Target 250 dollars for Solana? The market hesitates

Solana jumped 18%, briefly crossing 205 dollars, and investors speculate about a possible target of 250 dollars. Between encouraging on-chain signals and declining DEX volumes, the crypto market hesitates about the strength of this rally and its chances to last.

In brief

- Solana jumped 18%, reaching $205, thanks to a strong increase in crypto transactions and network fees.

- Declining DEX volumes and a cautious derivatives market slow Solana’s momentum towards $250.

- Without a major catalyst, a quick rally to $250 remains uncertain for Solana.

Solana on the rise: a surge that fuels hope for a rally to $250

Solana recently recorded one of its strongest increases in several months, reaching 205 dollars before slightly retreating below the psychological threshold of 200 dollars. This rise far exceeds the overall performance of the crypto market. This places SOL’s market cap at 107 billion dollars! Closing in on that of BNB at 117 billion.

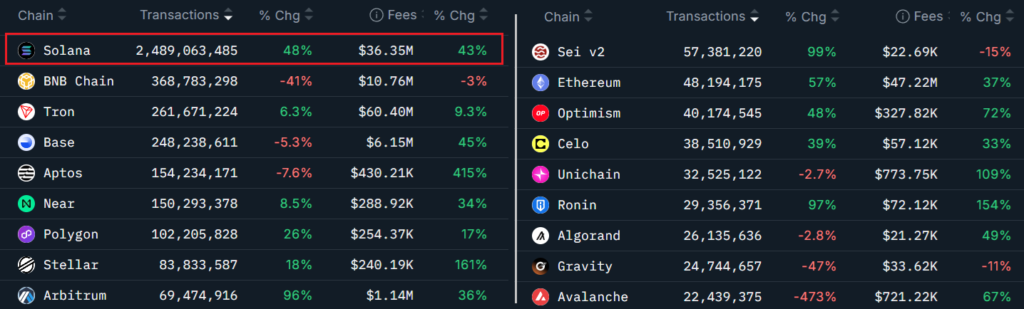

Network fundamentals reinforce this momentum. Indeed, over the last 30 days, the number of SOL transactions jumped 48%. Moreover, collected fees increased by 43%. These figures reflect increased use of the Solana ecosystem and a tangible economic impact for crypto holders. In comparison, BNB Chain saw its transactional activity decline by 41% over the same period, illustrating a clear contrast.

Obstacles and warning signals: what slows Solana’s race to $250

Despite these positive signals, several crypto indicators temper the enthusiasm. On one side, weekly volumes on Solana’s decentralized exchanges. These decline for the third consecutive week, standing at 20.6 billion dollars. A level below the 116.2 billion observed on Ethereum. This without counting an additional 91.7 billion generated by its layer 2 solutions.

On the other side, derivatives markets where the annualized funding rate of SOL perpetual futures contracts is at 12%! That is, the boundary between a neutral and bullish sentiment. This data indicates no excessive leverage, a sign that traders remain cautious and await a clear trigger before engaging further.

Solana at $250: credible scenario or simple crypto market illusion?

The last time SOL crossed 200 dollars, on July 22, this level was maintained for less than 24 hours. This historical fragility weighs on the credibility of a rapid crypto rally to 250 dollars. The absence of an immediate catalyst, such as SEC approval of a spot Solana ETF, currently limits institutional investors’ appetite.

Current data show a growing ecosystem and a crypto market that is not overheated by leverage! Two factors that argue for sustainable ascent. However, weak DEX volumes and persistent caution among market players suggest that breaking through 250 dollars in the coming days for Solana would require a significant influx of purchases, especially from institutional investors.

Solana thus retains a solid foundation to continue its progress. But reaching 250 dollars will require a resurgence of purchases and a major catalyst. Without real momentum or favorable macroeconomic signal, the SOL rally could falter before reaching this ambitious target closely watched by crypto investors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.