Bitcoin reaches $99,562, breaks a key resistance level, and is charging straight towards $100,000! However, what surprise awaits BTC? A rise to $120,000 or an imminent correction to $92,000? Let's explore technical trends and perspectives together.

Short news

MEXC, one of the leading cryptocurrency trading platforms in the world, has unveiled its new brand identity with a catchy global slogan: “Your Easiest Way to Crypto.” This rebranding marks a significant milestone in MEXC's evolution as an industry leader, reaffirming its commitment to making cryptocurrency trading simple and accessible for all.

MEXC, one of the leading global cryptocurrency trading platforms, has enhanced its Over-the-Counter (OTC) trading service by introducing euro (EUR) support. This strategic move aims to simplify access to cryptocurrencies for European users by allowing them to purchase and trade directly with their local fiat currency.

MEXC, a leading crypto exchange, has introduced a zero-fee trading event for spot USDC pairs. This initiative allows users to enjoy 0% Maker and Taker fees, optimizing their trading strategies and enhancing profitability.

XRP, like a reborn phoenix, is now only 83.4% away from surpassing Ethereum. A spectacular rise that disrupts the hierarchy of giants.

The year 2024 has been marked by a spectacular rise in the value of cryptocurrencies, with Bitcoin reaching an historic peak of $108,135. However, this meteoric growth has also led to a troubling increase in kidnappings and extortions targeting crypto traders and investors.

Metaplanet, a Japanese company specializing in bitcoin, recently announced its ambition to acquire 10,000 BTC by 2025. This initiative marks an important step in the company's strategy to strengthen its position as a leader in bitcoin treasury in Asia, placing it in direct competition with MicroStrategy.

Like a cut breath, Bitcoin hesitates below $100,000. Fewer sales, more waiting: where is it going?

Bitcoin reached a historic milestone in 2024. In just one year, $19 trillion flowed through its network, an absolute record that marks the end of two years of declining transaction volumes. This spectacular recovery reflects the return of investor confidence, driven by several major events. The approval of Bitcoin ETFs in the United States facilitated the entry of institutional capital, while the April 2024 halving reinforced the scarcity of BTC, which fuels demand. Meanwhile, the network has significantly strengthened, with a hashrate at an unprecedented level of 1,000 exahashes per second. Behind these staggering figures, a shift is taking place: Bitcoin is consolidating its status both as a store of value and as a global transactional infrastructure, raising questions about its future and its role in traditional finance.

The year 2025 is shaping up under favorable auspices for the global economy, despite ongoing challenges. As recession fears fade and inflation begins to normalize, several indicators suggest a positive momentum for the months ahead.

Bitcoin, the weary hero, struggles against fierce illiquidity. In January, analysts are gazing at the stars: $105,000 or false hope?

Goodbye pipeline, goodbye windfall: under the bombs, Kiev breathes a chilling wind that extinguishes the Russian stoves and warms Europe with embarrassment.

Solana, a blockchain known for its speed and efficiency, has recently achieved a major milestone by becoming resistant to quantum attacks. This advancement was announced by a Solana developer, who explained that the solution is based on an ancient yet extremely robust crypto technique.

For some time now, MicroStrategy has established itself as the leading company in Bitcoin. With a bold strategy that combines financial innovation and conviction, it is once again in the spotlight with an ambitious proposal: to raise 2 billion dollars to acquire more bitcoin.

On Friday, January 3, 2025, Wall Street experienced a day of gains marked by a return of risk appetite among investors. After a period of volatility and uncertainty, the major stock indices saw significant gains, reflecting renewed confidence in the American economy.

Blockchain, like a Swiss watch, measures the economy to the thousandth. Goodbye artistic blur, hello fractional wealth and disruptive promises.

The Bitcoin network has just reached a historic milestone, achieving a record hashrate of 1,000 exahashes per second (EH/s) on January 3, 2025. This symbolic threshold represents an unprecedented acceleration of computing power mobilized to secure the blockchain, as the mining sector undergoes a phase of strategic expansion. Over the span of a year, the network's hashing capacity has doubled, increasing from 510 EH/s in January 2024 to this unprecedented level, illustrating the scale of investments in the industry.

Cryptos continue to captivate the attention of the financial world, but the true players in this market often lurk in the shadows: the whales. These investors with colossal resources influence trends and open new paths. This time, it is in the realm of AI-based tokens that an anonymous whale has struck hard, raking in 11.5 million dollars in less than three weeks.

Victims of the FTX bankruptcy are finally seeing the light at the end of the tunnel. The crypto exchange platform officially activated its reimbursement plan on January 3, 2024, paving the way for the return of funds to millions of affected users.

In 2025, venture capital in the crypto sector will continue to grow. According to experts, venture capital investors will focus on three burgeoning areas in the cryptocurrency industry, likely attracting nearly 18 billion dollars in investments.

The numbers are dizzying, the actions are striking: T3 FCU turns USDT into a nightmare for international fraudsters.

Pepe, the ephemeral gladiator, sees his moment of glory under Musk: a flash of wealth, a resounding collapse. Crypto will remember this.

In 2025, China continues to demonstrate its resilience under international economic pressures, particularly those exerted by the future Trump administration. Despite attempts by the new American president to hinder China's economic rise, it persists in its openness, marking a significant victory in the war between the two superpowers.

The bitcoin market is going through a turbulent period at the beginning of 2025, despite recent historic highs. According to a report by Bravo Research, a correction down to $80,000 could represent a strategic buying opportunity for investors.

In January 2025, Ripple's XRP appears set for a significant rise, according to crypto data. Since the beginning of the year, XRP has already increased by 7%, extending its rally that started during the New Year celebrations. This rise is supported by five major elements that will enable XRP to reach new heights in the coming days.

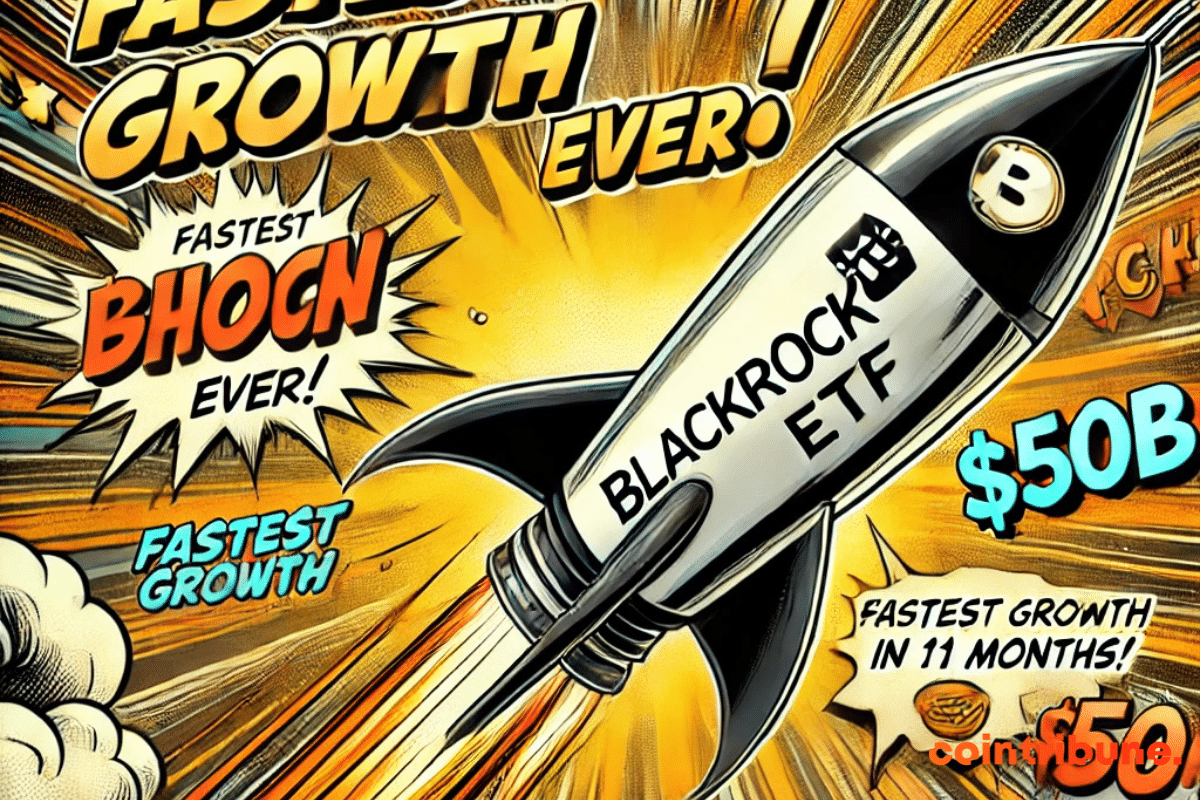

BlackRock's Bitcoin ETF sets a historic record with $50 billion in assets in 11 months, revolutionizing the ETF market and strengthening institutional adoption of Bitcoin.

Do Kwon, co-founder of Terraform Labs, appeared before a U.S. judge on January 2, 2025, where he pleaded not guilty to charges of fraud and money laundering. This hearing marks a key milestone in a case that has shaken the crypto world since the collapse of the Terra ecosystem.

Memecoins, the new stars of a digital circus, juggle between satire and seriousness, attracting millions and the astonished gaze of financiers.

The Solana memecoin generation platform Pump.fun is approaching a revenue of 400 million dollars, according to Lookonchain, despite a significant drop in the overall market capitalization of memecoins in December.

Like beacons in the crypto night, American ETFs illuminate the path for Bitcoin towards dizzying heights. The oracles whisper: $200,000, and perhaps more!