Ethereum consolidates after six weeks of consecutive gains. Let's together examine the future prospects for ETH.

Trading Exchange RSS

The crypto and financial industries are hoping that the Securities and Exchange Commission (SEC) will come out in favor of a spot Ethereum ETF. However, some experts believe that their hope could be dashed, as the likelihood of such an outcome seems to be dwindling. Here is why they are also pessimistic.

Bitcoin is at an all-time high, but lacks momentum. Will we have to wait for the GBTC ETF to be empty to go higher?

In 2024, France's trade deficit continues to decrease, a sign of a strengthening French economy!

Richard Teng, the current CEO of Binance, has spoken about the evolution of the exchange since he took over. Under his leadership, the company seems to have moved away from the illegal practices that prevailed under the reign of Changpeng Zhao, resolutely committed to continuing on this path to maintain its leadership in the market.

The U.S. Treasury is seeking new powers to better crack down on and penalize abuses related to crypto.

Influx of record and diversification of crypto assets since the beginning of the year: cryptocurrencies attract investors.

The SHIB whales are aiming for highs of $0.002, anticipating a surge in the memecoin. The SHIB rush continues.

Bitcoin is bouncing back after starting April on a downward trend. Let's analyze together the future outlook for the BTC price.

Arthur Hayes predicts the fall of Bitcoin before and after the Halving. Let's discover his strategy to navigate through this volatility!

For the past seven weeks, Bitcoin ETFs have seen a massive influx of capital. While many experts and investors were expecting this trend to continue, it is fading. Here is what explains this trend, which also affects several other crypto funds, including Ethereum, Solana, and Cardano.

Ethereum's cryptocurrency hits hard and fast, recording a dramatic 8% jump in just 24 hours. This soaring climb has propelled it toward the dizzying heights of $3,710 on Binance! But the climb doesn't stop there. Riding the wave of this week, the blockchain star has scaled an additional 3.0%. This has boosted its value from $3,510.48 to new heights. Although still below its record of $4,878.26, Ethereum displays an unwavering determination to redefine the limits of its potential.

The BRICS have announced their plan to launch their own currency to break free from dependence on the dollar. While waiting for this project to materialize, the alliance is shunning the dollar through various strategies. One of the most recent ones is the massive use of gold by the BRICS to support their local currencies.

What do Bitcoin ETFs have in store for us this week? Will we finally hit a new all-time high?

Charles Hoskinson from Cardano defies critics by promising two major crypto revolutions. Details in this article.

Among revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battlefield of regulatory and economic struggles. Here is a summary of the most significant news of the past week around Bitcoin, Ethereum, Binance, Solana, etc.

The CEO of Ripple predicts that the crypto market will double to reach $5 trillion by the end of this year 2024!

On Sunday, April 7, Bitcoin (BTC) saw a new increase in its value. Its price, which had significantly dropped in the previous days to a level close to $65,000, rose to just over $70,000. Just days before the halving, this rise in the price of the flagship crypto is sparking speculation.

Faced with the threat of Bitget being blocked by the AMF, French investors are urged to take measures to protect themselves.

Binance challenges while enhancing user protection and addressing crypto compliance.

Binance crypto exchange announced the end of support for Bitcoin NFTs on its marketplace by April 18th. This decision comes as part of streamlining its product offerings, despite the success of Ordinals.

The next Bitcoin Halving is approaching fast. As speculations and uncertainties intensify, TimeChain Calendar offers a wealth of information and real-time analysis to understand the internal workings of the Bitcoin network.

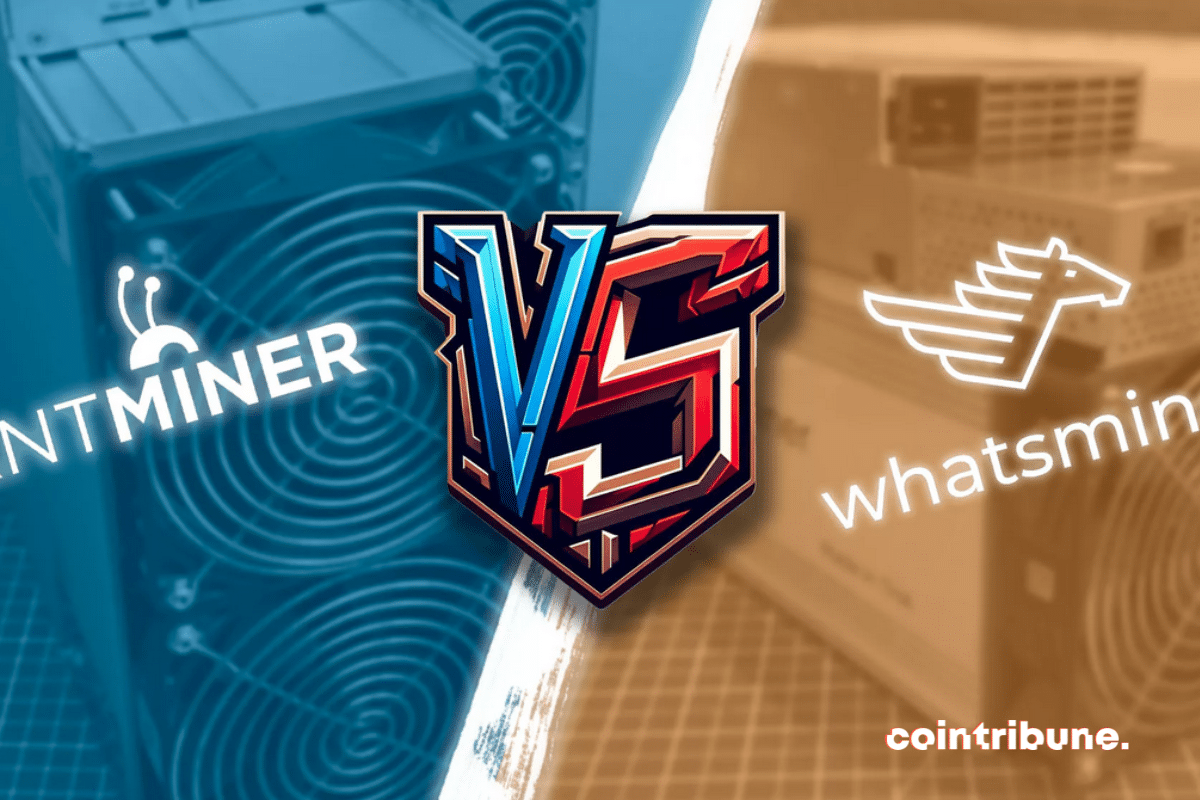

The high temperature performance of Bitcoin miners Whatsminer is significantly better than that of the Antminer.

Layer 2 networks on Ethereum could generate more revenue than the base network, according to VanEck.

Explore the revolutionary rise of AI in the crypto world, an explosive marriage that could potentially disrupt the ecosystem!

As Bitcoin approaches new highs, the prospects for an Ethereum ETF are dimming, underscoring the persistent regulatory challenges.

It was known that with the dynamism that has been theirs for several months, cryptocurrencies have lifted many people out of financial misery. The magazine Fort, in a recent study, documented these perceptions. Its report shows how in the space of a year, these assets, both beloved by some and feared by others, have created new billionaires. As for the old ones, they have seen their financial assets linked to crypto grow in line with their faith in these assets. In this article, we present to you those who, through risks, have become wealthy thanks to crypto.

During her visit to China, US Treasury Secretary Janet Yellen sounded the alarm about the massive subsidies granted by Beijing to its industry. These aids could destabilize the global economy by leading to production overcapacity.

The European Securities and Markets Authority (ESMA) recently signaled that reorganizing blockchain transactions to maximize profits, known as Maximum Extractable Value (MEV), could potentially constitute a form of market abuse under the MiCA law. However, some experts in the crypto industry are calling for a nuanced view on this stance.

It is traditionally accepted that Bitcoin (BTC) maintains a relationship with the stock market in terms of movement. If this link remains, a crypto expert reveals that it is not as strong as commonly believed. He especially notes that Bitcoin's correlation with the S&P 500 is now negative.