UK Tax Authority Targets 65,000 Suspected Crypto Tax Evaders

The British tax authority, HMRC, has just sent 65,000 letters to crypto investors suspected of tax evasion. A record, marking an unprecedented intensification in the fight against fraud in a booming sector.

In brief

- HMRC has sent 65,000 warning letters to crypto investors to combat tax evasion.

- Individuals, traders, and holders of undeclared crypto wallets risk fines, penalties or prosecution.

- Traceability tools reduce anonymity, marking a turning point in crypto regulation.

HMRC steps up the pace: 65,000 letters to hunt down crypto tax evasion

The United Kingdom strikes hard. In 2025, the tax authority, HMRC, has sent nearly 65,000 warning letters to crypto holders to make them pay their taxes. This offensive comes in a context where 7 million Britons now own digital assets, a constantly growing market.

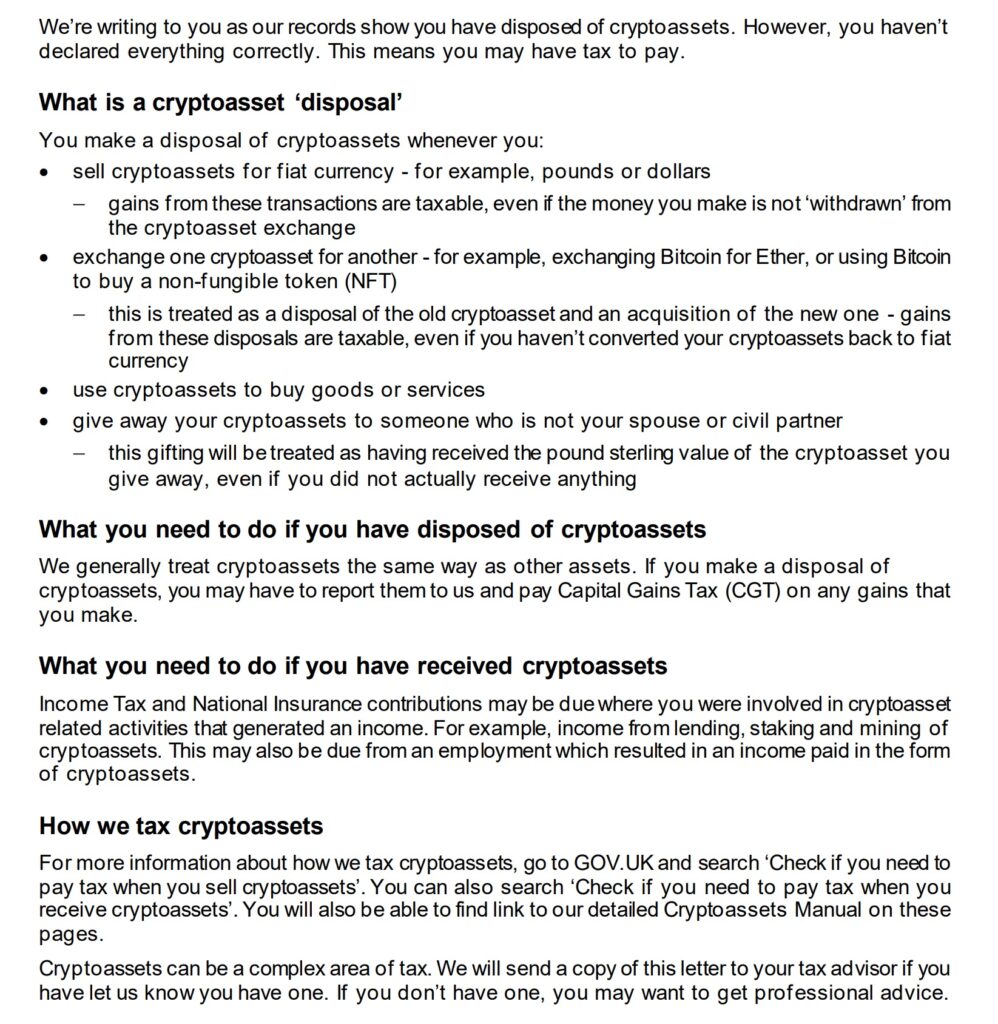

The objective is clear: encourage crypto investors to regularize their tax situation, even without formal proof of wrongdoing. These “nudge letters” remind taxpayers of their legal obligations, while warning them of the consequences of non-declaration. A strategy inspired by methods used in the United States or South Korea, where tax authorities are multiplying controls.

For HMRC, it is a matter of closing a tax revenue gap estimated at several hundred million pounds. With the explosion in crypto prices, undeclared capital gains represent a major issue for public finances.

Towards the end of anonymity in the crypto ecosystem?

HMRC no longer merely sends letters. To track fraudsters, the British tax authority uses increasingly sophisticated tools. Among them, collaboration with crypto exchange platforms, which must now transmit their user data:

- Names;

- Transaction histories;

- Wallet balances.

Technology also plays a key role. Thanks to blockchain analysis software, HMRC can trace crypto flows and identify suspicious wallets. A method that significantly reduces the anonymity once associated with digital assets.

Bitcoin vs regulation: the erosion of the anonymity principle in the face of tax controls

The massive sending of letters by HMRC reminds us of a reality: bitcoin, created in 2009 as a decentralized and pseudonymous transaction tool, is increasingly tracked by states today. Initially, Satoshi Nakamoto envisioned a currency freed from banking intermediaries and government controls. Yet, with the rise of blockchain analysis tools and collaboration with crypto exchange platforms, the original anonymity is fading.

The 65,000 letters sent to tax fraudsters by HMRC illustrate this trend: even BTC transactions, once seen as opaque, are now scrutinized. Regulators exploit the traces left on the blockchain to identify holders and demand tax declarations. An irony for a technology born from the desire to bypass the traditional system.

The sending of 65,000 letters by HMRC marks a turning point in crypto regulation. Between tax transparency and investor protection… doubt arises. Should controls be strengthened to fight fraud, or risk stifling innovation? And you, would you be ready to declare your gains, even small ones? In any case, if you use bitcoin, here is the solution to not paying taxes.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.