Haider Rafique warns that a national Bitcoin reserve could unsettle markets and trigger significant downward pressure on Bitcoin prices.

Cryptoasset

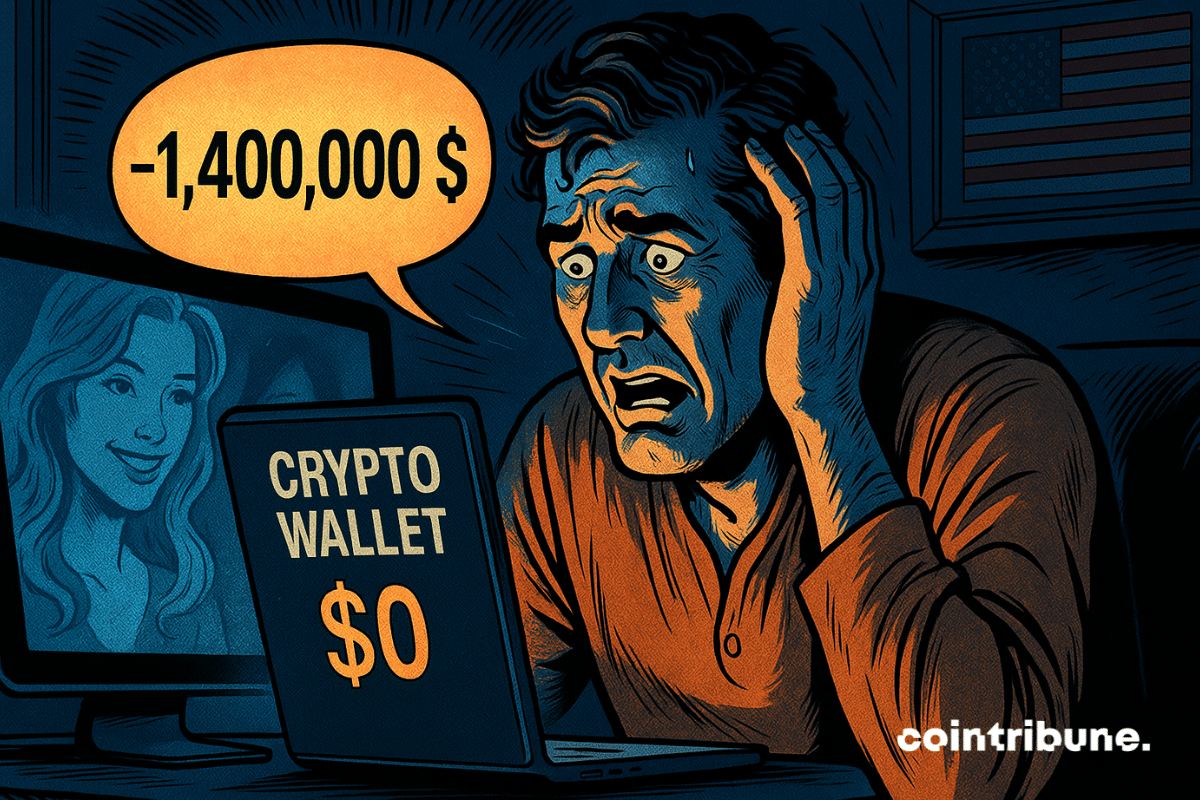

Online seduction, blind trust, and promises of quick profits: it only took a few months for a retiree from Colorado to see 1.4 million dollars disappear. But behind this individual tragedy lies a more worrying reality: the proliferation of scams in a crypto sector still too little regulated.

Decentralized finance is about to reach a new milestone. Aave, a leading crypto lending protocol, is preparing to launch its V4 update by the end of 2025. After crossing the symbolic mark of 50 billion dollars in net deposits, the ecosystem is ready for a major transformation. But what will this new version concretely bring?

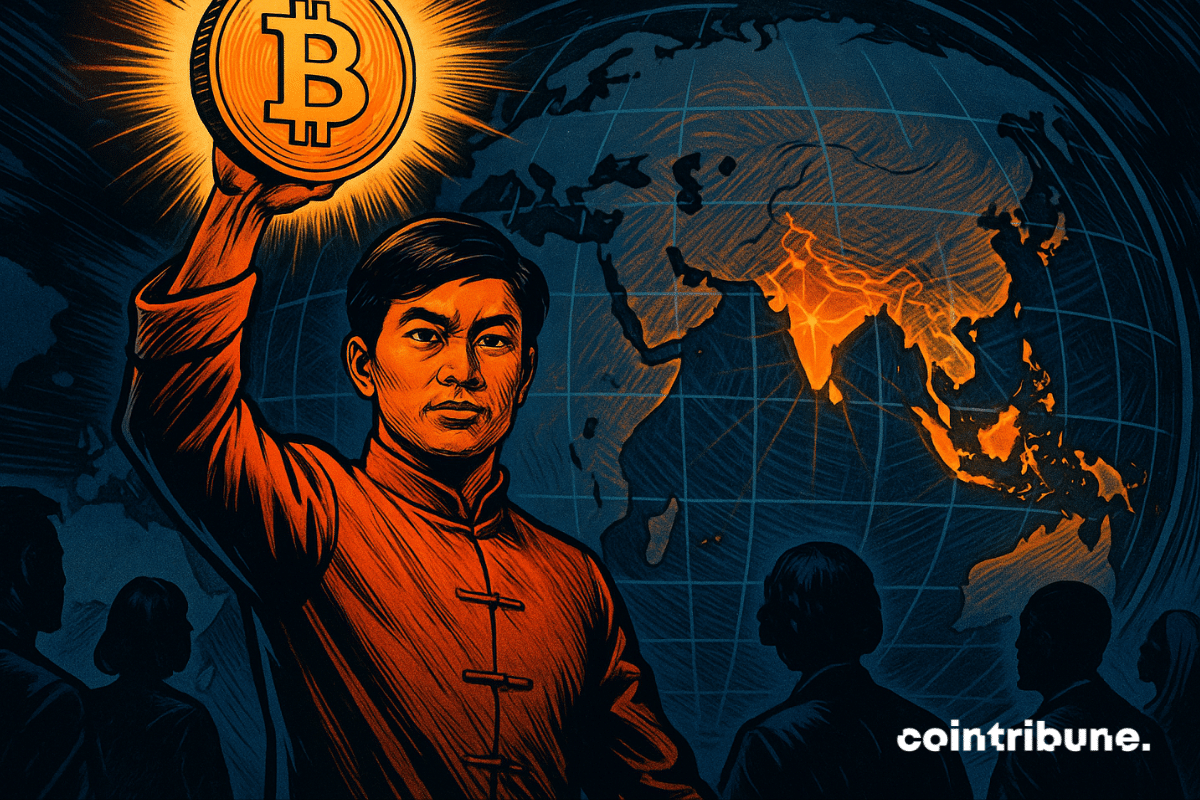

Cryptocurrency activity is growing worldwide, led by the Asia-Pacific region, with Latin America and Africa also seeing notable increases.

Despite leading global crypto transactions, the majority of U.S. investors remain largely uninvolved, with just 14% holding digital assets.

Nearly three years after the collapse of FTX, the shadow of the scandal still lingers. Ryan Salame, former co-leader of the platform, is serving a heavy sentence, but his plea deal remains at the center of a legal battle involving his wife, Michelle Bond. The justice system is still trying to unravel the ramifications of an explosive case.

The Bullish crypto exchange creates a surprise. Recently listed in New York, the exchange revealed second-quarter results significantly above expectations. Performances that exceed Wall Street forecasts. Bullish is also among the most publicized crypto IPOs of the year, alongside Circle, Gemini, and eToro.

The crypto ecosystem has just suffered one of the most sophisticated attacks in its history. A "crypto-clipper" injected via compromised NPM modules quietly diverts wallet addresses during transactions. How did this breach escape security radars?

As September begins, crypto traders approach the market cautiously, with Bitcoin, Ethereum, and XRP showing varied performance.

Crypto markets pulse to the beat of the Federal Reserve. As Jerome Powell mentions a possible rate cut in September, Santiment sounds the alarm. Could the current euphoria be hiding a trap for investors?

World Liberty Financial (WLFI), the crypto project supported by the Trump family, makes a spectacular entry into the derivatives markets. The launch of its perpetual contracts propelled the fully diluted valuation (FDV) beyond 40 billion dollars, even before the official first unlock of tokens scheduled for September 1st.

Cardano (ADA) ignites the crypto market with a surge in its futures volume, reaching nearly 7 billion dollars. This bullish momentum, driven by the shadow of a potential ETF, places ADA back at the center of discussions. Towards a lasting return above 1 dollar?

The bullish momentum of bitcoin seems to be fading. After reaching a peak above $124,000, the leading cryptocurrency shows signs of fatigue. Meanwhile, retail investor interest is shifting towards altcoins and Ethereum. Could this capital rotation signal a new phase in the crypto cycle?

Crypto-focused funds are leading U.S. ETF launches, with Ethereum and Bitcoin attracting record inflows and growing investor interest.

Ethereum drove strong inflows into crypto exchange-traded products last week, helping the market recover after earlier losses.

World Liberty Financial, supported by the Trump family, is preparing to create a Nasdaq-listed company to hold its WLFI tokens. This project inspired by MicroStrategy's pioneering strategy could open a new chapter at the crossroads of politics, financial markets, and cryptos.

The NFT market has just recorded its second-best month of the year, reaching $574 million in sales in July—a nearly unexpected rebound. While the number of buyers is declining, the average transaction value is rising, and Ethereum-based collections are surging. Is this just a temporary rebound—or the start of a more selective new cycle?

Interest in stablecoins is reaching unprecedented heights. As the market capitalization crosses the historic threshold of 270 billion dollars, Google searches are literally skyrocketing. Does this rush towards stable digital currencies coincide with the adoption of the GENIUS law?

In a rapidly changing banking sector, Fortuneo is about to reach a decisive turning point. By exploring the integration of cryptocurrencies into its offerings, the French neobank is following a trend already initiated by its European competitors. This strategy is expected at a time when digital investment is becoming a new norm rather than a passing trend.

Polymarket, the crypto platform specializing in predictive markets, is making its big return to the United States. To achieve this, it is betting on the acquisition of QCX, an exchange regulated by the CFTC. An ambitious move that could redefine the future of prediction on the blockchain.

The White House is preparing to open a new chapter in the integration of cryptocurrencies into the savings of American households. President Donald Trump plans to sign an executive order allowing, for the first time, 401(k) retirement plans to include bitcoin, gold, and private equity among their investment options. A decision that could eventually create a massive influx of liquidity into the crypto market.

Europe is not backing down. After MiCA, crypto companies must face a new wave of regulation driven by the European Anti-Money Laundering Authority (AMLA). Anonymous wallets banned, direct access to data, cross-border controls... Brussels clearly shows its intention to go further. Is the sector ready to absorb this new shock?

BlackRock experienced a massive surge in crypto ETF inflows in Q2 2025, driving strong revenue growth and setting new records for assets under management.

Donald Trump has just avoided a major political setback by rallying dissenters from his own camp. Thanks to a direct intervention in the Oval Office, he is back on track for the adoption of the flagship laws of Crypto Week. However, internal tensions regarding central bank digital currencies (CBDCs) hint at a battle that is far from over.

While the United States bets on open regulation of stablecoins with the GENIUS Act, China takes a more discreet approach. In Shanghai, a closed-door meeting among regulators reveals a willingness to experiment, without easing control.

The public affairs manager at Bitpanda warns about the persistent disparities in the application of the MiCA regulation across Europe. Despite its promises of harmonization, the European Union struggles to establish a true single market for cryptocurrencies. MiCA is on the way, indeed, but each member state interprets and applies the law in its own way.

Crypto cards are now competing with traditional banks for everyday purchases in Europe. With nearly half of transactions under 12 dollars, these new payment tools are transforming consumer habits. A silent revolution that is redefining the future of European payments.

"For several weeks now, Coinbase's (COIN) stock has been on the rise, reaching a historic high of $382 before closing at $369.21. This surge is not coincidental: it reflects both a major regulatory turning point in the United States and the profound strategic transformation undertaken by the crypto company, which is determined to become one of the pillars of global digital finance."

In a world where every geopolitical explosion shakes the financial markets, crypto seems strangely unflappable in the face of recent tensions between Israel and Iran. Yet, this apparent serenity may only be temporary. How long can greed, an irrational but powerful driver, keep the sector afloat?

Brian Armstrong, CEO of Coinbase, finally publicly acknowledges a "major issue" that has been plaguing his platform for years. The leading American exchange announces an 82% reduction in wrongful freezes. But is this improvement enough to restore trust shaken by recent data breaches?