Michael Saylor does not ease the pressure. The co-founder of Strategy announced a new bitcoin purchase, his third in a row this month. Despite the market volatility and the fluctuations in his company's stock price, he relentlessly pursues his plan: accumulate BTC, whatever the cost. His conviction remains intact, almost unshakable.

Microstrategy

Volatility is back on bitcoin. But despite some hesitation, the underlying bullish trend remains unshakable.

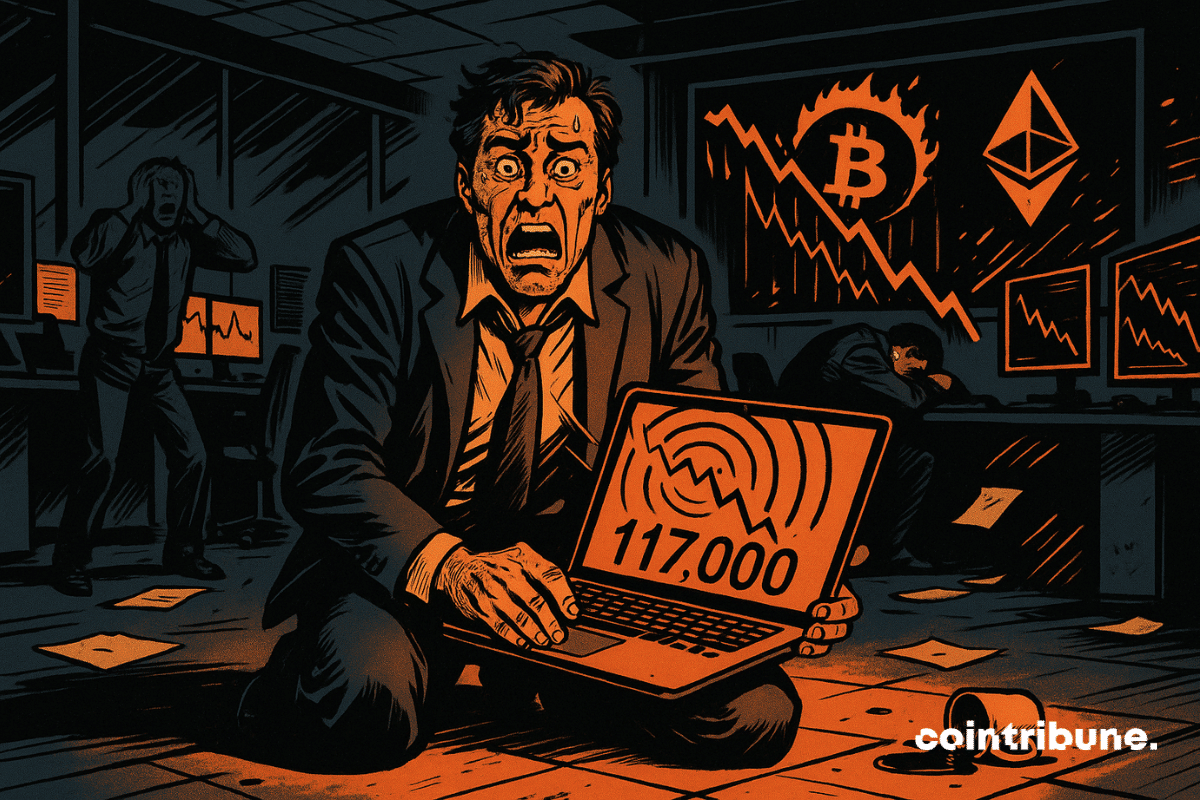

Less than 48 hours after hovering near a peak at 124,000 dollars, bitcoin falls below 117,000 while ether drops to 4,400. This brutal but seemingly classic correction exposed a weak link in the ecosystem: publicly traded companies exposed to cryptos. Thus, this segment long supported by bullish euphoria takes the reversal full on. The market, meanwhile, reminds that it never rewards excess for long.

Bitcoin is touching its all-time highs and Strategy is seizing the opportunity to celebrate a milestone: five years of uninterrupted purchases. The global leader among publicly listed companies holding BTC, Michael Saylor's group commemorates the event with a much more modest acquisition than usual. A symbolic gesture that, in a market hypersensitive to decisions by institutional heavyweights, reignites the debate on the viability of a forced-accumulation strategy, even when prices are flirting with their records.

Altcoins are no longer a fleeting bubble. Their presence is consolidating to the point of attracting the biggest names in traditional finance. BlackRock, a Wall Street giant, is now opening up to leading cryptos like ether. This institutional shift changes the game in the crypto ecosystem. However, for Michael Saylor, a leading figure of MicroStrategy, a hierarchy is imposed: bitcoin remains the benchmark. And even if Ethereum shines, he refuses to grant it the same status.

When a crypto token starts to challenge Nike and DBS Bank, it signals a major reshuffle in the ranking of power players. And to think this is just the beginning...

While the bitcoin market seems stuck in a waiting phase, reserves are running low on OTC desks, those platforms where institutions buy without moving prices. The company Strategy, which has already acquired more than 182,000 BTC this year, finds itself on the front line. Facing a drying supply, pressure is mounting. What if the next bullish shock was preparing... silently?

Metaplanet has made yet another landmark acquisition as it doubles down on its goal of becoming the largest corporate Bitcoin holder. Following its transition to a BTC treasury firm, the Tokyo-listed firm has become one of the largest publicly listed holders of Bitcoin in Asia.

As each bitcoin becomes rarer, Strategy aims to concentrate an unprecedented share. Michael Saylor, its co-founder, mentions the possibility of holding up to 7% of the global bitcoin supply, or nearly 1.5 million BTC. With already more than 3% in reserve, the company no longer just invests: it builds a financial model focused on the strategic accumulation of the asset. A trajectory that redefines corporate treasury codes in the era of digital currencies.

The Japanese firm Metaplanet is stepping up. It plans to issue up to 3.7 billion dollars of shares to finance a massive BTC accumulation strategy. A bold approach, directly inspired by the Strategy model (ex-MicroStrategy), which establishes bitcoin as a central pillar of its financial doctrine.

Saylor the enlightened, billionaire or prophet? He splashes out 2.5 billion on five-figure bitcoin. A speculative mass on the stock market... with monthly dividends, please!

Strategy, Michael Saylor's company, did not purchase any bitcoin during the last week of July, a surprising first, as the price of the flagship asset remains above 118,000 dollars. This slowdown starkly contrasts with the sustained pace of previous months and coincides with a fundraising of 2.5 billion dollars in preferred stocks. A calculated pause or a warning signal? Investors are questioning.

Michael Saylor has just published a new signal on X that is shaking up the crypto markets. The founder of Strategy shared the famous SaylorTracker chart, a habit that traditionally precedes his bitcoin acquisitions. This time, the accumulation machine seems ready to get back in motion.

Michael Saylor has never been one to hold back his words or be tight with his wallet. When he promises Bitcoin, he buys. And quickly. As soon as the preliminary tweet is published, the orchestra kicks off: 6,220 BTC absorbed in the midst of bullish euphoria, with surgical calm. Behind the scenes, this is not just a purchase — it’s a signal to the market, a new demonstration of strength that tells another story: the Strategy model is running at full throttle.

The co-founder of Strategy announced a new acquisition of BTC, further strengthening his company's colossal reserves, now valued at over $71 billion. This unprecedented cash management model, based on a methodical accumulation of bitcoin, is as intriguing as it is fascinating. How far is Saylor willing to go?

Bitcoin exchange-traded funds (ETFs) have become an emerging trend in recent years, providing investors with exposure to BTC without direct ownership. Large corporate bodies have joined this trend, with top companies like Michael Saylor-led Strategy leading the pack. However, Bitcoin maximalist and media personality Max Keiser has urged caution among crypto participants who invest in the asset through centralized treasuries, explaining that these firms could become a target for governments in the future.

Bitcoin is no longer just a hedge. Major public companies now treat it as a core asset, with market values shaped by how they hold it.

Here are TD Cowen's projections for the price of Bitcoin by the end of 2025. Three scenarios are proposed.

When Bitcoin takes off, Saylor pulls out his millions. 601,550 BTC later, the gentleman persists, signs, and turns his tweets into digital gold. Who can say better?

Larry Fink endorses bitcoins faster than miners can produce them. While staking is making its appearance, the ETF is turning BTC into a nice, juicy pawn.

While Strategy, a pioneer in bitcoin balance sheets, temporarily suspends its purchases, two listed companies are opting for the opposite trajectory. Metaplanet and Semler Scientific are heavily betting on BTC, redefining the balance of power in the market. In a context of macroeconomic uncertainty and persistent volatility, these bold acquisitions raise questions: Is this a mere speculative bet or a sustainable strategic repositioning?

Strategy, ex-MicroStrategy, is intensifying its bet on Bitcoin with a record raise of $4.2 billion through perpetual preferred shares at 10%. Under the leadership of Michael Saylor, the firm is strengthening its accumulation strategy despite a noticeable pause in its BTC purchases. This tactical shift, between liquidity seeking and financial optimization, marks a new phase in the controversial alliance between traditional markets and cryptocurrencies.

Corporate Bitcoin treasury firms have become an emerging trend in the last few years, with companies like Strategy adopting an aggressive ownership approach. But some market experts have expressed concern over this capital reserve strategy, arguing that it lacks purpose and may not stand the test of time.

While the markets hesitate, Saylor is accumulating bitcoins by the thousands. Another 4,980 units? At this rate, it's the FED that will end up calling him.

Michael Saylor has just confirmed his 11th consecutive week of Bitcoin acquisitions, an impressive streak that perfectly illustrates his relentless accumulation strategy. With 592,345 BTC in reserve, his company Strategy is becoming a true fortress of Bitcoin. But how far will he go?

Michael Saylor's company, Strategy (formerly MicroStrategy), could soon be included in the prestigious S&P 500 index. According to analyst Jeff Walton, it has a 91% chance of achieving this within the next 5 days. However, a crucial condition must be met: Bitcoin must remain above a critical threshold.

Saylor persists and signs: 245 BTC at 26 million dollars. While some tremble, he firmly believes that Bitcoin will one day reach 21 million. A strategy that defies the obvious.

Between financial scandal and assumed strategy, Michael Saylor remains committed to his bet on bitcoin. The details in this article!

The president of Strategy has just revised his projections for Bitcoin. His new target? 21 million dollars in 21 years. A prediction that is causing debate within the crypto community and raises questions about the foundations of this heightened optimism.

With $1 billion invested, Strategy boosts its bitcoin yield to 19%. A profitable or dangerous strategy? Experts are questioning!