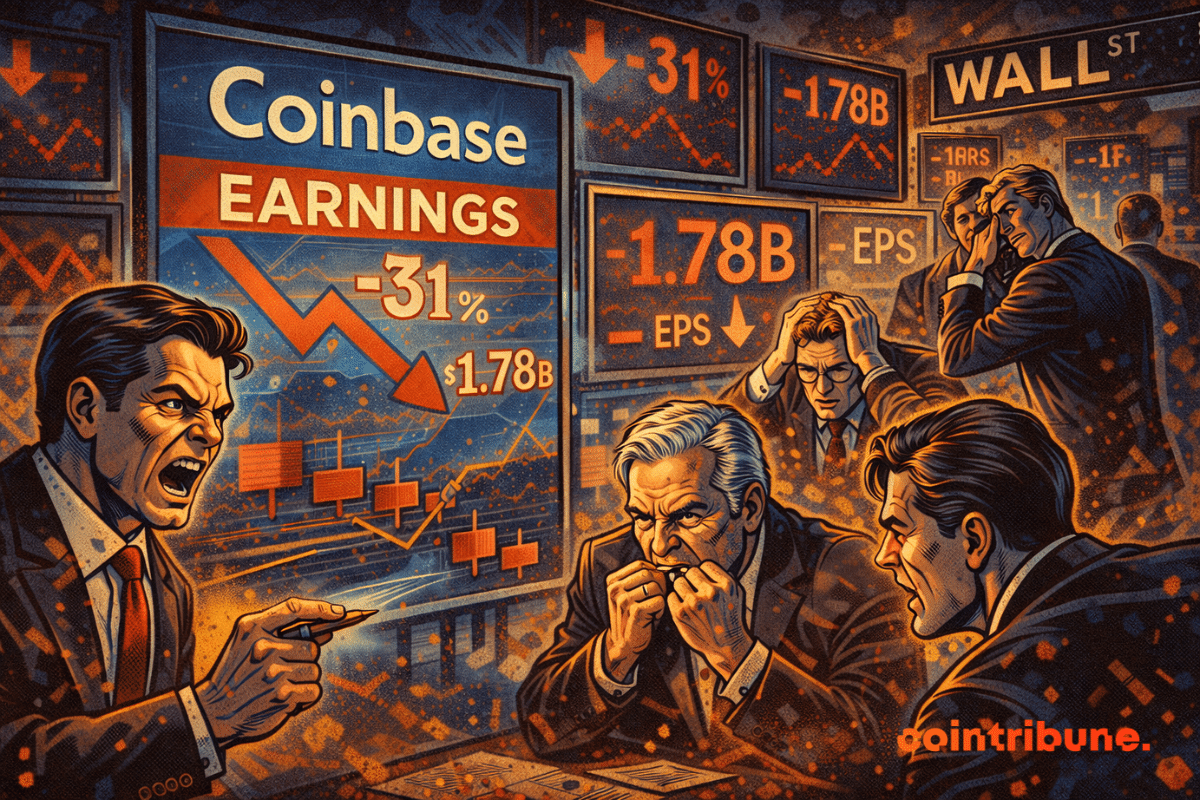

Coinbase loses 667 million. Yet, its subscribers are booming. Its stablecoins generate revenue. So do its loans. So? It's the trading that coughs. And Washington that sleeps in.

Derivative

While bitcoin is bogged down under the spotlight, fleeing ETFs and traders under Lexomil: the crypto star rediscovers the joys of the plunge, 2022 version, remixed 2025.

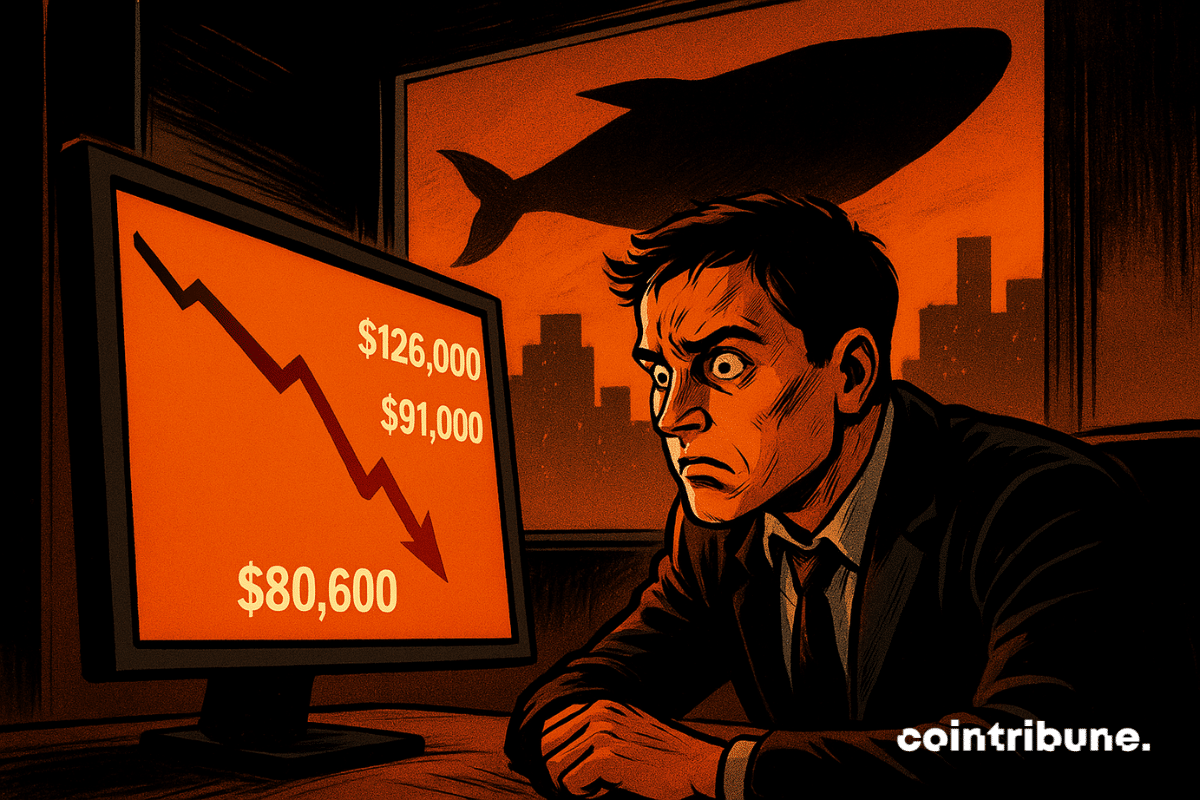

Fresh selling from large Bitcoin holders is putting renewed pressure on an already shaky market, as traders deal with one of the steepest pullbacks of the year. Price softness, rising exchange inflows, and cautious positioning across major trading venues all point to a market still trying to find its footing. Analysts at CryptoQuant say continued whale deposits could push Bitcoin lower if the pattern persists.

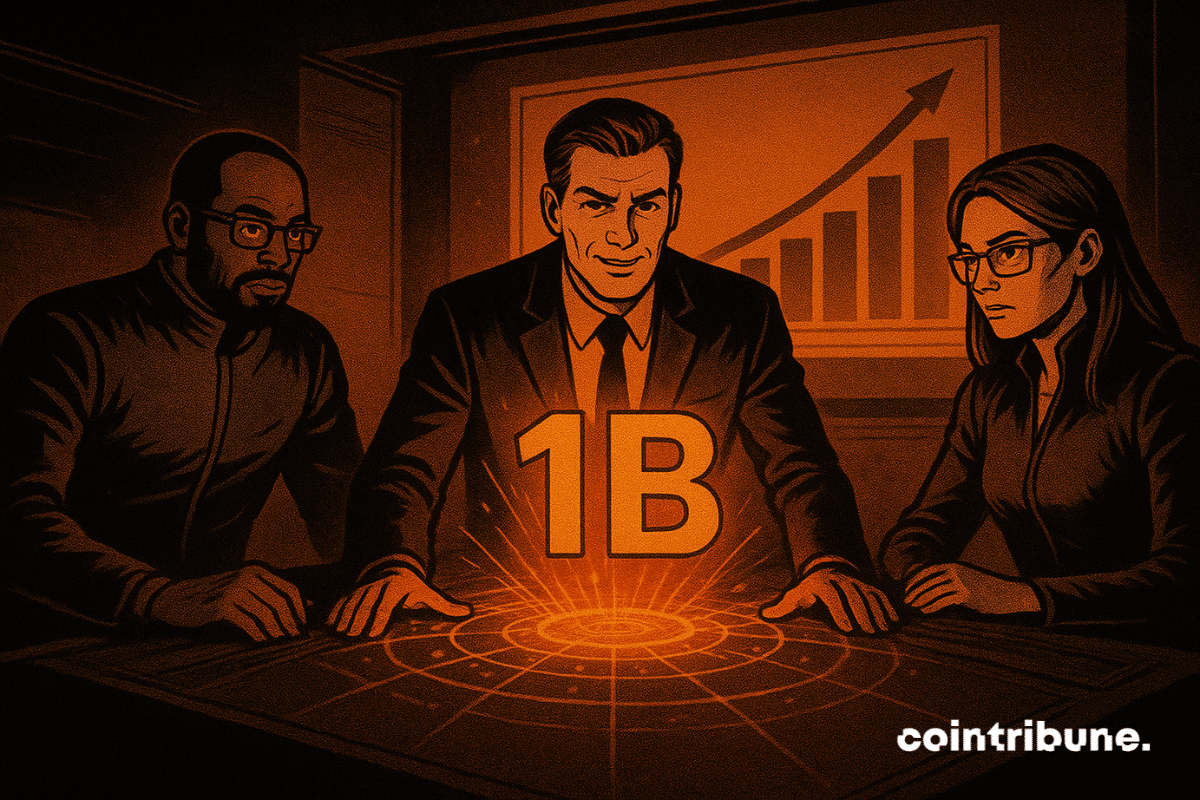

Hyperliquid Strategies is taking a major step to strengthen its presence in the decentralized finance (DeFi) ecosystem. The firm plans to raise up to $1 billion to expand its holdings of the Hyperliquid (HYPE) token, which powers the world’s largest decentralized derivatives platform.

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, is advancing its European expansion. Bybit EU Group took this next step with the formal application submission for a license under the Austrian implementation act of the Markets in Financial Instruments Directive (MiFID II) through one of its Austrian entities, Bybit X GmbH.

Trump, crypto and millions at stake: WLFI unlocks its tokens, promises of a jackpot or a new speculative prank? Investors oscillate between euphoria and suspicion.

Hyperliquid’s rapid growth in decentralized derivatives is turning heads as its trading activity edges closer to rival Binance.

Fewer movements, more silence: Bitcoin breathes. But behind the candlesticks, Trump is getting angry, Powell is trembling, and the dollar is melting... Is it enough to awaken a sleeping crypto queen?

While Bitcoin is napping above 100,000 dollars, Ethereum is filling the coffers. Funds are pouring in, ETFs are buzzing: who said that crypto is running out of steam?

While Wall Street is emptying its pockets, Bitcoin is puffing its chest, flirting with the peaks and attracting billions — crypto is becoming the new refuge for capricious capital.

At $100,000, Bitcoin becomes the boss of the derivatives markets, where institutions and traders dance a tight tango.

Bitcoin is making another roller coaster move, climbing to $69,000 before taking off for a new financial twist.

Vanguard on the crypto touch: "We do not copy BlackRock, nor their Bitcoin ETFs." There, it's said!

Cardano, despite an initial drop, sees its trading volume soar to 457 million. A crypto fireworks display!