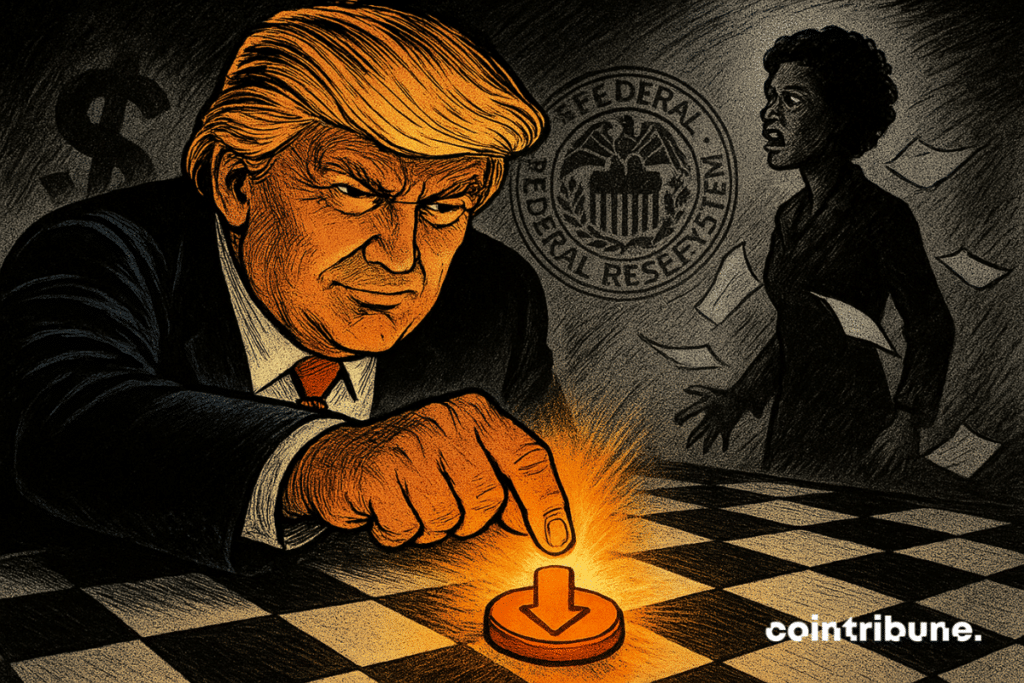

Trump Seeks to Oust Fed Governor Ahead of Rate Decision

President Donald Trump has renewed his efforts to remove Federal Reserve Governor Lisa Cook just days before the central bank is expected to deliver its first rate cut in nearly a year. The case has turned into a controversial legal battle that is now overlapping with one of the most significant policy decisions in the US economy. As the administration continues with its appeal, new evidence looms to erode its claims and heightens its political and financial stakes.

In brief

- Trump’s attempt to remove Fed Governor Cook sparks major legal and political debate.

- New evidence challenges misconduct claims, raising concerns over Fed independence.

- Markets anticipate 25-basis-point Fed cut amid uncertainty over future easing.

Legal Dispute Over Authority

President Donald Trump attempted to oust Cook in late August, citing alleged misconduct related to mortgage documents. His legal team argued that the statute granting “for cause” removal powers leaves broad discretion to the White House and shields such decisions from judicial review.

However, a district court issued an injunction earlier this month, preventing Cook’s removal pending further review. Consequently, the Justice Department filed an appeal, insisting that the president’s authority should prevail over judicial interpretation.

Nonetheless, Cook has criticized the reasoning behind her termination, arguing that her rights were infringed and that the allegations are unfounded. Notably, her case has come to be more than a personal defense. It has now become a wider confrontation of the boundaries of presidential authority and Fed autonomy, a body meant to be free of political influence.

New Evidence Weakens Case

The controversy deepened after new documents surfaced that appear to contradict the allegations against Cook. A 2021 loan summary shows her Atlanta property was listed as a second home, consistent with her disclosures.

This record weakens the administration’s claim of misrepresentation and adds weight to her defense. It also suggests that the president’s legal case may not be as strong as it first appeared.

The implications go beyond the courtroom. The case is stirring market concerns over political influence at the Fed. Investors fear that efforts to challenge the institution’s independence could unsettle global markets and erode confidence in the dollar.

Markets Brace for Rate Cut

The dispute unfolds as the Federal Reserve prepares to cut interest rates this week. CME futures markets overwhelmingly expect a 25-basis-point reduction, bringing rates to a range of 4.0% to 4.25%.

Analysts stress that while a modest cut is almost certain, the outlook for additional easing remains unclear. Additionally, attention is shifting to succession planning, with BlackRock executive Rick Rieder emerging as a leading contender for Fed chair once Jerome Powell’s term ends next May.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Peter is a skilled finance and crypto journalist who simplifies complex topics through clear writing, thorough research, and sharp industry insight, delivering reader-friendly content for today’s fast-moving digital world.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.