Bitcoin steadied after a sharp sell-off earlier this week, finding support near the $92,000 level as traders reassessed risk. Market watchers say exchange-traded fund inflows continue to support a positive long-term outlook, even as global political tensions keep volatility elevated. Recent price action suggests buyers remain active despite broader uncertainty.

Liquidation

Bitcoin sneezes, traders panic, whales scoop up everything. A drop without a shiver, a washout of leveraged positions, and presto! the market regains its Olympian calm.

Crypto markets appear to have moved past the leverage-driven stress seen in October, according to asset manager Grayscale. Recent research shared by the firm suggests derivatives activity has stabilized, supply pressure has eased, and market direction is now more closely tied to fundamentals and policy developments. As a result, price action may be better positioned to respond to upcoming regulatory and institutional shifts rather than past disruptions.

Bitcoin and Ether crossed major technical thresholds on January 14, triggering nearly 700 million dollars in liquidations on short positions. In the absence of a fundamental catalyst, this brutal movement highlights the weight of market mechanics and leverage effects in the dynamics of cryptos. Thus, in a few hours, the excess exposures were swept away, recalling the vulnerability of poorly calibrated speculative strategies.

The release of the latest Consumer Price Index (CPI) in the United States triggered a brutal movement on crypto derivatives, exposing an unprecedented imbalance on XRP. Ripple's asset recorded a wave of massive liquidations, revealing a lightning-fast repositioning of traders facing a possible monetary shift.

At the beginning of this year, a technical indicator draws attention: liquidation data on Bitcoin futures contracts reveal a marked imbalance. This signal, rarely observed at this level, suggests that a simple price movement could trigger a series of chain liquidations. For some analysts, this configuration could propel BTC towards 100,000 dollars.

Solana shakes up the crypto market with a massive liquidation in just one hour. All details in this article.

Bitcoin stumbled into the new month after a sharp weekend drop erased days of calm trading and reignited market-wide fear. Prices plunged without warning on Sunday, triggering heavy liquidations and closing out the asset’s weakest November in years. Traders now question whether the fall signals deeper trouble or a reset that clears the way for a rebound.

The crypto market gave way under the pressure of its own leverage. In a few days, nearly 8 billion dollars of open interest on Bitcoin futures contracts were liquidated, triggering a brutal purge of speculative positions. Behind this shock, a rebalancing is emerging, suggesting that a stabilization cycle could begin.

Market conditions continue to tighten around Bitcoin as traders confront nearly $2 billion in leveraged long positions that could be liquidated if prices fall to $80,000. Recent swings reveal how fragile derivative exposure has become, with borrowed positions at risk of automatic liquidation during sharp price moves.

Market pressure has surged across the crypto sector. Even so, analysts say the recent wave of Bitcoin ETF outflows reflects short-term trading adjustments rather than a meaningful pullback by institutional participants. Recent redemptions, combined with forced selling in spot markets, have put added stress on prices, but experts maintain that broader demand for Bitcoin remains intact.

Sharp volatility hit the crypto market on Friday after Bitcoin briefly plunged on Hyperliquid. The sudden drop triggered millions in liquidations and sharply raised investor anxiety. Prices bounced back quickly, but market data indicate that conditions remain fragile and pessimism is deepening among traders.

Uptober fizzled out, November bleeds: $3.79 billion gone, Bitcoin stumbles, Solana rejoices… What if the BlackRock giant just pressed where it hurts?

Bitcoin’s fall under $90,000 on Wednesday revived market fear and extended a sell-off that has already lasted several days. Prices slipped to levels not seen since earlier periods of stress this year. Traders responded by stepping back from risk and reducing exposure across both spot and derivatives markets.

Global cryptocurrency markets are under heavy pressure after a sharp decline in Bitcoin's value damaged sentiment across the sector. Prices are now giving back most of the gains made earlier in the year, while smaller tokens are falling to multi-year lows. Investors are reassessing risk, trading volumes are shrinking, and several analysts warn that further declines remain possible.

Bitcoin’s sharp rebound, fueled by optimism over the end of the 40-day U.S. government shutdown, has split traders. While most market watchers welcomed the recovery, aggressive short sellers faced a costly squeeze. High-risk trader James Wynn is at the center of the turmoil after a series of rapid losses pushed him into an even larger short bet.

The crypto market experienced a sharp decline at the start of the week. While US stocks remained in the green, Bitcoin, Ethereum, and Dogecoin collapsed, triggering over $1.1 billion in liquidations within 24 hours. A sudden drop, without a clear catalyst, revealing the weaknesses of an ecosystem still unstable and vulnerable to panic movements. This massive setback rekindles doubts about the market's strength and investors’ resilience amid an ever unpredictable volatility.

Crypto explosion: Zcash emerges from an 8-year bearish cycle and climbs to the top. We tell you more in this article.

The crypto market, already known for its volatility, has just experienced another major shock. In just 24 hours, over $1.1 billion has been liquidated, revealing the ecosystem's fragility against increasingly influential macroeconomic forces. The fluctuations of bitcoin and altcoins have not escaped investors' attention, who saw their positions swept away by this wave of liquidations, increasing the risks associated with this uncertain market.

The ghost Satoshi watches his bitcoins melt by 20 billion. Still silent, still rich... How long will the king of silence let chaos reign without a word?

On October 16, bitcoin sharply dropped below $108,000, disrupting an already fragile market. Such a sudden fall after a period of stability raises questions about the factors behind this destabilization. This event affects millions of investors and redefines crypto market dynamics.

Two crypto bullish stars promise an ETH at $10,000... But between ETFs, staking, and crashes, is the prophecy more of a miracle than a mathematical model?

Stablecoins continue to dominate blockchain activity, with Ethereum remaining at the center of this growth. Recent data shows stablecoin transactions on Ethereum hitting record highs, highlighting rising adoption and the network’s expanding role as a global settlement layer. Despite short-term price volatility, network fundamentals remain strong.

Bitcoin collapses, Trump threatens, Beijing counterattacks, and cryptos suffer: meanwhile, Dogecoin still seeks a way out of the crisis. Should we laugh or buy?

Trump sneezes on tariffs, Wall Street catches a cold, crypto convulses: 1.6 million traders liquidated, 19 billion evaporated. The crash is no longer a threat, it's a slap.

While some watch the Fed rates, bitcoin soars to 125,000 dollars. The crypto star climbs, but exchanges panic: will there be a shortage of coins?

When crypto goes up, he goes down. @qwatio, a relentless speculator, burns millions on XRP… and could well blow up at the next green candle. What are we waiting for to stop him?

Bitcoin in full panic, the index collapses... what if the storm was announcing a clearing? While the charts are turning red, some are arming themselves with patience.

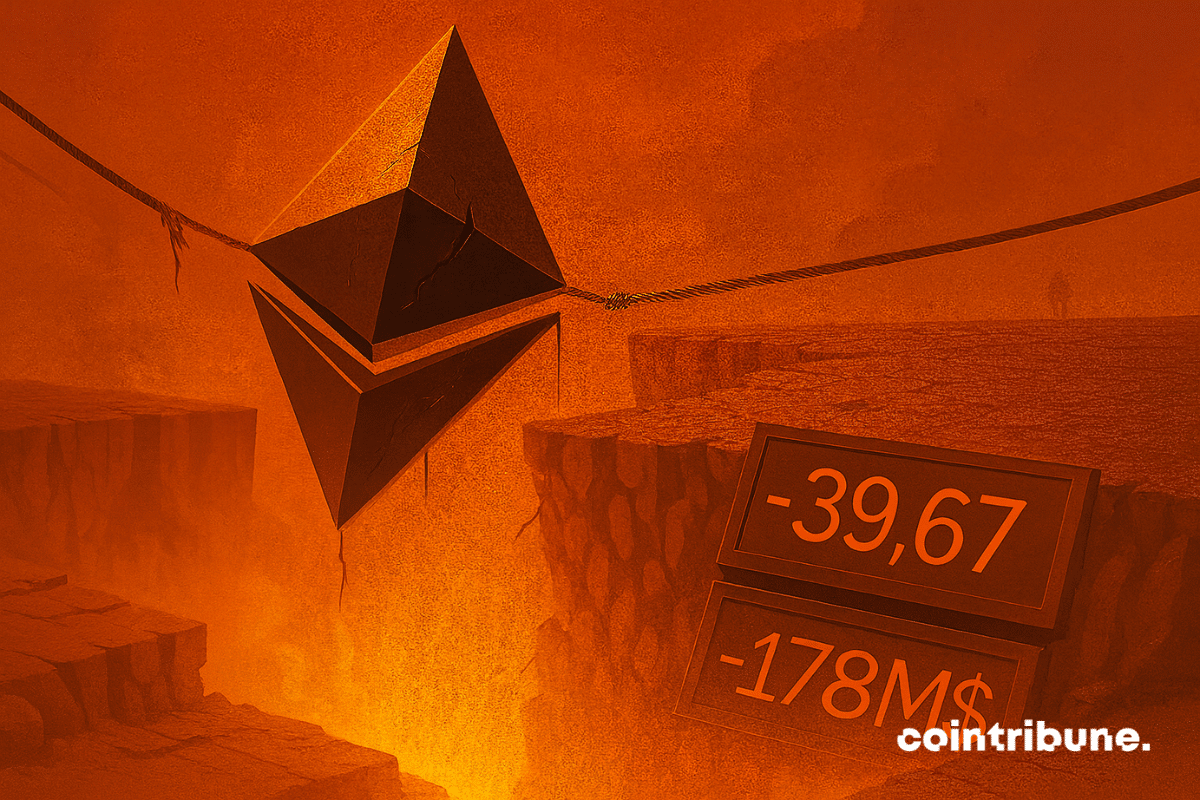

Ethereum falls below $4,000. Liquidations, ETFs outflows, but record accumulation behind the scenes. Complete analysis of the reversal.

The crypto market has just endured one of its harshest shocks since the start of the year. In less than 24 hours, more than 407,000 positions were liquidated, wiping out over 1.5 billion dollars of bullish bets from order books. This quick correction, triggered by the domino effect of margin calls, shook the largest capitalizations while revealing the vulnerability of a market still dominated by leverage and massive speculative movements.