Sudden start, but a sudden brake for Ethereum ETFs, between losses and optimistic forecasts for the future.

Ethereum (ETH)

The world of crypto is preparing for an event of particular significance: the imminent expiration of Bitcoin and Ethereum options totaling $1.87 billion. In a context where every movement of these digital assets can lead to waves of volatility, this specific event could redefine market dynamics in the coming hours. Indeed, options, financial instruments that allow speculation on future price movements, are often the stage for tensions between buyers and sellers, especially when such large volumes are at stake.

Gold and silver prices are rising, while the crypto market is collapsing! Are investors changing direction?

The Solana crypto, often hailed as the "Ethereum killer", is now at the center of controversy. Accused of hosting a disguised Ponzi scheme structure, the network faces allegations of manipulation, raising questions about its decentralization and the fairness of its ecosystem. While voting transactions represent a overwhelming share of activity, critics point to a system that seems to favor the most powerful validators, to the detriment of newcomers. But what is the reality? Let's decrypt the issues.

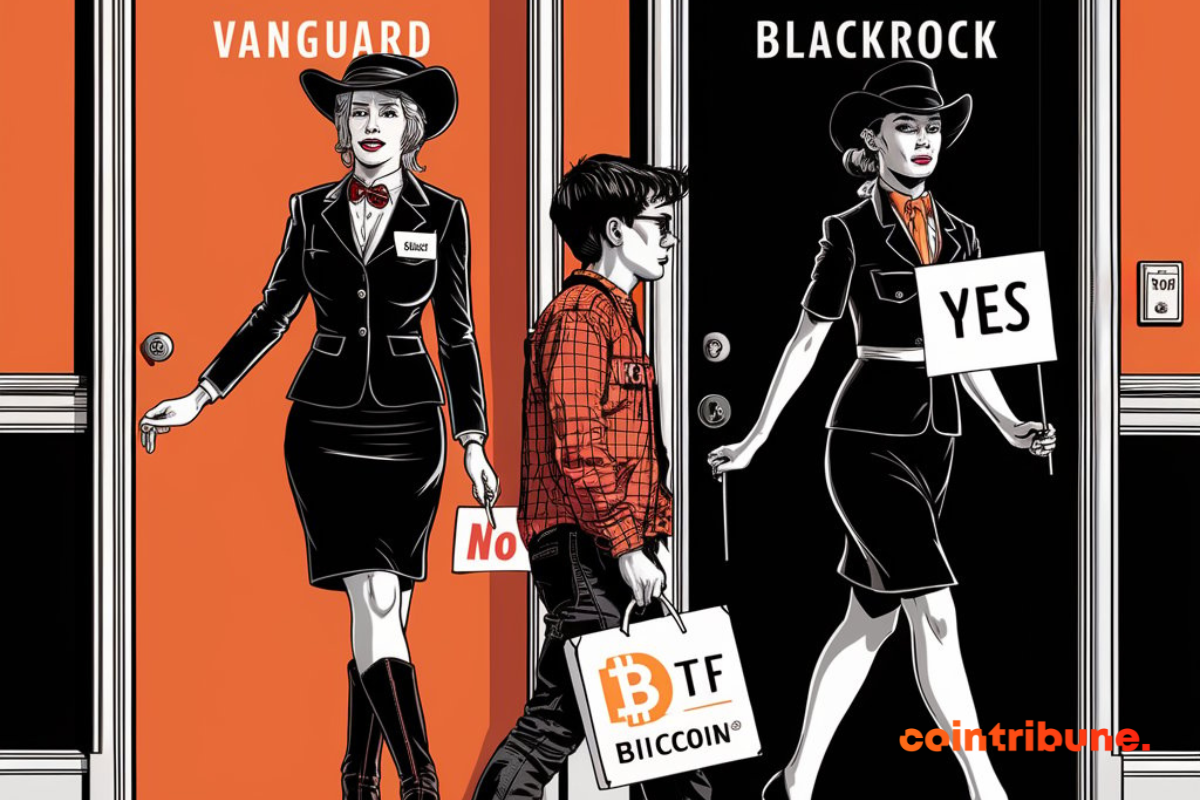

Vanguard on the crypto touch: "We do not copy BlackRock, nor their Bitcoin ETFs." There, it's said!

Ethereum may be facing an imminent decline according to crypto data, but the long-term outlook remains promising.

Cardano slams the door in Ethereum's face, rising among the champions of blockchain development.

Bitcoin is collapsing, ETFs are following. Investors are desperately looking for signs of recovery in this financial turmoil.

Seeing a meme coin surpass the world's second largest cryptocurrency over a one-year period remains as rare as it is eloquent. Shiba Inu (SHIB), long considered a mere fun derivative in the token universe, has recently defied expectations by showing annual growth higher than that of Ethereum (ETH). This success, although modest, embodies the profound and sometimes unexpected changes shaking up the crypto ecosystem.

The crypto world is abuzz, and not just because of the usual price fluctuations. Ethereum, once hailed for its deflationary mechanism, surprises by becoming inflationary for the first time in two years. And in the meantime, Uniswap, the giant of decentralized exchanges, is slowing down its rate of ETH burning, leaving observers puzzled. As these two crypto heavyweights navigate in murky waters, it is time to delve into the details of this unexpected evolution.

In this month of August, where market volatility in cryptocurrencies is at its peak, there are still over 20 days left to identify and seize the best investment opportunities. While some assets are stabilizing, others are showing signs of potential rebound. This article examines five cryptocurrencies to watch closely, analyzing recent developments and prospects that could turn this month into a key period for savvy investors.

Bitcoin shows a nice increase of 6% in the last 24 hours and is leading the way in the crypto market recovery!

Hackers launch an attack on the Olympics: ransom demanded in cryptocurrency. The Grand Palais and other tourist sites threatened.

Ethereum records a weekly decrease of 37% following the overall decline of the crypto market. Let's examine the future prospects for ETH together.

The cryptocurrency market is down 25%: here are the trends and outlook for crypto investors!

Crisis or not, Ethereum ETFs continue to attract funds, highlighting the stability and long-term attractiveness of ether.

Carnage in the crypto market: Is an imminent rebound of altcoins coming?

The price of ether (ETH) recently reached its lowest level in eight months. This marked decline raises concerns about a recovery that could take longer than expected.

The price of Ethereum, the second cryptocurrency in the world, has experienced a sharp decline in recent days. Experts point to a phenomenon of investor capitulation, amplified by macroeconomic factors.

The crypto market has just experienced a spectacular drop, losing nearly 500 billion dollars in just three days. This plunge, the largest in a year, comes in the context of weak employment data and recession fears. Let's dive into the reasons and consequences of this brutal crash.

Amid revolutionary announcements, technological developments, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a realm of limitless innovations and a battleground for regulatory and economic battles. Here is a summary of the most notable news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

The DeFi sector shaken by massive fund outflows! Leading to massive sales and a drop in crypto prices!

As the specter of a US recession looms, ether (ETH), one of the main crypto assets in the market, is facing considerable pressure. Peter Schiff, a renowned economist and financial commentator, shares grim analysis on the altcoin in a precarious economic context.

Paolo Ardoino from Tether: "Bitcoin is immutable." Ethereum is out, the company is focusing on a strong Bitcoin strategy.

A renowned crypto analyst predicts major movements for Pepe, Ethereum, and XRP. Find out the details in this article.

Worst day for traditional finance since the Covid crash! Cryptos, however, show unexpected resilience!

Promising start for Ethereum ETFs in August, with an influx of $26.7 million. Demonstrating the growing interest of crypto investors.

The news on spot Ethereum ETFs is experiencing a significant turnaround. After several months of substantial net outflows, the inflows to these funds have finally turned positive. Does this reversal indicate the end of the troubles for these crypto ETFs?

Vitalik Buterin unveils the future of Ethereum at EDCON2024, focusing on applications and crypto wallet security.

Bitcoin and Ether ETFs record record outflows after Trump's speech, reversing the initial bullish trend!