The States' Bold Bet on Strategy Could Send Bitcoin to $500,000

Bitcoin reaches a decisive milestone: States intensify their exposure via Strategy, bypassing regulatory barriers. This growing institutional adoption fuels the projection of a bitcoin at $500,000 by 2029, announcing a major revolution for financial markets and BTC’s role in the global economy.

In Brief

- States increase their indirect exposure to bitcoin via Strategy.

- Standard Chartered confirms this adoption supports bitcoin climbing to $500,000 by 2029.

- Bitcoin positions itself as a macroeconomic hedge asset, strengthening its place in global sovereign portfolios.

A Catalyst for Bitcoin at $500,000

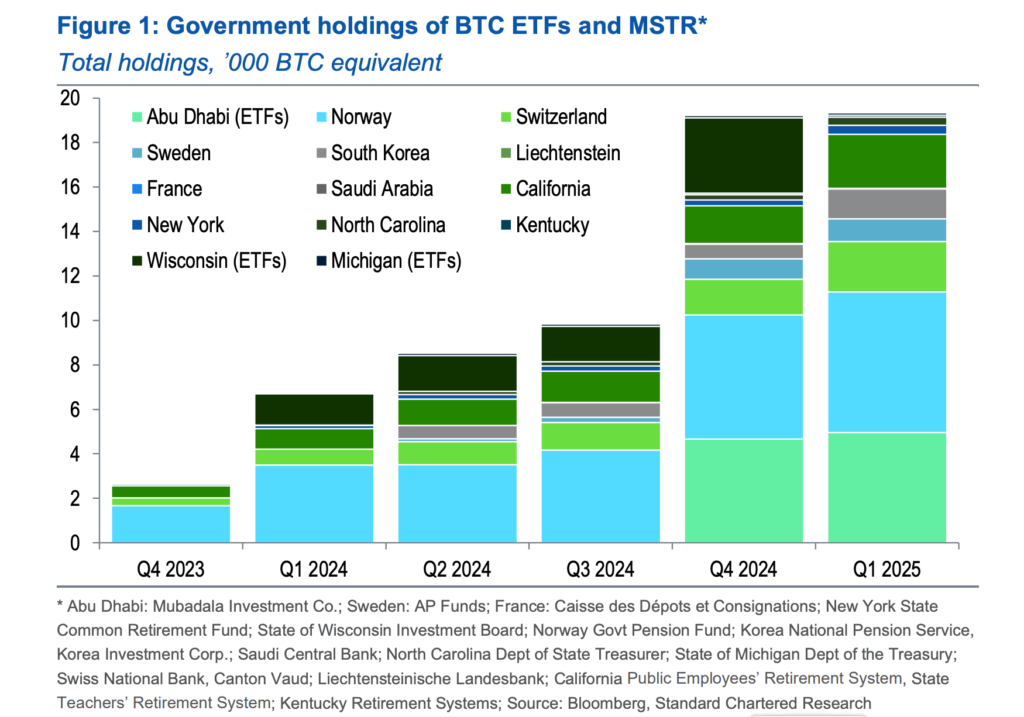

The growth in MicroStrategy (MSTR) stock purchases by sovereign states confirms a strong trend of indirect Bitcoin (BTC) adoption. This dynamic strengthens demand, reduces volatility, and significantly broadens the institutional investor base.

According to Standard Chartered, this development is a powerful bullish driver, supporting an ambitious projection: bitcoin could reach $500,000 by 2029. For the bank, this paradigm shift transforms bitcoin, now seen not just as a speculative asset but as a central strategic pillar of global investment portfolios.

The Quiet but Powerful Rise of States in Bitcoin via MSTR

In Q1 2025, MicroStrategy (MSTR) stock purchases by sovereign entities saw a notable increase. This trend reflects growing interest in indirect bitcoin exposure, previously less visible among some institutional actors. Among new positions and increases are:

- France and Saudi Arabia, entering this segment for the first time;

- Norway, Switzerland, and South Korea, who are strengthening their stakes;

- Several key U.S. state pension funds are also involved.

This dynamic marks a turning point in the global institutional strategy towards bitcoin.

Why States Choose Strategy: Indirect Access to BTC

Strict regulations often prohibit sovereign institutions from buying bitcoins directly. Strategy therefore appears as an effective alternative, offering exposure to BTC through publicly traded shares. This indirect vehicle bypasses regulatory obstacles while ensuring sufficient liquidity.

This strategy allows states to integrate BTC into their portfolios, reinforcing market confidence in this asset. Growing interest in MSTR shares reflects increased sophistication of institutional investors, ready to use every lever to capture bitcoin’s potential. For example, Norway, Switzerland, and South Korea each added the equivalent of 700 BTC via MSTR in Q1 2025.

Macroeconomic Perspectives and Implications

Bitcoin is now establishing itself as a hedge asset against global economic uncertainties. This new role is attracting more and more institutional actors seeking to diversify risks beyond traditional assets. Signs of market maturity are numerous, including:

- The rapid rise of stablecoins;

- The growing recognition of bitcoin in sovereign portfolios;

- The integration of BTC into global macroeconomic strategies.

This dynamic is expected to intensify, creating a snowball effect where the continuous influx of investors will further strengthen bitcoin’s central role in institutional portfolios.

The growing commitment of states via MicroStrategy is redefining the future of Bitcoin, which is soaring toward $110,000 this week. This evolution marks an unprecedented maturity but also raises questions: how far can this indirect adoption transform the global financial landscape, and what risks will emerge?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.