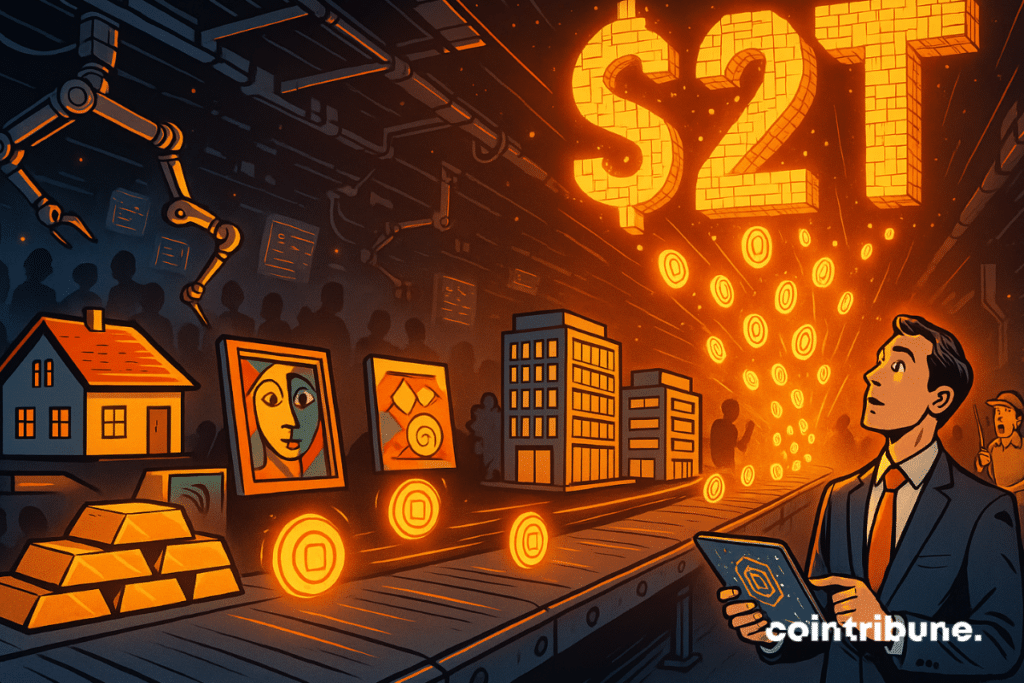

Tokenized Real-World Assets Projected to Hit $2 Trillion by 2028

The market for tokenized real-world assets (RWAs) is on the cusp of a boom. These assets, currently valued at about $35 billion excluding stablecoins, could reach $2 trillion by 2028, according to Standard Chartered. This represents an increase of more than 5,600%, reflecting the strong growth potential of on-chain financial activity.

In brief

- Standard Chartered projects the tokenized real-world asset market could grow from its current size of 35 billion dollars to 2 trillion dollars by 2028.

- Tokenized money market funds and listed equities are expected to account for the largest portions of the market at 750 billion dollars each.

- Ethereum is expected to host most tokenization activity due to its reliable infrastructure and long-standing network stability.

Stablecoins as the Foundation for Tokenized Assets

Geoffrey Kendrick, Standard Chartered’s Head of Digital Assets Research, said in a Thursday report that stablecoins have established the foundation for other asset classes to move on-chain. He explained that by improving visibility, providing greater access to funds, and enabling lending and borrowing on-chain, stablecoins have allowed tokenized money market funds (MMFs) and tokenized equities to expand their presence in the digital ecosystem.

Kendrick outlined how the projected $2 trillion tokenized RWA market could be divided among different segments:

- Tokenized money market funds, supported by corporate adoption of stablecoins, are expected to represent $750 billion.

- Tokenized listed equities could contribute another $750 billion, contingent on regulatory clarity in the United States and further growth of DeFi solutions.

- Tokenized funds are projected to add $250 billion to the market.

- Less liquid assets, including stakes in private companies, commodities, corporate bonds, and property holdings, are anticipated to make up the remaining $250 billion.

Ethereum’s Reliability and Stablecoins Fueling DeFi Growth

According to Kendrick, the majority of tokenization activity will likely occur on the Ethereum network due to its reliability. Ethereum has operated for more than ten years without a mainnet outage, making stability a more critical factor than speed or transaction costs offered by alternative blockchains. This dependable infrastructure has been crucial for the growing role of stablecoins and decentralized finance.

Building on this foundation, stablecoins are already influencing traditional finance. They have started to disrupt payment systems and savings mechanisms while supporting the growth of decentralized finance. Initially, DeFi mainly allowed crypto-native users to engage in digital asset transactions, provide financing, and access credit on-chain. The rise in stablecoin liquidity has expanded these activities to a broader range of assets, creating the conditions for more extensive DeFi adoption.

Kendrick identifies lending and real-world assets as the primary areas where decentralized finance could challenge traditional finance. He explained that if tokenized RWAs become tradable on decentralized exchanges, they could serve as an alternative to conventional stock exchanges.

Regulatory Developments and Their Impact on Tokenized Assets

Despite the optimistic growth outlook, Kendrick warned that the main risk would be a lack of regulatory clarity in the U.S., which could occur if reforms are not enacted before the November 2026 midterm elections, although he emphasized this is not their expected scenario.

Recent policy measures, however, have provided a stronger foundation. The GENIUS Act, passed in July, established a defined legal framework for stablecoins, supporting adoption among both retail and institutional users.

Additionally, the Digital Asset Market Clarity Act, anticipated to advance toward completion sometime between the end of 2025 and the beginning of 2026, is projected to further support tokenization, DeFi lending, and on-chain trading. With this framework in place, borrowing, lending, and trading of these digital assets are likely to become more secure and reliable, creating a stronger foundation for market growth.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.