Changpeng Zhao (CZ), co-founder of Binance, and Yi He, head of customer service, firmly denied speculation regarding a potential sale of the world's largest cryptocurrency exchange. These statements come amidst a backdrop of regulatory tensions and significant asset movements.

Coin Stats RSS

Bitcoin is once again at a critical turning point. After weeks of consolidation in a narrow range, leading technical indicators suggest a bearish scenario that could shake the market. According to Material Indicators, several death crosses have appeared on the daily BTC charts, a signal generally associated with an increase in selling pressure. This setup is worrying traders, especially as the $92,000 level may be tested as support. Should we expect a simple temporary correction or a more prolonged downward phase?

During the week of February 10 to 14, 2025, Bitcoin and Ethereum ETFs experienced massive capital outflows, exceeding 700 million dollars. This phenomenon raises concerns among investors and significantly impacts the price of cryptocurrencies. What factors led to these withdrawals and what are the consequences?

The intoxication of power, the bite of scandal. Accused of fraud, Javier Milei wavers, pursued by justice and abandoned by a betrayed nation. The storm is brewing in Argentina.

The Paris Stock Exchange is going through a marked period of hesitation, facing a double challenge: the threats of a trade war from Donald Trump and the geopolitical developments surrounding Ukraine. On Monday, February 17, 2025, the CAC 40 shows a slight decrease of 0.03% at 8,176.47 points, reflecting the investors' caution in the face of these major issues.

Bitcoin continues to assert itself. This time, twelve American states are making headlines with a colossal investment of 330 million dollars in Strategy, formerly known as MicroStrategy. This move marks a major turning point in the integration of crypto into institutional portfolios.

Bitcoin (BTC) continues to test traders' patience as its price stagnates below the $100,000 mark. Between potential bullish pressure and signs of weakness in the markets, here are the 5 key elements to watch this week.

The crypto market is often driven by spectacular announcements and hopes of institutional adoption. Indeed, one of the latest events, the filing of a Cardano ETF (GADA) by Grayscale, triggered a wave of optimism around the ADA token. This caused a 20% jump in just a few days. However, this euphoria was not enough to push Cardano to the next level: its price quickly encountered a key resistance before retreating.

The crypto market is currently experiencing a period of uncertainty, as Bitcoin, which had recently reached historical highs, is showing signs of weakness. Experts from CryptoQuant have identified concerning indicators suggesting a possible impending bearish phase.

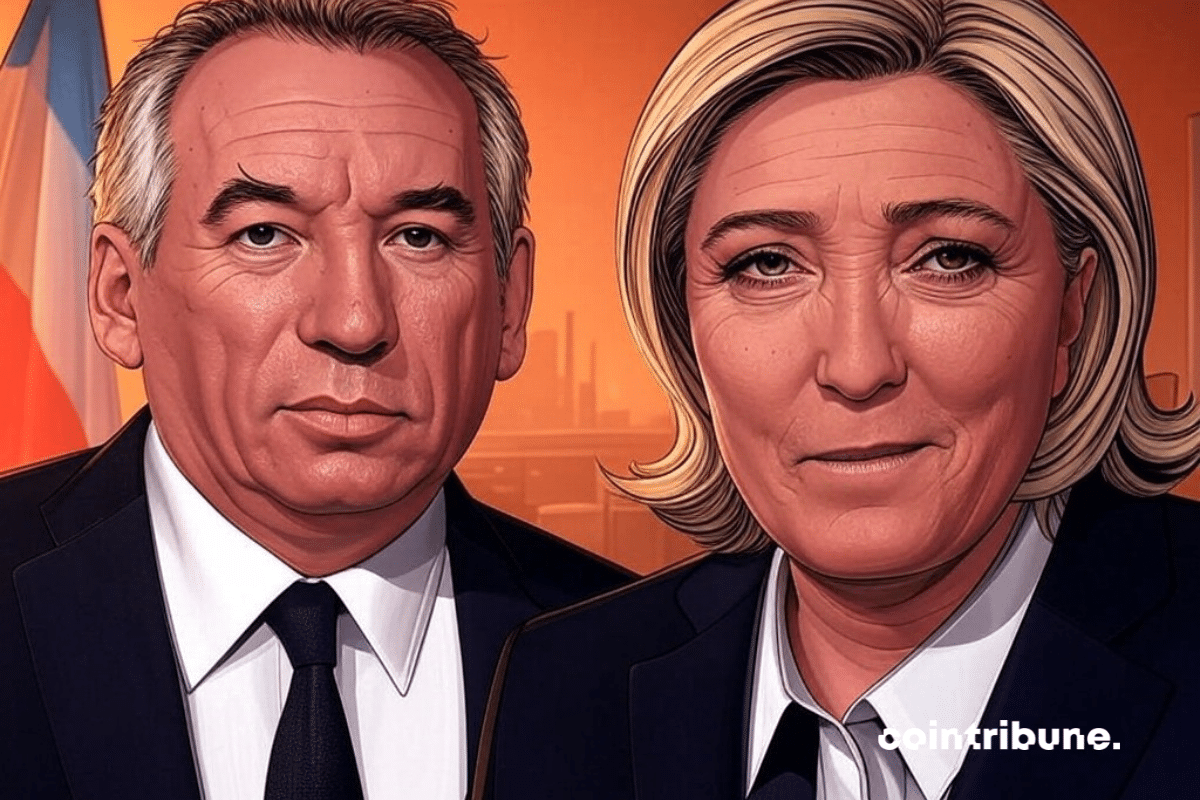

France is going through a pivotal period. On one hand, public debt has reached historic highs, exceeding 3 trillion euros. On the other hand, a profound transformation of institutions is disrupting the traditional balance of the Fifth Republic.

Investors in Ether (ETH) are closely monitoring developments in the options market, where a clear majority of contracts bet on a price increase in the medium term. However, this bullish trend is tempered by persistent volatility and a critical threshold at $2,600, below which $500 million in liquidations could be triggered. As the February and March expirations loom as a major turning point, the market oscillates between hope and caution.

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic challenges. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

The founder of Cardano (ADA), Charles Hoskinson, recently expressed his concerns about the future of Layer-1 networks in light of the emergence of the GAFAM in the blockchain universe. According to him, companies like Meta, Google, Apple, Microsoft, and Amazon could soon dominate the crypto space, relegating the current blockchains to the background. This would likely mark the end of the crypto industry as we know it today.

The influential crypto analyst PlanB, known for his predictions on Bitcoin, surprised the community by announcing on February 15 that he had transferred all of his BTC to spot ETFs. This decision marks a major turning point, stepping away from the Bitcoin maximalist ideology.

190 dollars yesterday, 340 tomorrow? Solana sows doubt and excitement. A double bottom as a springboard, an accelerating adoption: the markets resonate, history is being written.

The crypto market is currently going through a period of uncertainty, characterized by low trading volumes and increased volatility. As Bitcoin fluctuates between a breakthrough towards $100,000 and a possible correction, macroeconomic factors, including FTX repayments and inflation, will play a key role in its evolution in the upcoming week.

Barely born, already dismembered! The token blessed by Milei is undergoing an express massacre: 4 billion evaporated, fleeing initiates, Binance in post-apocalyptic crypto sage mode.

The crypto market has never been shy about ambitious predictions, but a new technical analysis has reignited investor enthusiasm. A rare chart pattern, dubbed the "megaphone pattern," is said to have been crossed by Bitcoin, paving the way for a potential rise to $300,000 by 2025. As the crypto evolves in an environment of growing institutional adoption, and some experts no longer hesitate to compare it to gold, this forecast triggers as much optimism as skepticism.

Transaction fees on the Ethereum network have dropped by 70%, from $23 million to $7.5 million per day. This dramatic decrease comes amid a major transformation for the blockchain, with the announcement of two significant updates scheduled for April 2025.

Regulations surrounding stablecoins are no longer a distant threat for crypto issuers. They are now an unavoidable reality. In this uncertain climate, Tether, the industry leader with a market capitalization exceeding 142 billion dollars, has chosen not to remain a spectator. Rather than directly opposing American lawmakers, the company seeks to influence the regulatory process. A strategic choice that could redefine the future of stablecoins and the entire crypto market in the United States.

The crypto market experienced an unprecedented surge in new token issuances in January 2025, raising concerns about liquidity fragmentation and its impact on altseason. According to recent data, over 600,000 new tokens were created during the month, twelve times more than the same period in 2024.

"Analyzing crypto market trends often resembles a balancing act between rational anticipation and unpredictable volatility. Since the beginning of the year, Bitcoin has experienced a significant downward trend during weekends, a pattern that has persisted for five consecutive weeks. However, according to Geoffrey Kendrick, the head of crypto research at Standard Chartered, this pattern could be broken as early as this weekend. He anticipates a bullish reversal for Bitcoin, supported by inflows into Bitcoin ETFs and an improvement in the macroeconomic climate. If this analysis proves accurate, the leading global cryptocurrency could regain $100,000, but may aim for $102,500 in the short term."

The Russian economy is wobbling under the weight of its own structural flaws and an increasingly hostile international environment. While the Kremlin attempts to project resilience in the face of Western sanctions and geopolitical tensions, the latest reports from the Bank of Russia and the Ministry of Economy paint a much more troubling reality. With the collapse of oil revenues, a skyrocketing budget deficit, and a private sector on the brink of asphyxiation, Russia faces major economic challenges that could profoundly affect its stability in the medium term.

Is the value of a property still based solely on its location? While the French market is undergoing its most significant correction in decades, the dynamics of the sector seem to be reversing. After a sharp price drop in 2024, the year 2025 is set to be one of profound transformation for the market. From major metropolitan areas to medium-sized cities, from deserted offices to less accessible housing, a shift is taking place, driven by an unprecedented economic and regulatory context. Amid rising interest rates, tighter credit, and new environmental requirements, real estate must rethink its fundamentals.

The National Bank of Canada (BNC), one of the largest financial institutions in the country, appears to be taking a cautious, even bearish, stance on bitcoin. According to a recent filing with the Securities and Exchange Commission (SEC), the bank has acquired a put option on a portion of its holdings in BlackRock's Bitcoin ETF (IBIT). This option would allow it to sell over $1.3 million worth of Bitcoin ETF, indicating a possible anticipation of a decline in the asset's price.

Hyperliquid ignores the chaos and offers a staggering +176%. The HYPE, it’s him. Bitcoin and Ether? Just side characters in this financial soap opera.

The issuer of the world's largest stablecoin, Tether, has just acquired a minority stake in the prestigious Italian club Juventus. This announcement marks a new milestone in the convergence between the crypto sector and professional sports.

Bitcoin struggles to stay above 100,000 dollars, but traders are becoming increasingly optimistic about a possible rise. Dr. Sean Dawson, head of research at Derive, now assesses the probability that the crypto will reach 125,000 dollars by the end of June at 44.4%, a significant upward revision from previous forecasts.

The story of Ripple (XRP) is one of a regulatory battle that has kept the entire crypto industry on edge. After years of tug-of-war with the Securities and Exchange Commission (SEC), an unexpected change has just shaken the market: the U.S. regulator has officially acknowledged the requests for XRP and Dogecoin ETFs filed by Grayscale. Is this just an administrative procedure? Perhaps, but for investors, this signal was enough to propel the price of XRP by 20% in just a few days, with open interest now flirting with 4 billion dollars. Behind this surge, the entire future of altcoin ETFs is at stake, and traders are closely monitoring the upcoming decisions from regulators.

The crypto sector is used to forecasts and bets on the future. But when a probability rises to 81%, it stops being mere speculation and becomes a credible scenario. This is the case with the XRP ETF, whose approval in the year 2025 seems increasingly plausible, according to the bets recorded on Polymarket. While American regulators are still struggling to clarify their position on cryptocurrencies, this sudden rise in forecasts is noteworthy.