Altcoin ETFs are arriving, but the initial frenzy seems to dissipate quickly. Savvy investors prefer direct acquisition on platforms, far from these newly reinvented promises.

Investissement

Elon Musk's journey has always been marked by meteoric rises and brutal shocks. However, rarely has a week been as financially challenging for the head of Tesla and SpaceX. In just a few days, his fortune evaporated by $41 billion, a drop that raises questions about the strength of his companies as well as his controversial management. While Musk retains his status as the world's richest man, this unprecedented loss is symptomatic of the growing difficulties faced by Tesla, whose transition strategy towards artificial intelligence worries investors. Additionally, there are political tensions and criticisms of his omnipresence in various fields, which makes the situation even more complex. Amid colossal financial losses and a crisis of confidence, Musk finds himself under the spotlight for reasons very different from those that brought him success.

The central Bank of China has just carried out an important medium-term lending operation to support its banking system. This injection of 300 billion yuan (approximately 41.83 billion dollars) is part of a broader strategy aimed at maintaining favorable liquidity conditions in an uncertain economic context.

European authorities are not very favorable towards bitcoin, to say the least, but the German election could change the game.

Strategy strengthens its position with 20,356 bitcoins purchased for $2.00 billion. Discover the details of this acquisition in this article!

Amid revolutionary announcements, technological evolutions, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battlefield of regulatory and economic conflicts. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Warren Buffett is not a man who speaks into the void. When he speaks, the financial world listens. At 94 years old, the legendary investor uses his annual letter to shareholders to deliver a blunt message to Washington: budgetary excesses and monetary instability threaten the American economy. This alarm signal comes at a time when Berkshire Hathaway is recording spectacular financial performances, with a record profit and a historic cash reserve of $334.2 billion. Thus, in a market where investment opportunities are becoming scarce, Buffett favors caution and is preparing to hand over to his designated successor, Greg Abel.

The LIBRA token, briefly supported by Argentine President Javier Milei, has proven to be a financial disaster for the majority of its investors. According to a study conducted by a blockchain research firm, over 13,000 traders suffered losses exceeding a total of 251 million dollars.

The global economy wavers between uncertainties and successive crises, and some analysts predict an even darker future. Among them is Robert Kiyosaki, entrepreneur and author of the bestseller "Rich Dad Poor Dad," who issues multiple warnings. He claims that a major economic collapse looms on the horizon, driven by a housing market crash, rampant inflation, and mass unemployment. More than just a prediction, his message is a call to action: those who do not prepare risk seeing their wealth collapse. But for Kiyosaki, solutions do exist, and among them, one currency seems truly capable of withstanding the financial chaos: Bitcoin.

The Paris Stock Exchange is going through a marked period of hesitation, facing a double challenge: the threats of a trade war from Donald Trump and the geopolitical developments surrounding Ukraine. On Monday, February 17, 2025, the CAC 40 shows a slight decrease of 0.03% at 8,176.47 points, reflecting the investors' caution in the face of these major issues.

France is going through a pivotal period. On one hand, public debt has reached historic highs, exceeding 3 trillion euros. On the other hand, a profound transformation of institutions is disrupting the traditional balance of the Fifth Republic.

Is the value of a property still based solely on its location? While the French market is undergoing its most significant correction in decades, the dynamics of the sector seem to be reversing. After a sharp price drop in 2024, the year 2025 is set to be one of profound transformation for the market. From major metropolitan areas to medium-sized cities, from deserted offices to less accessible housing, a shift is taking place, driven by an unprecedented economic and regulatory context. Amid rising interest rates, tighter credit, and new environmental requirements, real estate must rethink its fundamentals.

The consolidation phase of Bitcoin seems to be coming to an end. While recent fluctuations have not disrupted retail demand, the enthusiasm of retail investors remains palpable. Several signals indicate that a trend reversal could be imminent, offering new bullish prospects.

The economic divide between the French is widening as wealth concentrates in the hands of a tiny minority. At a time when the debate over tax justice is raging, a recent study by the General Directorate of Public Finances (DGFiP) paints a picture of the 0.1% of the wealthiest French citizens, revealing an increasingly marked fracture with the rest of the population. Who are these 74,500 households that make up this financial elite? What are their incomes, the structure of their wealth, and how has their situation evolved over the past few decades?

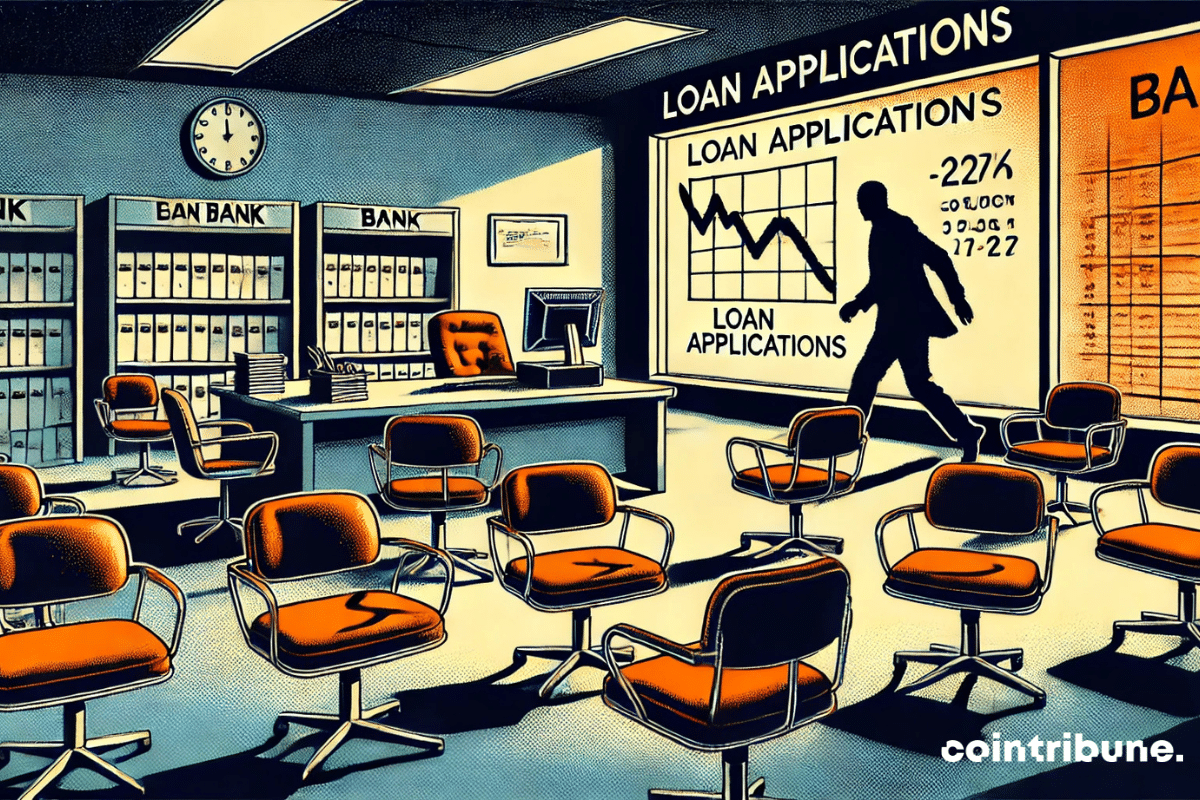

The French are borrowing less and less, an unprecedented trend that raises numerous questions about the country's economic dynamics. For the past six years, the contraction of the credit market reflects both the caution of households and the structural difficulties in real estate and consumption. The rate of credit holdings has fallen to its lowest level in over thirty years, a situation that even exceeds the shockwave caused by the subprime crisis in 2008. However, the first signs of a rebound in 2025 are emerging, fueled by a gradual improvement in households' financial situations.

Amid revolutionary announcements, technological evolutions, and regulatory upheavals, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic disputes. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

The financial elite is gradually abandoning gold for Bitcoin. This massive adoption could redefine the role of digital assets in the economy.

The social network X, formerly Twitter, is once again under judicial investigation in France. On January 12, Deputy Eric Bothorel alerted the Paris prosecutor's office about the algorithms of Elon Musk's platform, suspected of manipulation. This investigation follows several ongoing legal actions against the platform.

Shares of gold mining companies surged on Wednesday, February 5th, on Wall Street, driven by a new historic record of gold at $2,869.68 per ounce. This spectacular increase comes amid a revived trade war between Washington and Beijing, prompting investors towards safe-haven assets.

The creation by Donald Trump of a sovereign fund overseen by Howard Lutnick is very promising for the bitcoin reserve.

Amid revolutionary announcements, technological developments, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic struggles. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

After a decade of exceptional growth, India's economy is showing signs of slowing down. Government forecasts predict a growth rate between 6.3% and 6.8% for 2025, a significant decline from the 8.2% of 2023-2024.

Rents in France continue to rise in 2025, putting pressure on household budgets in a rapidly transforming real estate market. With an average cost of 723 euros per month including charges, the increase reaches 3.3% compared to 2024. This phenomenon, which spans the entire territory, reveals significant disparities between major metropolitan areas and more affordable cities. While some regions experience a surge in prices, others remain more accessible. What are the factors behind this rental inflation and which cities are the most affected?

A Chinese startup is redefining the stock market and AI, causing Nvidia to drop by 17%. Details in this article!

The return of Donald Trump to the White House in January 2025 marks a historic break in American politics. In less than a week, the president signed 78 decrees affecting various areas such as domestic policy and international aid.

The dream of owning a detached house with a garden, shared by nearly 80% of the French according to a recent study, could soon become unattainable. The reason is a reform introduced by the Climate Resilience Law which aims to reduce land artificialization to preserve natural, agricultural, and forested areas. By 2050, this measure aims to achieve "net zero artificialization," which radically changes urban planning rules. This project, although ecological, is already causing a surge in the price of buildable land and limiting its availability, raising concerns among future homeowners and real estate professionals.

The decree by Donald Trump and the repeal of the deadly accounting standard SAB 121 are very promising for bitcoin. Promise Kept Donald Trump promised that his government would stop putting obstacles in the way of bitcoin. This promise has been fulfilled with the decree “Strengthening…

Bitcoin, this $100,000 digital mirage, attracts Morgan Stanley into a dance where profits skyrocket and sanctions loom.

Saudi Arabia has unveiled an ambitious economic project led by Crown Prince Mohammed bin Salman, aiming to invest 600 billion dollars in the United States over four years. This commitment is part of the Kingdom's economic diversification strategy, a cornerstone of its Vision 2030. By strengthening its trade ties with Washington, Riyadh seeks not only to diversify its economic partnerships but also to consolidate its influence on the international stage. This plan, which comes amid a redefinition of global balances, underscores the growing importance of economic cooperation as a lever for geopolitical stability and mutual growth.

The mortgage credit market is undergoing a major shift at the beginning of 2025. After a rapid increase between 2022 and 2023, interest rates have been continuously declining for more than a year, with the hope that they will fall below the symbolic threshold of 3% in the coming months. This evolution, driven by the slowdown in inflation and the accommodative monetary policy of the European Central Bank (ECB), is attracting the attention of households and investors. However, these promising figures are set against a fragile economic context, characterized by low growth and rising financial uncertainties. It therefore becomes crucial to understand the underlying issues and their implications for the future.