Tether ended 2025 with strong momentum, even as the broader crypto market weakened following October’s sharp sell-off. New data shows its dollar-pegged stablecoin, USDT, continued to attract users, activity, and capital during a period of reduced risk appetite. While competing stablecoins stalled or contracted, USDT expanded across nearly every major metric—highlighting growing demand beyond speculative trading.

USD Coin (USDC)

While bitcoin showed its worst performance since 2022, a massive capital movement was preparing in the shadows. Stablecoin volumes reached 10 trillion dollars in January, nearly a third of the annual activity of 2024 concentrated in just 30 days.

Ten banks join forces to create Qivalis, a stablecoin designed for fast crypto payments in euros. Details here!

In Davos, the head of Circle promises that stablecoins will not blow up banks. What if crypto became the secret weapon... of AI? Allaire swears no, or almost.

As the year 2026 is just beginning, Ethereum is already breaking transaction records and showing negligible fees. Analysis!

The boundary between traditional finance and crypto continues to fade. Interactive Brokers, a heavyweight in online brokerage, brings new proof by allowing account funding via USDC. This stablecoin, pegged to the dollar, thus becomes a bridge between two worlds long opposed. Behind this decision is a clear desire to accelerate the modernization of global financial flows, bypassing the limits of traditional banking systems.

Former New York City Mayor Eric Adams unveiled a new memecoin project on Monday, drawing swift attention from both local media and crypto analysts. The token, called NYC Token, was introduced during a press conference in Times Square shortly after Adams officially left office on Jan. 1. Within hours, on-chain data began raising concerns about the project’s liquidity structure and risk profile.

Hyperliquid progresses as a crypto desk that doesn't want to waste time with slogans. No big speeches "DeFi for all." Instead, two very concrete levers in pre-alpha: portfolio margin and BLP Earn vaults. Translation: more flexible risk management, and a yield and borrowing component directly connected to Hypercore. The kind of addition that makes no noise, until the day traders understand what it changes.

Stablecoins continue to gain a stronger foothold across global crypto markets. This growth now appears not only in supply figures but also in transaction activity across blockchains. In Europe, momentum is building around euro-linked tokens, while USDC continues to expand across multiple networks. Recent data points to a shift toward transaction-driven expansion rather than passive issuance.

The Christmas season often raises the same question each year: what gift will have lasting value? For people involved in crypto, interests extend far beyond standard tech gadgets. Crypto users form a global community focused on digital ownership, financial independence, and long-term participation in blockchain networks. And as such, selecting a crypto-related gift shows awareness of these priorities. This article presents practical, beginner-friendly crypto gift ideas suited to different interests while remaining useful long after the holidays.

JPMorgan, one of the largest American banks, has just completed a historic transaction: a 50 million dollar commercial paper fully managed on the Solana blockchain. Galaxy Digital, Coinbase, and Franklin Templeton participated in this pioneering operation settled in USDC.

Circle, the issuer of the famous USDC, takes a decisive step by developing USDCx, a stablecoin designed to offer banking privacy to companies and institutions. Developed in partnership with Aleo, this project answers a growing demand: how to benefit from blockchain without exposing transactions to the public?

Solana’s lending sector is dealing with one of its most visible internal disputes of the year, raising concerns about how public conflicts may affect trust in the ecosystem. A tense exchange between Kamino Finance and Jupiter Lend has now pulled in Solana Foundation president Lily Liu, who urged both projects to direct their energy toward growing Solana’s overall lending market.

While many eyes remain fixed on Bitcoin and Ether, Solana is currently playing a much subtler game. The SOL crypto still holds above the 120 dollar area, but this level is not just a technical support: it is supported by a real shift in liquidity and on-chain supply. However, trader-side demand remains surprisingly timid. And as long as this gap persists, Solana's structural advantage is not fully reflected in the price.

Momentum around Coinbase is rising as the company enters a new phase of financial stability and public-sector experimentation. Latest data show revenue increasing while costs remain controlled. And as expected, this combination has created a sturdier foundation than in earlier market cycles.

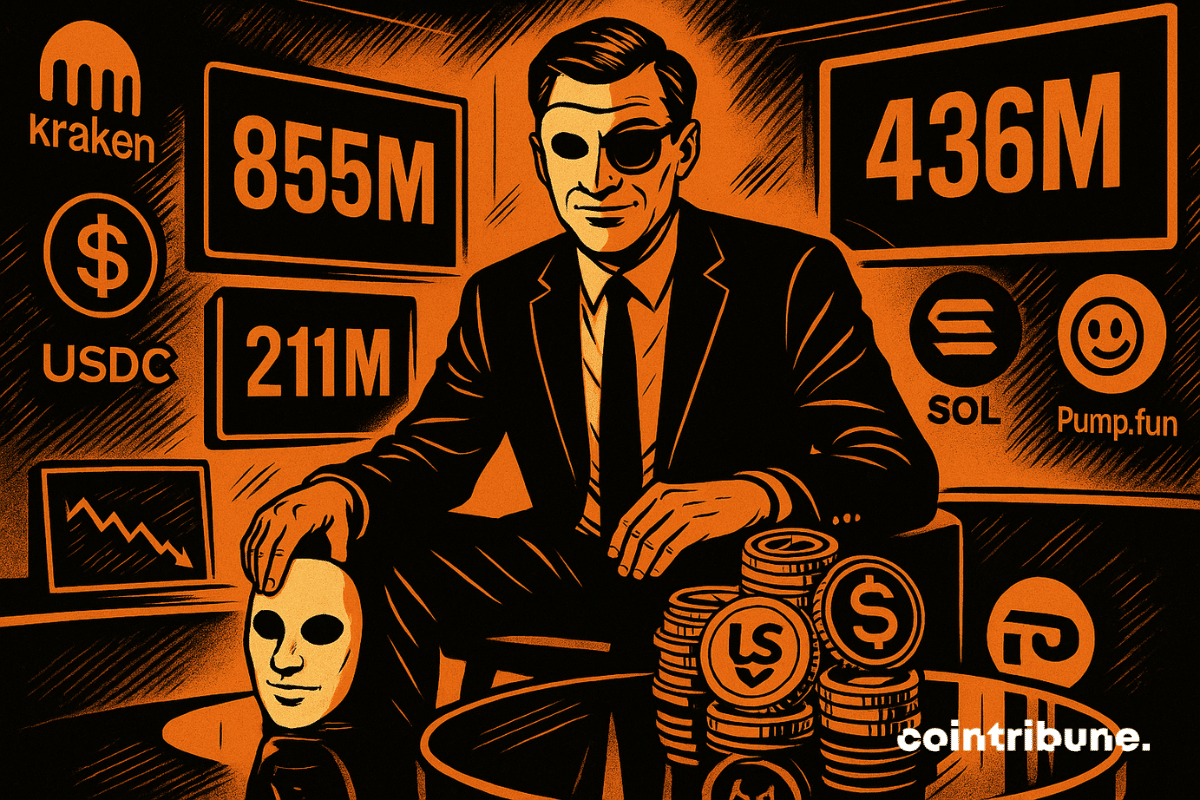

An explosive case shakes the crypto world: Pump.fun accused of siphoning $436M. The founder denies, but doubts remain.

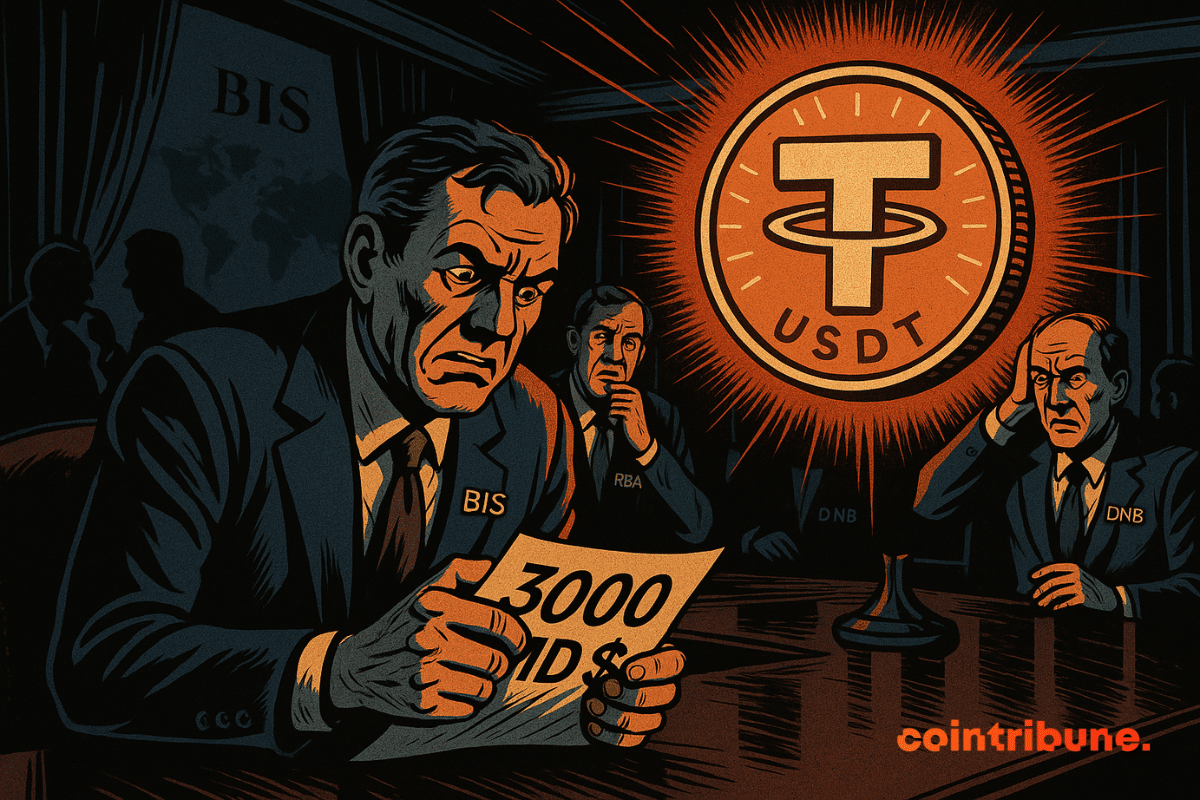

When tokens want to play treasury bonds, the BIS panics. Crypto-confidence or crypto-catastrophe? Finance views stablecoins as a Pandora's box ready to open.

Cash App is preparing one of its biggest updates yet as parent company Block sets a timeline to add stablecoin operations to the platform. New tools for both Bitcoin and digital dollar payments are being prepared for rollout, with early 2026 cited as the target window. Essentially, Block is pushing to expand access to digital payments while keeping Bitcoin at the center of its ecosystem.

Polymarket is regaining momentum after a long cooldown period as trading activity climbs again. User participation is also on the rise, with renewed interest from both crypto-native and mainstream audiences. Recent data shows the platform nearing the trading volumes last seen during the peak activity surrounding the 2024 U.S. elections.

The boundary between crypto and politics is becoming clearer. By now allowing the legal purchase of firearms with USDC, Circle brings the issue of financial neutrality to the forefront. This decision, praised by some and contested by others, reveals tensions between the promise of decentralization and institutional realities, while reigniting the debate on what crypto can or cannot allow within a legal framework.

Ripple’s US dollar–pegged stablecoin, RLUSD, has rapidly climbed the ranks to become one of the top ten stablecoins by market capitalization. Less than a year after its December 2024 launch, RLUSD has surpassed the $1 billion mark—a milestone that reflects growing confidence in Ripple’s expanding digital asset ecosystem.

The cryptocurrency ecosystem has just experienced a major turning point with the announcement of a strategic partnership between Kraken, one of the most respected exchange platforms in the world, and Circle, the undisputed leader in stablecoins. This alliance, formalized in September 2024, promises to transform the user experience for the USDC (USD Coin) and EURC (Euro Coin) stablecoins on the Kraken ecosystem.

Coinbase, the well-groomed crypto exchange, is cooking up a Base token. JPMorgan sees billions there. Should we worry when banks applaud tokens they do not control?

Wall Street trembles, BlackRock applauds, and the dollar digitalizes without asking the Treasury's opinion… Stablecoins are taking hold, while crypto weaves its planetary monetary web.

The third quarter of 2025 marked a major milestone for the stablecoin market, reflecting growing global adoption and institutional use. Fueled by record DeFi activity and greater regulatory clarity, stablecoins reached historic highs in both supply and transaction volume, solidifying their role as a core pillar of the digital asset economy.

When Christine Lagarde brings down the regulatory hammer, even the crypto giants tremble. The digital euro advances masked but clearly targets stablecoins too comfortable in Europe...

Recent chatters within crypto chat rooms indicate that prediction platforms Polymarket and Kalshi are exploring ways to raise capital, with Polymarket aiming for a higher valuation than Kalshi. Interestingly, this comes as decentralized betting begins to catch the eyes of top firms within the crypto space.

In the crypto arena, Binance sits like a central banker: 67% of stablecoins under lock. Historic record, guaranteed concern, and dry powder ready to explode.

While some still dream of Bitcoin at $200,000, Mastercard slips the USDC under the rug and pays the bill in stablecoin... Quietly, but surely.

The announcement of the launch of mUSD, Metamask's native stablecoin, marks a strategic milestone for the crypto ecosystem. Indeed, by partnering with Bridge, a Stripe subsidiary, and the decentralized infrastructure M0, Metamask is not just adding a feature: it is reshaping the contours of decentralized finance as we know it.