The crypto market sends contradictory signals. Indeed, investor sentiment has just reached a historic low, reflecting a strong distrust towards bitcoin. At the same time, some data from Binance indicate a slowdown in selling pressure. This discrepancy between market psychology and real flows raises a central question: are we witnessing a simple technical lull or the beginnings of a lasting rebalancing?

Theme Centralized Exchange (CEX)

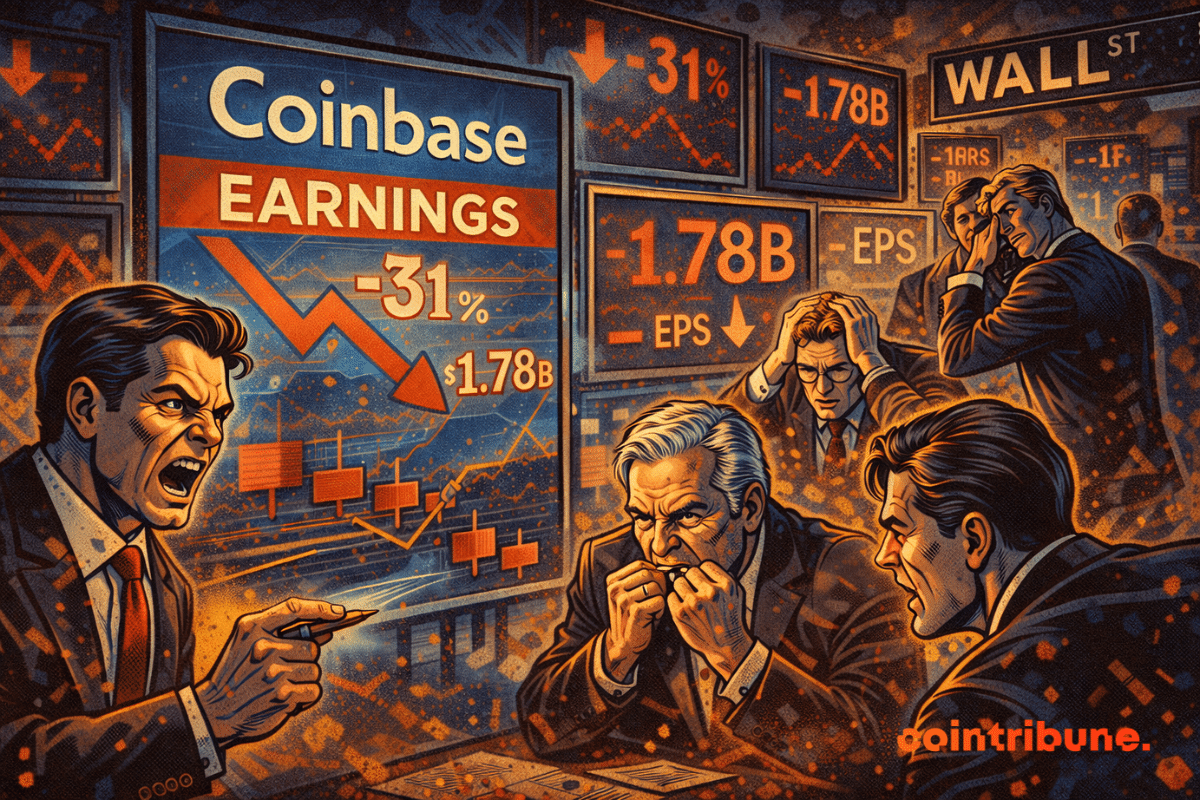

Coinbase loses 667 million. Yet, its subscribers are booming. Its stablecoins generate revenue. So do its loans. So? It's the trading that coughs. And Washington that sleeps in.

In trouble? Binance allegedly lost 17 billion. The exchange thanks its detractors, calls them friends, and offers them a holiday to withdraw their stakes. Clever.

Bithumb erroneously distributes billions in bitcoin instead of a few wons… then recovers in 48 hours. Is it genius or just a big keyboard cold?

I'm shocked! A Korean exchange mistakenly offers 44 billion in bitcoin. The price plummets. Regulators choke. And trust? Evaporated.

Gemini, the crypto exchange founded by the Winklevoss brothers, exits international markets, downsizes, and now bets on prediction markets, a booming sector, with a risky but strategic wager.

Binance creates a staggering gap. CoinMarketCap's Proof of Reserves report reveals overwhelming domination: $155.6 billion in assets, far beyond any other platform. As transparency becomes a vital requirement in a market under regulatory pressure, this ranking raises a crucial question: who can be trusted today? Binance establishes itself decisively.

When crypto bites its own tail: at Coinbase, shareholders scream betrayal, and executives swear they only sold reluctantly. It smells like asset freezing...

The American exchange Kraken has officially added Hyperliquid's HYPE token to its spot trading offering. The HYPE/USD and HYPE/EUR pairs have been available since January 28, 2026, at 15:00 UTC, according to the announcement published on the platform's official X account. This listing comes as the token shows a spectacular increase of more than 50% over one week, driven by the explosion in trading volumes on the protocol's commodity markets.

October 2025 marked crypto history with a historic crash and the mysterious depeg of the USDe stablecoin on Binance. Changpeng Zhao (CZ) rejects all responsibility, but technical evidence and expert criticism suggest another reality.

Crypto: Coinbase opens the doors to legal betting in 50 US states. We provide you with all the details in this article!

On January 6, 2026, Kraken formalized a major partnership with Ethena Labs. The American exchange becomes one of the institutional custodians of assets backed by USDe, the synthetic dollar that rose to be among the three largest stablecoins in the world. This selection, validated by the Ethena Risk Committee (ERC), marks a decisive step in the institutionalization strategy of the DeFi protocol.

Caroline Ellison released from prison. FTX returns to the heart of debates in the crypto ecosystem. All the details in this article!

The American exchange Kraken transformed its European presence in 2025. MiCA license obtained from the Central Bank of Ireland, deployment in the 30 EEA countries, launch of the Krak Card with Mastercard, tokenized stocks xStocks, Circle partnership for stablecoins: a review of a year positioning Kraken as a major player in the European market.

The American exchange Kraken launches "Bundles", thematic baskets of cryptocurrencies allowing you to instantly diversify your portfolio. Automatic rebalancing, recurring purchases, zero trading fees: a turnkey solution for investors of all levels.

The Bybit EU platform finally launches its long-awaited "Recurring Buy" feature. European users can now schedule recurring cryptocurrency purchases directly from their bank card, at a daily, weekly, or monthly frequency. A revolution for DCA enthusiasts.

In 2026, the crypto universe will change its face. Binance announces a historic shift driven by different factors. All the details here!

Binance has suspended withdrawals via Visa and Mastercard for its users in Ukraine. The measure, linked to its fiat provider Bifinity, comes amid increasing regulatory pressures in Europe. This decision complicates access to funds for Ukrainians, already weakened by war and financial restrictions.

December 26, 2025 — Global cryptocurrency trading platform Zoomex today announced the official early registration for its latest payment product, the Zoomex Card.

Coinbase pays for justice, not ransom. Data leak, arrest in India, bounty for whistleblowing... courtroom crypto-comedy in several acts.

The Kraken exchange platform officially launches xStocks for European investors, allowing the purchase of tokenized versions of American stocks and ETFs such as Apple, Tesla, or NVIDIA. A revolution in access to US markets, but with nuances to understand.

On December 25, bitcoin briefly dropped to 24,000 USD on Binance's USD1 pair before rapidly returning to more usual levels. Such an unexpected move raises questions about the stability of low liquidity pairs and risk management on trading platforms. In a rapidly evolving crypto market, this incident reveals challenges related to liquidity and regulation.

The exchange Kraken officially launched the Krak Card on November 25, 2025, a Mastercard debit card allowing spending of more than 400 cryptocurrencies and fiat currencies. Available for residents of the European Union and the United Kingdom, this card is part of Kraken's strategy to position itself as an alternative to traditional banks.

Despite a historic agreement with US authorities in 2023 and strict commitments against money laundering, Binance reportedly failed to block suspicious accounts. These accounts transferred colossal sums, raising serious questions about the real effectiveness of the controls in place.

Binance has exceeded 300 million registered users, eight years after its launch. In crypto, this milestone matters as much for the symbol as for what it reveals. It tells a story of a liquidity machine, solid technical execution, and the ability to survive storms.

The SEC has just dropped the hammer: Caroline Ellison, former CEO of Alameda, is banned for 10 years, while Gary Wang and Nishad Singh face 8 years of prohibition. A historic sanction after the fall of FTX.

Coinbase Institutional sees in 2026 much more than a simple market rebound: a strategic shift. In a 70-page report published in mid-December, the platform anticipates a deep integration of cryptos at the heart of global finance. While this year has been marked by volatility and persistent regulatory uncertainties, Coinbase is betting on a new emerging phase where regulation, institutional adoption, and new uses will sustainably reshape the crypto landscape.

Until December 30, 2025, the MiCA-regulated platform offers a welcome bonus to new European users. Full breakdown.

In an official communication, Binance warned its users and project holders against fraudulent agents claiming to facilitate token listing on Binance, often in exchange for payments. To accompany this message, the exchange announced a reward of up to 5 million dollars for any credible information identifying these practices.

Over the past year, OKX has been steadily expanding across Europe—we're listening to what traders want and building the products they need. From advanced trading tools to deeper liquidity and new institutional partnerships, Europe has quickly become one of the most important regions driving OKX’s global growth.