. This symbolic threshold crystallizes the tensions between caution and euphoria, where every movement in the price becomes a closely scrutinized indicator. Uncertainty reigns, and the upcoming trajectory promises to be more decisive than ever for investors.

Bull Run

Bitcoin has once again shaken up the market. By surpassing the $105,000 mark, the iconic crypto has returned to levels it hasn't seen since January. This surge, accompanied by a rise in the major altcoins, reignites speculation: is it just a technical rebound or the start of a new bullish cycle? In a rapidly changing geopolitical context, as investors regain their appetite for risk, signals are multiplying... but their interpretation remains uncertain.

May 2025. Bitcoin is navigating beyond $103,000, but this seemingly dizzying figure may just be a warm-up. Behind the scenes, a structural imbalance is taking hold: supply is melting away like snow in the sun, while institutional demand is skyrocketing. Some already speak of a point of no return. Others, like Bitwise or Strategy, are betting on an explosion in prices — up to $200,000 before the end of next year. Myth or inevitable mechanism? What is certain is that the race is on, and the stakes are colossal.

The world of investing has been revolutionized over the past decade by the democratization of ETFs and passive management. However, this investment strategy is beginning to show signs of worrying fatigue. With potentially overvalued markets and anemic return forecasts for the next decade, it becomes urgent to question ETFs.

As Ethereum cheerfully crosses the $2,600 mark this week, a thrill runs through the crypto community. Behind this skyrocketing rise of 37% lies a rare technical signal: maintaining the price above the realized price of $1,900. An indicator that, combined with the Petra update, paints an unprecedented bullish scenario. But why does this symbolic threshold electrify the experts? A deep dive into the insides of a boiling market.

The European Union is ending anonymity in crypto transactions. Starting July 1, 2027, any transfer exceeding €1,000 will be required to reveal the precise identity of the sender and the recipient. According to Paschal Donohoe, president of the Eurogroup, these new anti-money laundering rules (AMLR) clearly place blockchain and digital assets under the direct oversight of European authorities. For crypto enthusiasts, this measure represents both a necessary revolution and a painful betrayal.

Bitcoin is still struggling to reach the symbolic target of $150,000, despite a recent rebound to $104,000 recorded on May 8th. Michael Saylor, founder of MicroStrategy and a staunch advocate of Bitcoin, has clearly identified the culprits behind this slowdown: opportunistic investors, whom he labels as tourists or weak hands, who exit the market at the slightest sign of quick gains.

The bitcoin market has recently freed itself from its winter timidity. Fueled by a resurgence of optimism in financial markets, it has reached its highest level since January. Good news is piling up: an unexpected trade agreement, rising global indices, and a massive influx of digital capital. This combination of factors creates fertile ground for bitcoin.

It is rare for an NFT project to still create an authentic thrill in the crypto universe. Yet, Doodles has just made a splash. In just 24 hours, this colorful collection saw its sales soar by 97%, flirting with $1.1 million. This surge is no coincidence: on the horizon, a certain crypto DOOD is tantalizing investors.

Arizona makes a significant move in the emerging world of digital assets. In May 2025, the state makes headlines by announcing the creation of a strategic bitcoin reserve (SBR). This bold decision demonstrates an unprecedented political will. It illustrates how dollars forgotten by citizens can be transformed into a forward-looking position. More than just a symbolic gesture, it represents a step toward the integration of bitcoin into the dominant economic landscape.

The crypto market surged on May 8, 2025, driven by a spectacular rise in Ethereum. In just a few hours, the asset jumped 22% to surpass $2,200, triggering a strong reaction throughout the crypto ecosystem. This rapid surge is a reminder of the market's reactive power and reignites speculation around the world's second-largest cryptocurrency.

There are psychological thresholds in life, such as turning 30, weighing 100 kilograms, or for cryptocurrency ETH, reaching 1900 dollars. The first seems trivial, the second causes concern, and the last sends shivers through the markets. Yet, all of them provoke turmoil. While the crypto market appears to be dozing, Ethereum chose this precise moment to breach that barrier. A wake-up call? A jolt? Perhaps both. But one thing is certain: in a universe dominated by Bitcoin, Ethereum has decided to remind everyone that it is much more than just a mere number two.

The European Data Protection Board (EDPB) has recently integrated the Bitcoin public key into the scope of the GDPR, turning every transaction into a legal issue. While not formally banning cryptocurrency, this approach creates a difficult gray area to navigate.

As Bitcoin flirts with $94,500, one surprising statistic stands out: 88% of the supply is in profit. A statistic that should make holders smile... with one caveat. Those who bought between $95,000 and $100,000? They are not laughing. This segment, tiny yet symbolic, now concentrates the majority of the losses. But what does this market anomaly really indicate? More than just a simple numeric reading, it is an X-ray of investor psychology.

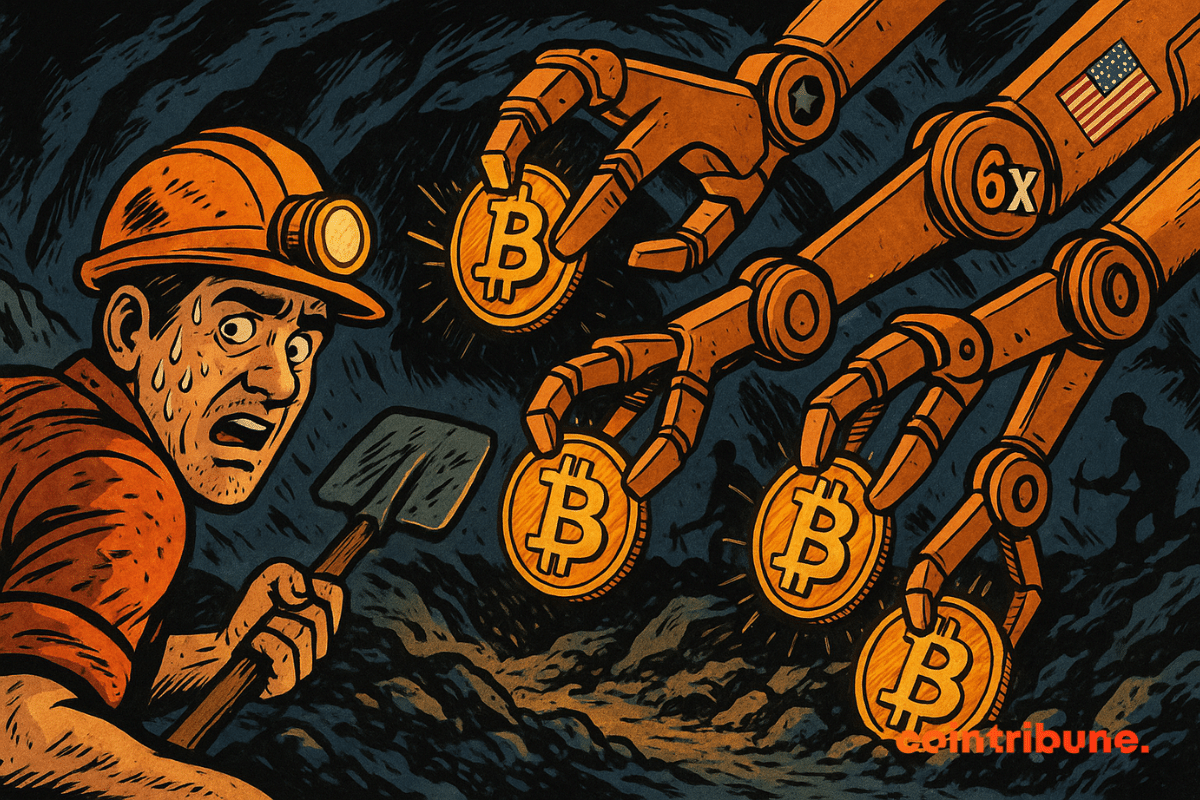

Institutional demand for bitcoin is skyrocketing. Last week, U.S. ETFs accumulated 18,644 BTC. In comparison, miners only extracted 3,150. An unprecedented gap is disrupting the traditional balance.

Bitcoin is a topic of debate. Nassim Nicholas Taleb maintains his frankness. He describes Bitcoin as a "technological tulip." His biting commentary leaves no one indifferent. Thus, let us dive into the heart of his attack to understand his grievances.

The depths of Ethereum are stirring once again. While the market seemed to be dozing off, powerful players are resurfacing, quietly but with a confidence that speaks volumes. No media sirens, no speculative frenzy: just heavy, silent, and resolute movements. The crypto ecosystem is wondering – what are these mysterious whales up to?

The countdown has begun. Indeed, Bitcoin could reach a new all-time high much sooner than we imagine. A recent analysis by Timothy Peterson, a recognized economist in the Bitcoin network, predicts a surge to $135,000 within the next 100 days. The origin of this projection: the drop in the VIX index, a symbol of a renewed appetite for risk, and an aligned macroeconomic context. This could reignite the bullish ambitions of a market in search of solid catalysts.

Invisible to the eyes of the markets, Alliance Resource Partners (NASDAQ: ARLP) has quietly opened a new front. Indeed, this American coal giant is using its surplus electricity to mine Bitcoin. As a result, $45 million worth of BTC now sits on the company's balance sheet. Thus, away from prying eyes, coal fuels more than just boilers. Let’s explore this bold transformation.

Raoul Pal's optimism for Sol and Sui cryptos is intriguing. Contrary to skeptics, the founder of Real Vision presents an unexpectedly positive long-term vision. To understand this "bet", let's first examine the technology, and then Pal's sharp analysis.

The face of the cryptocurrency market is evolving at a rapid pace. On one side, individuals clinging to every satoshi. On the other, institutions ready to commit colossal sums. However, the price of Bitcoin does not always follow the same trajectory for these two populations. In Dubai, during the Cointelegraph LONGITUDE panel, major players sounded the alarm. According to them, soon only the largest wallets will be able to afford a Bitcoin.

The prospect of a bitcoin reaching $200,000 by the end of 2025 raises eyebrows. Standard Chartered asserts this trajectory. The scenario is based on various indicators. It combines returns, ETF flows, and whale movements. In short, the institution bets on a rapid surge. This article details the reasons. It highlights the key signals.

Right from the start, the rise of the memecoin TRUMP has taken an unprecedented political turn. Influential senators are now questioning the White House about the implications of this cryptocurrency. They denounce the very idea of a "gala dinner" reserved for the largest holders. This process raises serious doubts. It could indeed blur the line between private interests and public functions. Through this controversy, the cryptocurrency becomes both a lever of power and an instrument of controversy.

Bitcoin once again takes center stage. Hunter Horsley, CEO of Bitwise, takes boldness to its peak. He envisions a Bitcoin capable of competing not only with digital gold but also with the dollar and U.S. Treasury bonds. Consequently, he mentions a potential market of $50 trillion. So, can we really contemplate such a transformation?

Since its creation, Bitcoin has nurtured the ambition of a global monetary revolution, as the queen of cryptocurrencies fluctuates between spectacular surges and brutal falls. While the symbolic threshold of 100,000 dollars seemed within reach, several recent signals dampen that enthusiasm. Between technical fragilities and macroeconomic instabilities, the current dynamics call for caution. In a market increasingly sensitive to the slightest tremors, it is more essential than ever to read between the lines to understand the true forces at work.

As Bitcoin hovers around $94,000, a dissonance is emerging. Institutions, on the other hand, seem to scream the opposite: $3 billion injected in just one week via Bitcoin ETFs, despite an estimated discount of 40%. Such a striking gap raises questions. Why this massive influx when the price seems to be down? Behind the numbers, a silent battle is taking place between apparent discount and strategic conviction.

One year after its fourth halving, Bitcoin is showing a perplexing trajectory. Although the crypto has climbed since April 2024 — nearing $109,000 in January — its progress remains pale compared to previous cycles. A paradox? Despite absolute records, the annual growth rate is capped at 49%, far from the quadruple digits of the past. How can this historic slowdown be explained when ETFs and the planned coin shortage were supposed to propel the market?

Bitcoin continues to gain, but 87% of its supply is already in profit. The temptation to sell is great, but demand could still support the crypto. Tensions are rising.

The Ekaterina Djanova case resembles a financial thriller where crypto, organized crime, and judicial loopholes intertwine. While this 38-year-old Frenchwoman, nicknamed 'the shadow banker,' has been languishing in prison for two years, a legal twist could set her free. Behind this possible legal escape lie burning questions: how does the crypto system facilitate large-scale money laundering? And to what extent does digital impunity extend?

The global financial geography is experiencing a spectacular transformation. Far from the sanitized skyscrapers of Wall Street or the centuries-old Swiss banks, a new map is emerging: that of the cities that have embraced the blockchain revolution without complexes. Ljubljana, the Slovenian capital nestled between the Alps and the Balkans, embodies this metamorphosis. With regulatory boldness and a crypto culture already ingrained, it now outshines Hong Kong and Zurich. How has this city of 300,000 inhabitants managed to dominate the game? The answer lies in a subtle mix of legislative pragmatism, agile infrastructures, and an almost organic popular adoption.