Trump Family’s Net Worth Surges $1.3B Amid ABTC Debut and WLFI Rally

The Trump family is back in the spotlight after their wealth coffers skyrocketed following American Bitcoin’s (ABTC) debut and World Liberty Financial’s (WLFI) price surge. However, both DeFi projects linked to the family have since faced a market correction of over double digits.

In brief

- Trump’s family wealth spiked by $1.3B as ABTC debuts and WLFI rallies before double-digit market corrections hit.

- ABTC surges to $14 before crashing below $7, while WLFI tanks 40% post-launch despite early trading momentum.

- Eric Trump calls ABTC “the greatest Bitcoin company” as shares swing wildly after the Gryphon merger debut.

- The family’s combined net worth is $7.7B, excluding $4B in locked WLFI, reinforcing its influence in crypto markets.

Trump Family Rides Crypto Wave as ABTC Debut and WLFI Rally Boost Wealth

The family of President Donald Trump recently saw their collective wealth quickly grow by $1.3 billion, immediately catching the attention of crypto fans worldwide. According to reports from Bloomberg, World Liberty Financial’s recent price gains saw the pro-crypto family net a whopping $670 million. Meanwhile, Eric Trump’s stake in ABTC, a project he co-founded, was pegged at over $500 million following its mainstream entry on Wednesday.

Upon its debut, shares of ABTC touched a high of $14, followed by a steep drop to $6.24 after losing over half of its value. The fresh net worth estimates did not include the family’s $4 billion worth of WLFI holdings, currently under lockup.

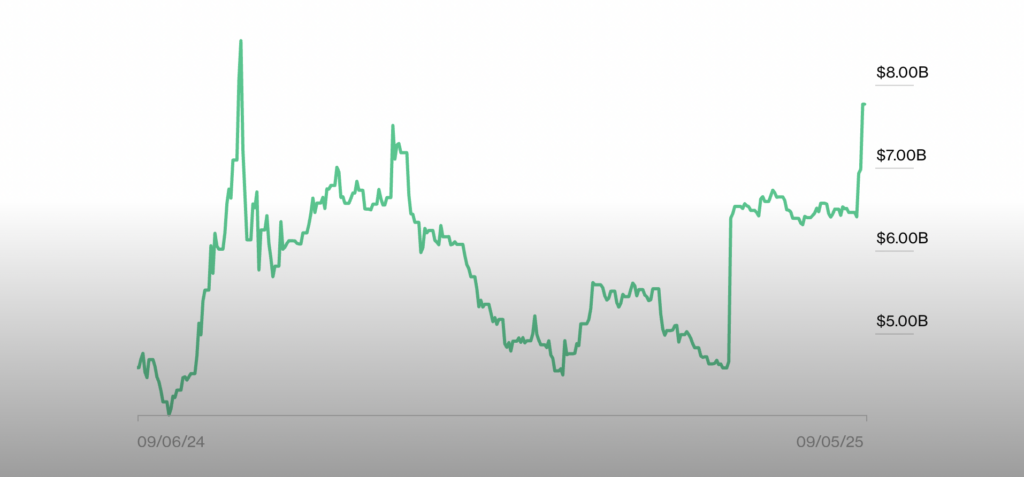

At current market rates, the family’s combined net worth exceeds $7.7 billion, even without factoring in the locked tokens. Since Trump assumed office, his family has been active in the crypto space.

The president’s crypto-focused stance has driven political interest in the sector. After facing years of stringent oversight, many within the crypto circles believe that the Trump family’s crypto involvement has helped legitimize the industry within the U.S. Still, some of the recent crypto-focused regulatory moves by the president have received backlash from Democratic lawmakers.

Major Market Moves: WLFI’s Volatile Launch and ABTC’s Return Through Gryphon Merger

World Liberty Financial made its mainstream entry on major crypto platforms on Monday, with 24.6 billion WLFI tokens unlocked for the exchange debut. Following the launch, the asset recorded a sharp spike before tanking by over 40%.

Meanwhile, ABTC reentered the market on Wednesday following a merger with NASDAQ-listed crypto mining company Gryphon Digital Mining. During the Wednesday session, American Bitcoin’s stock experienced five trading halts due to extreme price swings, causing it to close near $7.36 per share.

Commenting on the market comeback, Eric Trump described American Bitcoin as a move to create “the greatest Bitcoin company on Earth,” adding that the company would mine and hold the crypto asset.

He also remains bullish on the Bitcoin price trajectory, betting on the asset eventually touching $1 million at the recent Bitcoin 2025 Asia conference in Hong Kong. Meanwhile, Gryphon Digital Mining owns about 6,000 mining computers imported from China, a trading partner facing import tariffs under the Trump administration.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.