The strong comeback of memecoins: PEPE, Dogecoin and Shiba Inu leading the gains

In January 2026, memecoins like PEPE, Dogecoin and Shiba Inu establish themselves as the unexpected stars of the crypto market. Their striking rise, driven by an active community and technical catalysts, reflects a return of risk appetite. Why are these assets, often criticized for their volatility, becoming key indicators of traders’ confidence?

In Brief

- PEPE, Dogecoin and Shiba Inu recorded spectacular increases at the beginning of 2026, with gains up to 70% for PEPE and 20% for Dogecoin.

- Whales massively accumulated tokens, while short position liquidations amplified price increases.

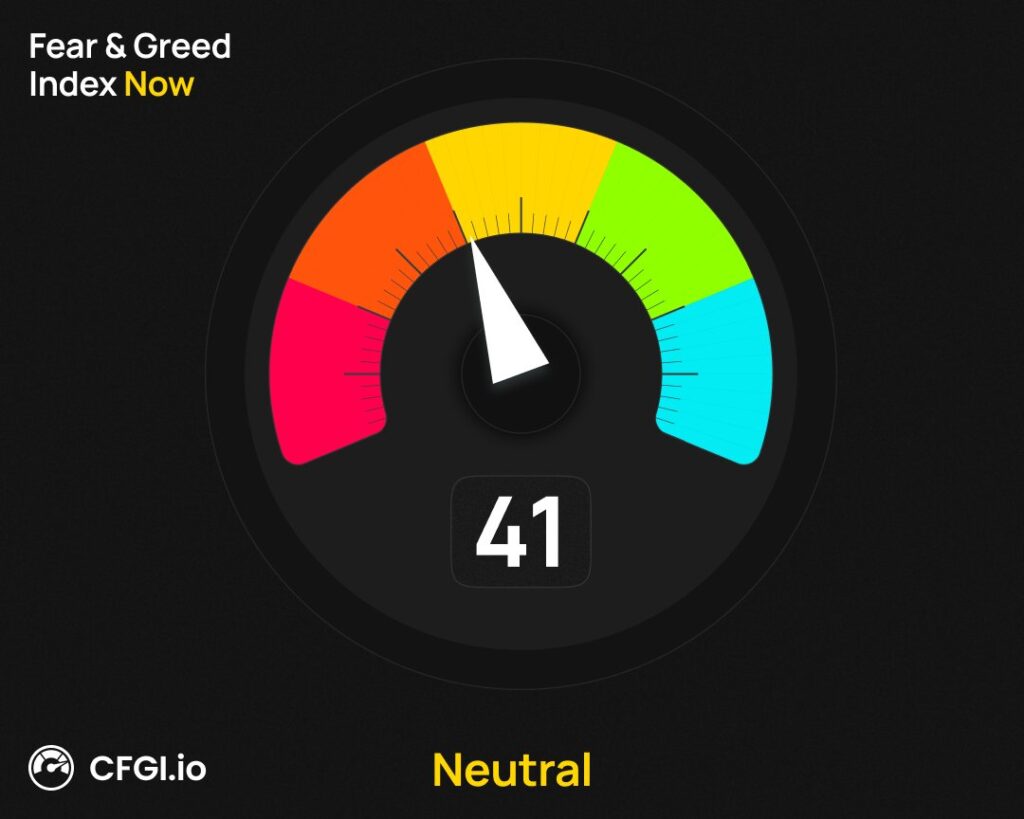

- This rally coincides with improved market sentiment, although the Fear & Greed index remains in a neutral zone.

Memecoins: a rally driven by social and technical catalysts

At the beginning of 2026, memecoins experience a surge thanks to a combination of social and technical factors. Social networks, notably Reddit, Telegram and X, play a central role in their virality. Moreover, crypto influencers and trader communities amplify price movements, creating a crowd effect difficult to ignore. For example, Dogecoin benefited from massive whale accumulations, while PEPE saw its capitalization jump 70% in a few days, thanks to cascading liquidations of short positions.

On the technical front, these memecoins have broken through historic resistance levels, attracting new buyers. Shiba Inu, for instance, broke a downtrend that lasted since 2024, confirming a shift in momentum. Finally, leverage and short squeezes amplified the rise, making these assets even more attractive to those seeking quick gains. However, this volatility remains a double-edged sword, capable of generating both significant profits and losses.

Memecoins, the barometer of crypto market sentiment?

Memecoins act as a true barometer of market sentiment. Indeed, their performance often reflects the overall risk appetite in the crypto ecosystem. In 2026, their rally coincides with a noticeable improvement in indicators like the Fear & Greed index, which has moved into the “neutral” zone. A transition into the “greed” zone would trigger broader growth phases for altcoins, a similar event to those of 2021 and 2024.

Recent data show an over 20% growth of the memecoin market in two weeks, with trading volumes doubled or tripled for assets like PEPE and Shiba Inu. These figures confirm that traders are seeking high volatility opportunities. However, this momentum remains fragile as dependence on social trends makes these assets particularly vulnerable to sudden reversals.

Opportunities and risks: how to navigate the crypto market in 2026?

For crypto traders, memecoins offer opportunities for quick profits but require a disciplined approach. Scalping or swing trading strategies are often favored to benefit from their volatility, with tight stop-losses to limit risks. Leveraged positions, although tempting, should be avoided due to the high risk of liquidation.

For long-term investors, memecoins are not classic “hold” assets. However, some projects are beginning to develop real utility, such as PEPE’s integration into NFT games or Dogecoin’s partnerships with payment platforms. These developments could eventually grant them increased legitimacy. But risks remain numerous:

- Increased regulation;

- Market manipulation;

- Sharp corrections in case of renewed risk aversion.

In 2026, PEPE, Dogecoin and Shiba Inu are no longer simply speculative assets. They symbolize a return of confidence and a quest for high returns, while remaining risky bets. Their performance offers valuable clues about traders’ mindset, but their volatility demands caution and preparation. And you, would you be ready to include these memecoins in your portfolio?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.