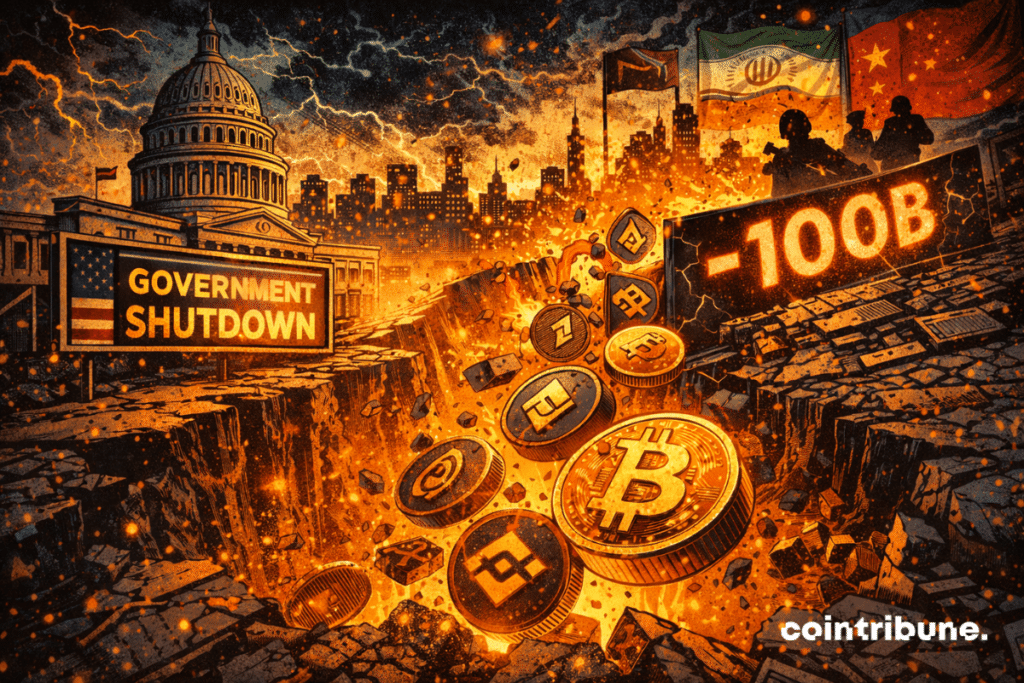

The crypto market loses 100 billion amidst political tensions

Not long ago, the crypto market was still touching dizzying heights, flirting with 4 trillion dollars. Today, that euphoria has evaporated like the fog on a winter morning. In just a few hours, political fear coming from Washington has swept away investors’ certainties. Between shutdown threats, incendiary speeches, and international tensions, the crypto-sphere rediscovers that no asset is safe from the shocks of an increasingly unstable world.

In brief

- Nearly 100 billion evaporate from the crypto market in seven hours, creating global panic.

- Bitcoin drops 3.4% and ether loses over 5% Sunday evening.

- Analysts attribute the decline to American political tensions and federal shutdown risk.

- Gold climbs to historic records while Bitcoin ETFs see massive withdrawals.

Washington bogs down, the crypto market plunges

The weekend turned into a nightmare for crypto traders despite the unexpected rise of the memecoin PENGUIN. In barely seven hours, nearly 100 billion dollars vanished from the global market. The cause: the threat of a partial shutdown of the American government, triggered by a political deadlock between Republicans and Democrats. The latter refuse to vote on the Department of Homeland Security budget, accused of abuses after a tragedy in Minneapolis.

Chuck Schumer, Democratic leader in the Senate, stated:

The Senate Democrats will not provide the necessary votes to advance the appropriations bill if DHS funding is included.

Result: markets panic, bitcoin drops 3.4%, ether falls 5%, and more than 360 million dollars of leveraged positions are liquidated. On the Polymarket and Kalshi prediction platforms, the probability of a shutdown now reaches 80%, reflecting a climate of panic.

Between Trump and Tehran, geopolitics suffocates the crypto-sphere

For analysts, this correction is not just a simple technical adjustment. It fits into an atmosphere of extreme geopolitical tension, where even the slightest statement from Donald Trump can shake bitcoin. The president threatened to impose 100% tariffs on Canada if it reached a trade agreement with China. At the same time, the deployment of American ships in the Middle East has revived fears of a conflict with Iran.

Rick Maeda, from Presto Research, analyzes:

The crypto market movement at the start of the week was driven by broad macroeconomic risk aversion rather than news specific to the crypto sector.

In other words, crypto now follows the moods of the real world. When the White House heats up, bitcoin retreats. During the previous shutdown in 2025, BTC had already plunged from 126,000 to 100,000 dollars. This scenario of political panic seems to be repeating, revealing crypto market’s dependence on American institutional shocks.

Gold shines, bitcoin pales: the promise of refuge crumbles

In the hours when crypto was collapsing, gold and silver were reaching new historic records. This contrast illustrates an unsettling truth: despite its aura as the “new digital gold,” bitcoin remains a risky asset, subject to market nervousness.

Vincent Liu, analyst at Kronos Research, observes that markets remain on edge: the probability of a shutdown now approaches 75%, a direct consequence of persistent political deadlock.

American Bitcoin ETFs recorded more than 1 billion dollars in net withdrawals in one week, their worst performance since 2025. Only a few bold players, like ARK Invest, continue to accumulate Coinbase or Bullish shares, betting on the sector’s long-term resilience. But for now, crypto is going through an acute crisis of confidence, dominated by fear, politics, and global uncertainty.

Figures that summarize the storm

- 100 billion $ erased from the global crypto capitalization in less than 7 hours;

- 87,689 $: bitcoin (BTC) price at the time of writing;

- 5.3% drop for ether in 24 hours;

- 80% probability of a US shutdown according to Polymarket;

- 1.33 billion $ withdrawals on US Bitcoin ETFs the week of January 23.

As confidence falters, some signs of recovery emerge. Several industry players are betting on the return of tokenized stocks, an innovation that could reconnect traditional finance to the blockchain. If political winds calm, this avenue could offer crypto a new, more concrete and lasting breath.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.