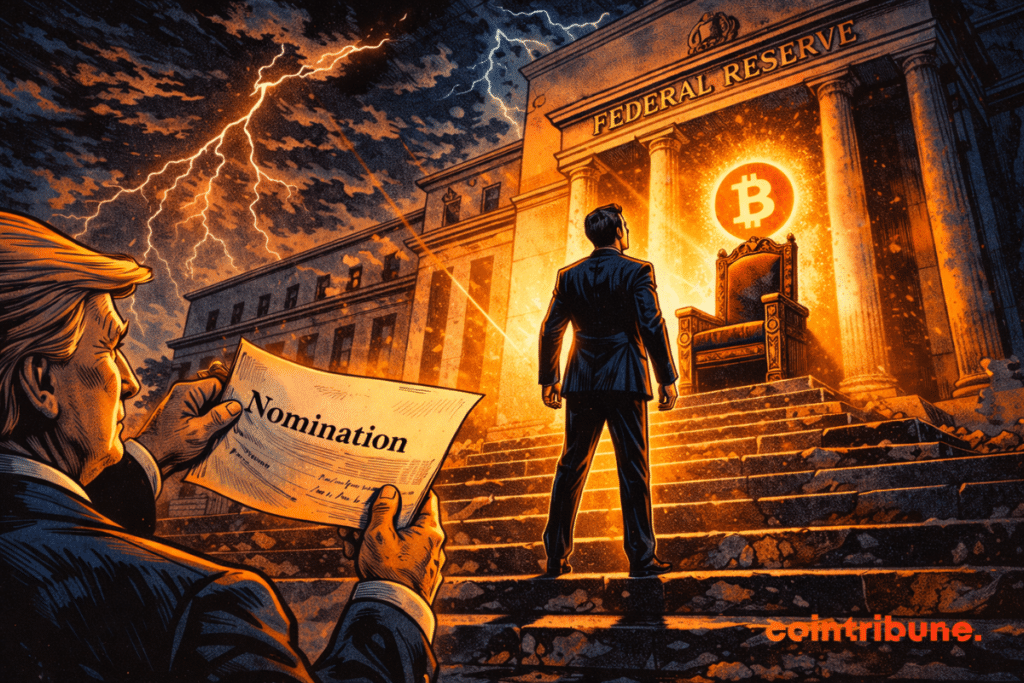

Trump is preparing to appoint Kevin Warsh as head of the Fed

The debate “Can Trump eject Jerome Powell from his golden seat?” is no longer relevant. The current president of the United States, a virtuoso of political provocation, is preparing to take action. Friday morning, he will announce the name of the person who will head the Fed. The leading candidate? Kevin Warsh, a respected former governor with a profile both orthodox and unexpected. The man who could well give a new face to the American central bank.

In brief

- Trump wants to replace Powell with Kevin Warsh, former Fed governor.

- Warsh defends fiscal discipline but is interested in bitcoin as a regulatory tool.

- Markets anticipate a more political and less independent Fed under Trump.

- Powell could remain governor until 2028, limiting the president’s total influence.

Kevin Warsh, the banker between monetary tradition and crypto curiosity

Rumors were confirmed after Kevin Hassett’s withdrawal: Donald Trump met Kevin Warsh on Thursday at the White House, and the exchange apparently impressed the president. The former Fed governor (2006–2011) now appears as the almost designated successor to Jerome Powell.

On the prediction markets Polymarket and Kalshi, his nomination probability jumped from 30% to over 90%.

Warsh has distinguished himself by a rare position: conservative on rates, but open to financial modernity. In July, in an interview with the Hoover Institution, he stated:

Bitcoin doesn’t bother me. I consider it an important asset that can help policymakers know when they are doing things right or wrong. I think it can often be a very good policeman for policy.

By speaking this way, Warsh fits into a singular line of thought: he views bitcoin (BTC) as a tool for moral evaluation of fiscal policies, not as a threat to the national currency. A vision that intrigues markets and appeals to part of the investors.

Trump against Powell: the Fed, a new arena of political battle

The quarrel between Trump and Jerome Powell is not new. For months, the US president has been attacking the Fed, accused of hindering growth by excessive caution. On Thursday again, he wrote on his social network:

We should have a much lower rate now that even that idiot admits inflation is no longer a problem or a threat… He is costing America hundreds of billions of dollars a year in totally useless and unjustified interest expenses.

This outburst illustrates the rift between monetary policy and the executive power. Trump demands rates at 1%, convinced that the economy must be boosted before the elections.

Powell, meanwhile, advocates for a balanced approach despite a tense environment: a Department of Justice investigation looms over the Fed related to the management of a $2.5 billion real estate project.

In this climate, Warsh appears as the compromise candidate: firm on rigor, but politically malleable.

His arrival embodies an implicit promise: that of a more flexible, more presidential Fed. And more in line with Trump’s economic vision.

Bitcoin, nervous markets and high-risk institutional shift

If Trump announces Warsh this Friday, it is because the moment is strategic. The economy is slowing, markets are hesitant, and the Fed’s credibility is wavering.

Warsh, respected on Wall Street, represents a synthesis between expertise and political loyalty. His view of bitcoin as a trust thermometer attracts younger investors.

But this nomination raises a concern: that of a central bank under direct influence of the power. Powell could indeed remain on the board of governors until 2028, preventing Trump from having the majority. An unprecedented coexistence in recent history.

Traders are watching for signals. The dollar has already strengthened, long rates have risen, and hedge funds are repositioning ahead of the official announcement.

Milestones to watch

- Warsh served on the Fed from 2006 to 2011;

- The appointment could be official Friday morning;

- Polymarket and Kalshi markets give over 93% probability;

- Powell holds a governor mandate until 2028;

- The bitcoin (BTC) price is currently trading around 82,554 dollars.

The appointment of Kevin Warsh is expected as a turning point. The already jittery markets hope for clarification. Gold continues its surge, a symbol of caution. Bitcoin remains suspended on the news. As long as it holds below 83,000 dollars, calm prevails. But several analysts fear a sharp correction, down to 70,000 dollars, if the Fed strengthens its monetary tone in the coming weeks.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.