Crypto markets appear to have moved past the leverage-driven stress seen in October, according to asset manager Grayscale. Recent research shared by the firm suggests derivatives activity has stabilized, supply pressure has eased, and market direction is now more closely tied to fundamentals and policy developments. As a result, price action may be better positioned to respond to upcoming regulatory and institutional shifts rather than past disruptions.

Spot Market

Spot is making a comeback, Binance still reigns, and ETFs attract big fish: crypto hasn't said its last word... except for altcoins that are sulking.

Spot trading activity across crypto exchanges slowed in September, hitting its weakest level in months, even as institutional demand for Bitcoin surged through exchange-traded funds. The contrasting trends highlight a shift in market behavior, with speculative trading losing momentum while long-term investment flows gaining strength.

While Ethereum staggers, Wall Street joins the crypto party: ETFs galore, billions lurking, and a network that makes less noise, but more waves.

Ethereum shunned, Wall Street panics, BlackRock empties its bags... Crypto smells burnt, but some billionaires seem to sense a good buyout scent. The smell of sales?

Bitcoin flirted with $113,000, traders were enthusiastic, the Fed was complacent, and Saylor was euphoric. But without spot buying, beware of a backlash: the intoxication could quickly turn to vertigo.

Wall Street flirts with a cypherpunk: 30,000 bitcoins, a SPAC, an impatient heir, and a wink to Satoshi. The question remains who will press the button...

While crypto ETFs are hitting record highs, volumes are evaporating. Blackrock and Fidelity are leading the influx, but the market seems to be holding its breath. Boom on the surface, empty underneath?

While Bitcoin is napping above 100,000 dollars, Ethereum is filling the coffers. Funds are pouring in, ETFs are buzzing: who said that crypto is running out of steam?

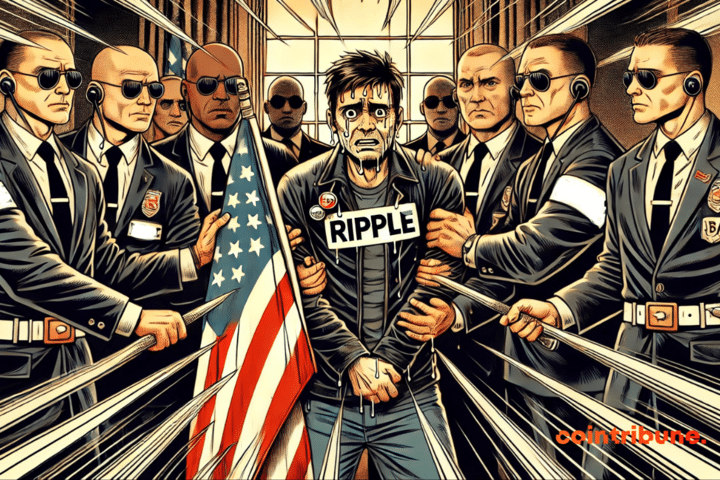

Under the sun of the SEC, no shadow for the XRP ETF: the crypto market waits, Bitwise is brooding.

Cardano, despite an initial drop, sees its trading volume soar to 457 million. A crypto fireworks display!

Franklin Templeton plans a Solana ETF, illustrating the growing presence of cryptocurrencies in the financial world.

Bitcoin is gaining more and more favor among institutional investors. Major names in the global finance industry are beginning to adapt their strategies to include the queen of cryptos. The Chicago Mercantile Exchange (CME), a global leader in futures exchanges, is also considering entering the bitcoin spot trading market. An initiative that could have profound repercussions for the crypto market.

The SEC, master of procrastination: the decision on Ethereum ETFs, still postponed yet again!

The insightful tweet from Novogratz about Bitcoin and Grayscale reveals his optimism, predicting higher prices despite the challenges