Ethereum takes the prize for the big players, Bitcoin clings to its throne. A duel of numbers, egos and billions: who will emerge victorious from this digital waltz?

Liquidation

Trump dead? No, just putting around! But the rumor was enough to shake the crypto market, social networks... and some nerves in high places.

When bitcoin falters, whales sell, small holders pick up, and the Fed sneezes. Crypto, this monetary theater where everyone plays their part... often without knowing the script.

While Ethereum was showing off at nearly $5,000, Bitcoin was crashing… Traders saw their dreams evaporate faster than a presidential alibi.

After weeks of bullish euphoria, the crypto market violently corrected, revealing an underlying tension ignored for too long. In just 24 hours, over 500 million dollars of long positions were liquidated, dragging down bitcoin, Ethereum, and XRP in their fall. This brutal wave revealed the fragility of a market fueled by leverage, where technical indicators, sidelined by optimism, suddenly regain all their importance. A return to reality is necessary for investors.

The crypto market has just suffered one of its most significant setbacks of the year. In a few hours, bitcoin lost over $5,000, causing a widespread rout among other assets. Indeed, the release of a US Producer Price Index (PPI) well beyond expectations rekindles the specter of persistent inflation. This statistic, which surprises both Wall Street and the crypto ecosystem, upends monetary policy expectations and triggers a cascade of liquidations on leveraged positions, increasing downward pressure.

Ethereum suddenly emerges from its lethargy. By breaking through a strategic price zone, the asset marks one of its sharpest movements in weeks. Increased volumes, aligned technical signals, and a resurgence of volatility: all the markers of a market awakening are present. This unexpected sequence repositions Ethereum at the center of attention, amidst the liquidation of short positions and the return of speculative appetite. Such a surge raises as many questions as it intrigues, as the ecosystem still struggles to regain a clear direction.

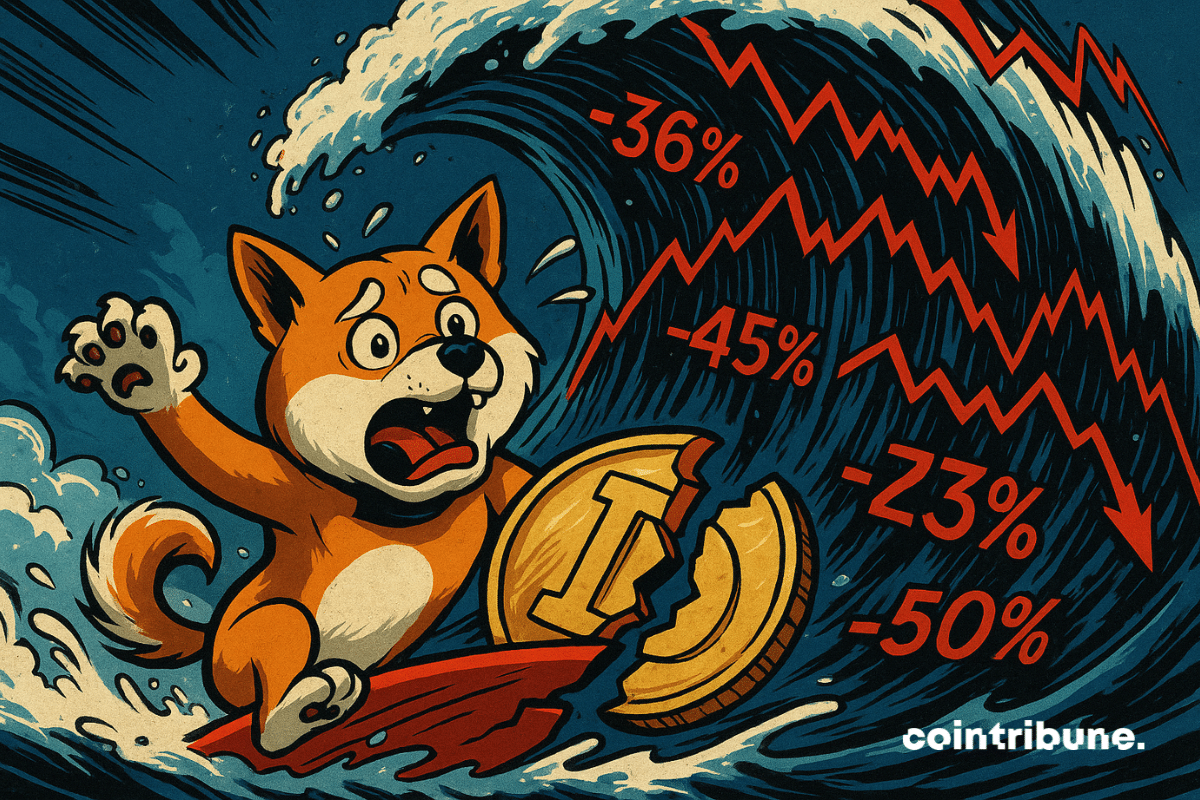

Dogecoin put derivatives markets under pressure in record time. In four hours, long-position traders saw more than $590,000 go up in smoke, trapped by a 1,000% liquidation imbalance. The asset, fueled by a meteoric rebound before dropping again, exposed the ambient nervousness and vulnerability of speculative positions. This sequence illustrates how unpredictable Dogecoin remains, even for the most seasoned operators.

The first half of 2025 saw massive crypto liquidations driven by market shocks and policy shifts, but recovery signs are now surfacing.

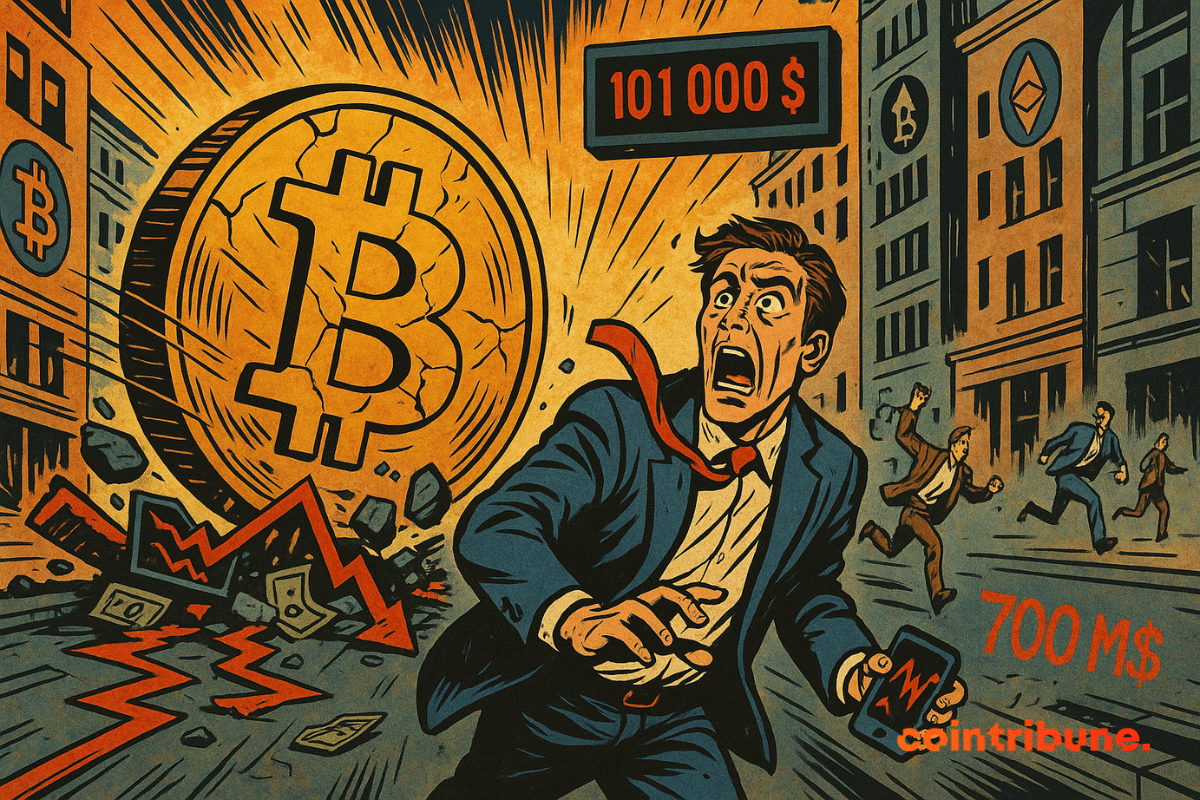

Bitcoin climbed back above $105K after a sharp dip amid Middle East tensions. $700M liquidated as traders pull back ahead of a key options expiry.

The calm will have been short-lived. Within a few hours, Bitcoin dropped below $99,000, triggering a chain reaction: over a billion dollars in positions liquidated, altcoins shaken up, and volatility reignited. The episode, marked by rare brutality, reminds us of the relentless mechanics of leveraged markets. After several weeks of calm, the correction hits hard, sweeping away the illusion of a controlled recovery. Reckless traders bear the cost of excessive confidence, in a market always quick to flip.

Trump targets Iran, Bitcoin stumbles, traders are jittery, and indicators falter: what if war determined the next peak of crypto?

Violent return to reality for XRP traders. Within 24 hours, a historic imbalance in liquidations triggered instability in the derivatives market, trapping traders. As the crypto plunged below $2.30, the leverage turned against those betting on a continued bullish trend. This technical setback, seemingly innocuous, raises questions about the strength of the narrative surrounding XRP.

Solana is shaking, XRP is plummeting, Ethereum is swaying... the whales dance and small investors suffer. The crypto circus continues, without a net, to the rhythm of an increasingly unpredictable market.

Dogecoin has just experienced a disruption that goes beyond the usual volatility of the crypto market. In one hour, the memecoin faced a liquidation imbalance of 200%, triggering a wave of losses on long positions. This unusual figure reveals far more than erratic movement. It highlights the increasing exposure of traders to relentless market mechanics. This is not an epiphenomenon, but a revealing signal of latent tension, in a climate where consolidation often conceals imminent breakages.

In the span of a few hours, the crypto market was hit by a brief correction. While bitcoin seemed firmly established above $100,000, a sudden reversal changed the trend, sweeping away the bullish momentum. Over $700 million in positions were liquidated, which brought BTC below $101,000. This rapid and unexpected drop destabilized investors, once again confirming the vulnerability of a market where confidence can shift in an instant.

The price of Ethereum has fallen below 1,900 dollars, recording a decline of 6% over the last week. This drop jeopardizes several significant positions on MakerDAO with over 238 million dollars potentially at risk.

Ethereum is going through a critical period, and a 20% drop could trigger $336 million in liquidations on the DeFi market. With key levels to watch and increased volatility, investors must prepare. Risk analysis, adaptation strategies, and solutions to protect their crypto portfolio against this threat.

DeFi protocols had promised a brighter future. The result? 500 million ETH evaporated, stunned investors, and a crypto market that wobbles like a tightrope walker without a net.

Like a ship in the midst of a storm, Bitcoin sways, capsizes, and sees its passengers jumping into the water. Only the seasoned sailors remain on board, confident in the future clear-up.

Bitcoin, the wavering king, falls below $90,000, wept over by runaway ETFs, drowned in a billion liquidated, against a backdrop of farcical Sino-American disputes.

Bitcoin sways under a threatening sky, and nearly 300 million dollars vanish in the storm. Traders, like tightrope walkers, are scrutinizing the bar at 96,000 dollars.

Financial and crypto markets are evolving amidst increasing uncertainty, and Bitcoin is no exception. As volatility intensifies, investors are watching closely the critical threshold of $93,000, a key level whose breach could trigger a cascade of massive liquidations estimated at $1.3 billion. This critical scenario unfolds in a tense geopolitical context, where the trade war between the United States and China affects all risk assets. The fear of a harsh correction in Bitcoin, long seen as a refuge against macroeconomic instability, fuels speculation and heightens investor caution.

The crypto market has just experienced an unprecedented financial tsunami. In 24 hours, 2.24 billion dollars evaporated under the blows of trade wars, propelling Ethereum to the forefront of a historic debacle. A massive liquidation, driven by Donald Trump's surprise announcement on customs duties, shattered the records of the FTX crisis and the COVID-19 crash. Behind these dizzying numbers, over 730,000 traders saw their positions turned to ashes. How could a political tweet shake a decentralized ecosystem? Let's dive into the machinery of this debacle.

Ripple slides, XRP wavers. Between broken hopes and chilling figures, 36 million dollars flirt with the abyss.

The crypto market is showing encouraging signs as open interest in bitcoin reaches its lowest level in two months, suggesting a decrease in selling pressure. This development comes against a backdrop where BTC has been fluctuating around $95,000 since the end of December 2024.

When the longs break, a billion fades away. Bitcoin wavers, but dreamers still hope for their Christmas miracle.

Amidst the tumult of whales and the shine of profits, Uniswap dances with the hope of a rise... or a plunge.

A fascinating chaos is shaking the crypto world: Coinbase, as an improbable puppeteer, triggers a ballet of $1.6 billion in liquidations, leaving traders and altcoins in tatters.

Amidst the upheavals of the crypto market, a wisdom awakens: the lows extend, and opportunities whisper to the bold.