Beneath its capricious star appearance, bitcoin hesitates, retreats, but watches for the perfect moment to bounce back better… What if the whales know something we don’t?

Death Cross

Bitcoin, in slide mode, flirts with the precipice of the CME Gap while whales do their shopping. Bounce to come or final plunge? Suspense guaranteed.

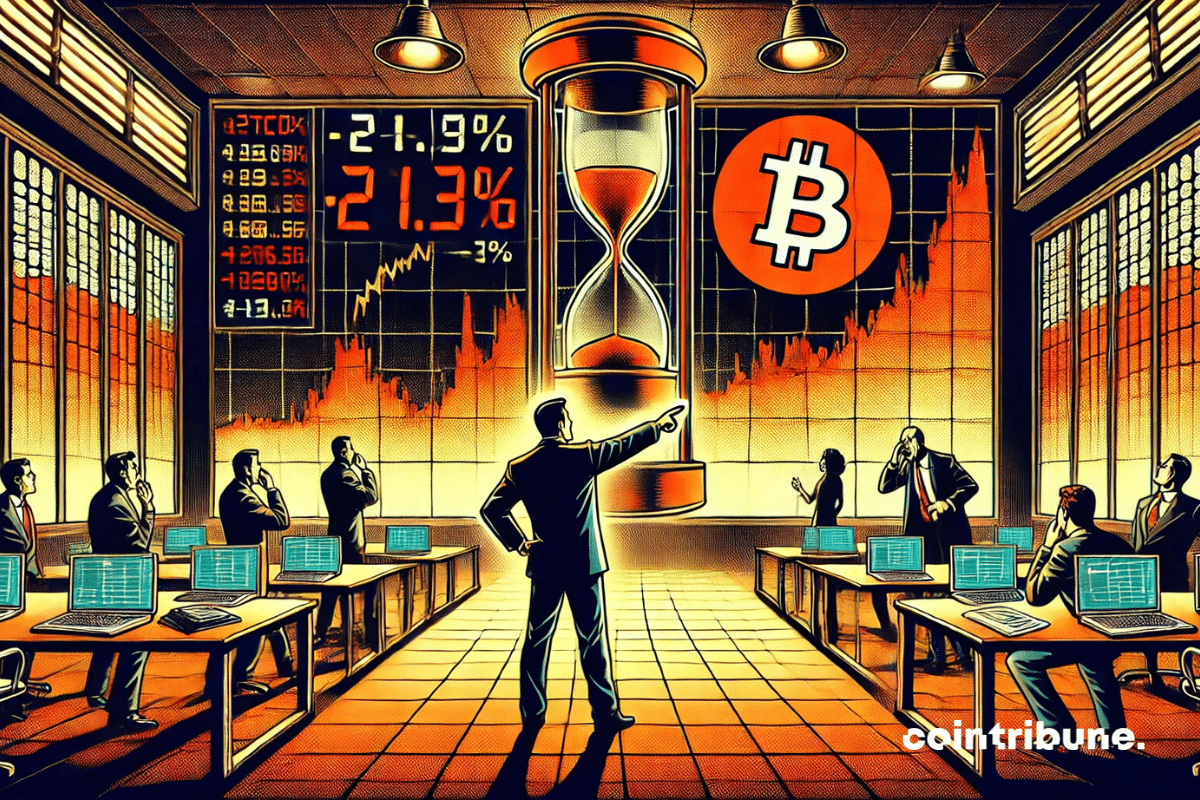

As tension rises in the market, Bitcoin is about to cross a critical technical threshold: the "death cross." This signal, feared by traders, occurs at a pivotal moment, at the intersection of a 25% correction and an uncertain macroeconomic climate. While some see it as a classic bearish indicator, others recall it coincided with market lows. In this context, certainties waver, and each candlestick becomes a test for investor morale.

Ripple parades with Mastercard and Nasdaq, raises 500 million… but XRP collapses. In the crypto world, golden speeches do not always prevent wallets from lightening.

The crypto market remains suspended on technical signals that experienced investors scrutinize closely. On XRP, the alert has been raised: a death cross, a bearish crossover of moving averages, has just been detected. Rare and feared, this signal often heralds prolonged pullback phases. In a climate of indecision where the asset struggles to regain a direction, this indicator could modify investors' perceptions and influence their short-term positions. This configuration could weigh heavily on the trajectory of XRP.

XRP is faltering against Bitcoin. A feared technical crossover, the "death cross", has just appeared on the XRP/BTC pair, rekindling investor concerns. This signal, associated with a marked bearish trend, contrasts with the strength displayed by Bitcoin. However, against the backdrop of this grim picture, some technical indicators on longer time frames suggest a possible reversal. Amid short-term tensions and hopes of a rebound, XRP is once again capturing the attention of a crypto market searching for benchmarks.

Under pressure in a feverish crypto market, Bitcoin is approaching a key technical signal: the Golden Cross. This chart pattern, where the 50-day moving average crosses above the 200-day moving average, is often seen as a precursor to sustained bullish momentum. Still uncertain, this signal gains credibility each day, fueling traders' expectations. As the curves draw closer, the market holds its breath, ready to interpret this potential crossover as a major turning point in the current BTC cycle.

Bitcoin is nearing its peaks, but a specter hovers over its trajectory. While the asset tests $86,000, a dreaded technical indicator remains frozen: the "death cross." This crossover of moving averages, often associated with bearish reversals, persists despite the current surge. Why does such a signal persist? Is it merely an anomaly or a serious warning? As positions accumulate, traders oscillate between confidence and caution, torn by a market in full dissonance.

The crypto market is going through a phase of uncertainty, where every technical indicator is scrutinized closely. Solana, long considered one of the most promising projects in the sector, finds itself at a decisive crossroads today. As its price records a notable drop, a feared signal from analysts threatens to increase the pressure: the death cross. This technical event, often interpreted as a bearish indicator, could well influence investor behavior and trigger a new cycle of volatility. But is this signal really heralding a prolonged downtrend, or could it precede an unexpected rebound?

Bitcoin is once again at a critical turning point. After weeks of consolidation in a narrow range, leading technical indicators suggest a bearish scenario that could shake the market. According to Material Indicators, several death crosses have appeared on the daily BTC charts, a signal generally associated with an increase in selling pressure. This setup is worrying traders, especially as the $92,000 level may be tested as support. Should we expect a simple temporary correction or a more prolonged downward phase?

ADA, Cardano's native cryptocurrency, is currently showing a bullish trend despite the bear market and is trading around $0.30. However, some signals indicate that a potential decline in the asset's valuation cannot be ruled out.