Global markets are entering a concentrated period of macroeconomic risk that could shape sentiment into early February. Five key U.S. economic releases are scheduled for January 27, increasing pressure on already cautious investors. Crypto markets remain highly sensitive in this environment, with Bitcoin still absorbing the majority of capital flows.

Derivatives Market

Crypto markets appear to have moved past the leverage-driven stress seen in October, according to asset manager Grayscale. Recent research shared by the firm suggests derivatives activity has stabilized, supply pressure has eased, and market direction is now more closely tied to fundamentals and policy developments. As a result, price action may be better positioned to respond to upcoming regulatory and institutional shifts rather than past disruptions.

The release of the latest Consumer Price Index (CPI) in the United States triggered a brutal movement on crypto derivatives, exposing an unprecedented imbalance on XRP. Ripple's asset recorded a wave of massive liquidations, revealing a lightning-fast repositioning of traders facing a possible monetary shift.

Fresh selling from large Bitcoin holders is putting renewed pressure on an already shaky market, as traders deal with one of the steepest pullbacks of the year. Price softness, rising exchange inflows, and cautious positioning across major trading venues all point to a market still trying to find its footing. Analysts at CryptoQuant say continued whale deposits could push Bitcoin lower if the pattern persists.

Hyperliquid Strategies is taking a major step to strengthen its presence in the decentralized finance (DeFi) ecosystem. The firm plans to raise up to $1 billion to expand its holdings of the Hyperliquid (HYPE) token, which powers the world’s largest decentralized derivatives platform.

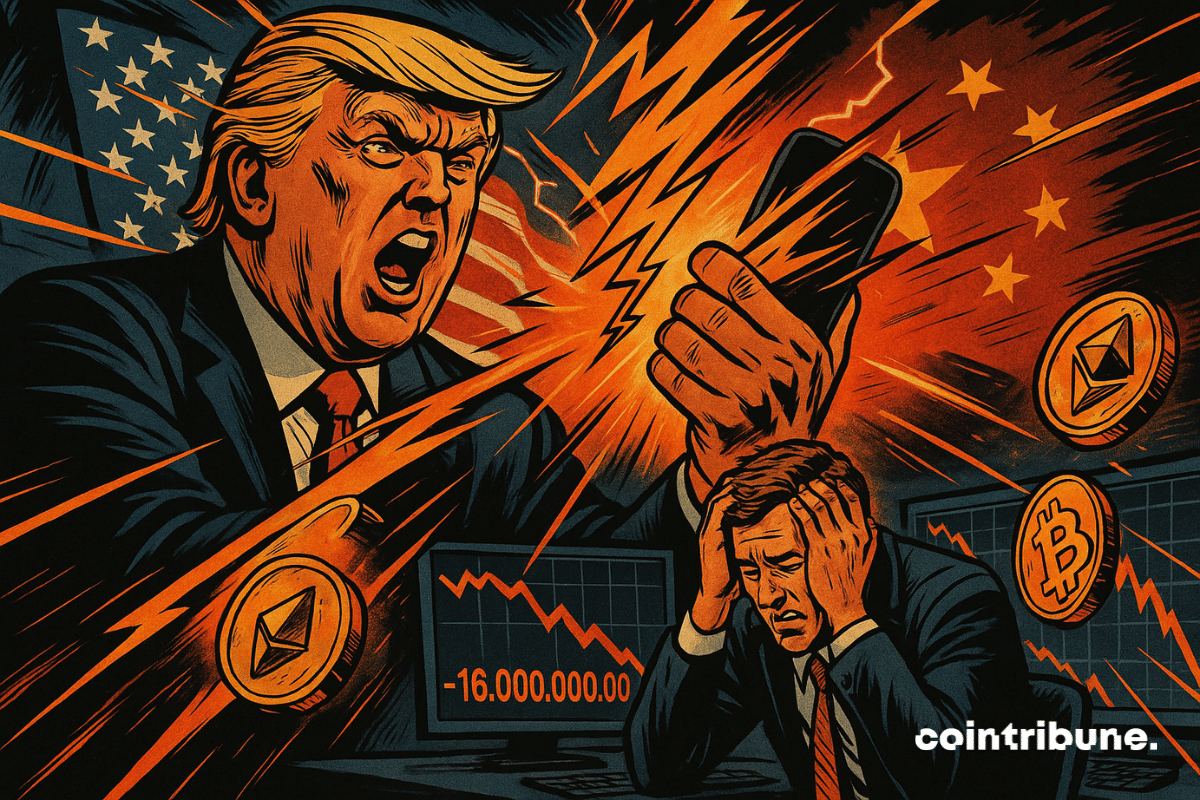

Trump sneezes on tariffs, Wall Street catches a cold, crypto convulses: 1.6 million traders liquidated, 19 billion evaporated. The crash is no longer a threat, it's a slap.

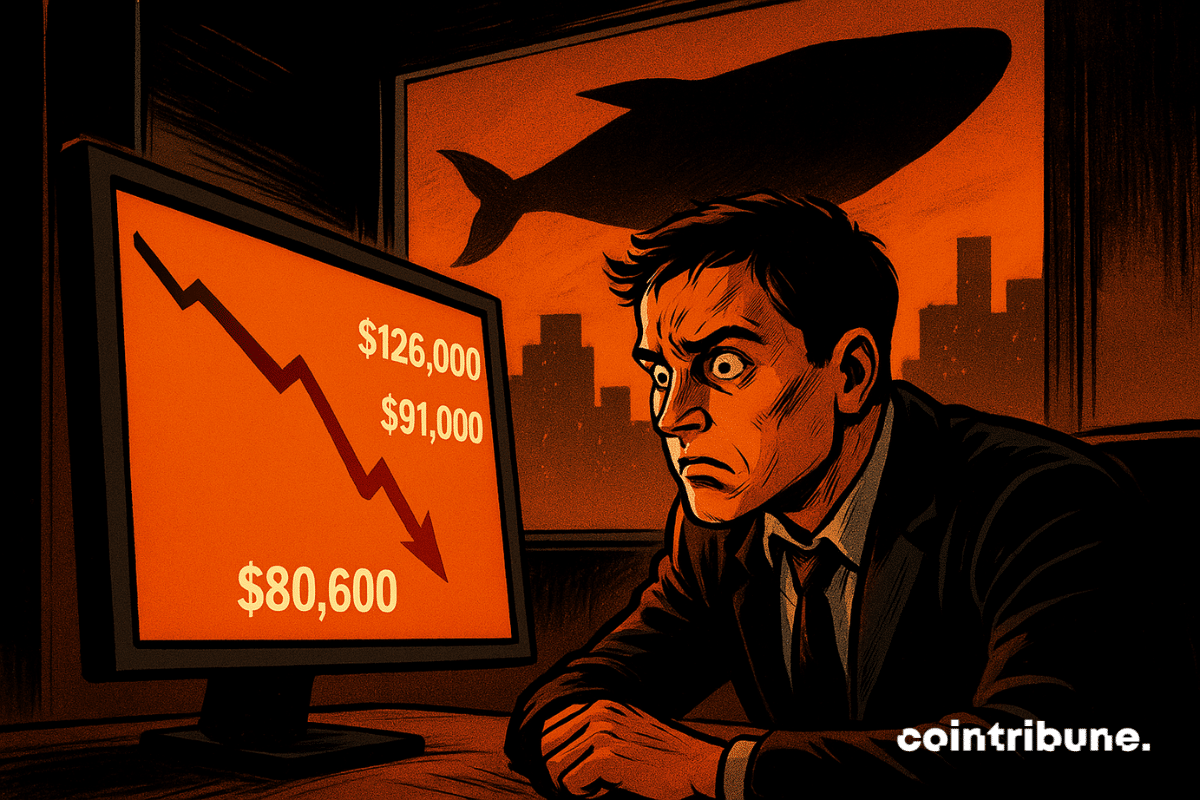

Despite a correction of more than 4% after a historic peak at $126,219, bitcoin maintains a solid bullish momentum, supported by robust institutional fundamentals. Massive flows to ETFs and renewed Wall Street confidence paint the picture of a maturing market. From Citibank to JPMorgan, the giants of American finance now anticipate a rise to $150,000 by December.

During this festive Christmas season, the crypto market is buzzing with a notable surge of optimism. Data from the bitcoin derivatives market suggest a strong likelihood of seeing the queen of cryptos reach 105,000 dollars, driven by a persistent bullish sentiment and favorable technical indicators.

In a consolidation context below 98,000 dollars, bitcoin shows signs of short-term weakness. However, derivatives market data reveals persistent trader confidence, suggesting that this phase is only temporary.

Bitcoin is making another roller coaster move, climbing to $69,000 before taking off for a new financial twist.

Vanguard on the crypto touch: "We do not copy BlackRock, nor their Bitcoin ETFs." There, it's said!