The International Monetary Fund has rejected Pakistan’s proposal to subsidize electricity for crypto mining operations, citing concerns over market distortions and energy infrastructure strain.

Theme Regulation

The world of crypto is often built on the fringes of institutions. However, some companies choose to swim against the tide by seeking to fully integrate into them. This is the case with Circle, the issuer of USDC, which is no longer content to be just a tech player. The American company has officially applied to become a national trust bank in the United States. This is both a bold move and indicative of a broader shift in the crypto ecosystem: integration into the federal banking system to better ensure trust.

The BIS stands up to defend the Fed. Can the economy withstand a monetary crisis? The details in this article!

On June 17, the U.S. Senate passed the GENIUS Act, short for Guiding and Establishing National Innovation for U.S. Stablecoins Act, by a 68-30 bipartisan vote. If passed by the House and signed by the President, the bill would introduce the first comprehensive federal framework for regulating stablecoins in the United States.

Kraken, often discreet but never truly withdrawn, has just taken a strategic step that could reshuffle the crypto market in Europe. By obtaining its regulatory license under the MiCA framework, the platform is stepping into the big leagues at a continental level, just behind Coinbase, but not too far behind to be considered lagging. In an environment where compliance is becoming a must-have, Kraken chooses to embrace regulation rather than circumvent it. And this choice could pay off handsomely.

The U.S. is facing a serious financial challenge. The national debt is now over $36 trillion, and rising interest rates are making it more expensive to borrow money. Much of the debt that was issued during the COVID-19 era is about to roll over, meaning it needs to be refinanced at today’s much higher rates.

The Federal Reserve just made a big change that could make it easier for crypto companies to get bank accounts. On Monday, the Fed said it would no longer use “reputational risk” as part of its official bank supervision process. That vague label was often used to warn banks away from doing business with crypto firms, and many in the industry say it led to years of unfair “debanking.”

While Trump rushes headlong to save his stablecoins, Europe is rolling out MiCA and taking the crypto prize. What if, for once, bureaucracy won the race?

The regulation of stablecoins in the United States has just reached a historic milestone. The U.S. Senate voted 68 to 30 to advance the GENIUS Act, paving the way for a plenary session debate. Does this advancement finally mark the birth of a federal regulatory framework for dollar-backed cryptocurrencies?

The United States is preparing to regulate stablecoins. A key vote on the GENIUS Act could transform the crypto industry forever.

Crypto is entering a new era in the United States. The SEC supports self-custody and defends users' freedom. Details here!

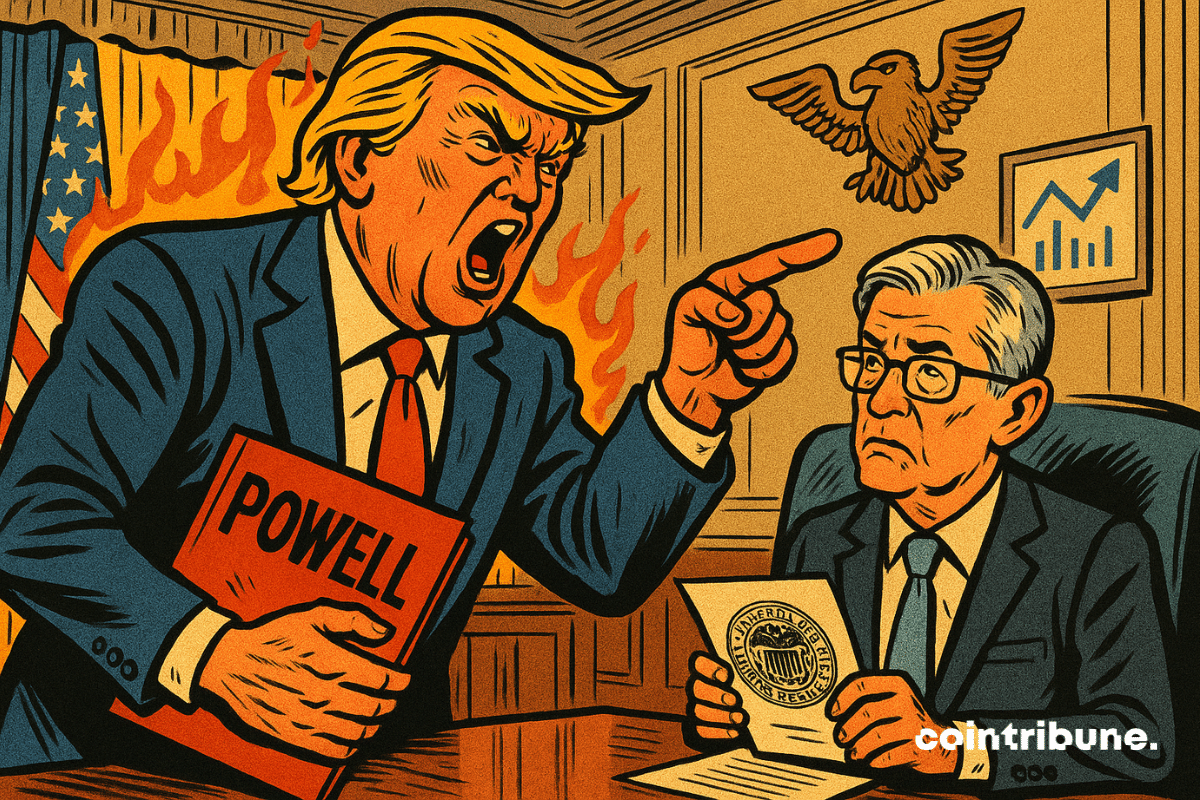

While monetary decisions now dictate the pace of global markets, the White House is preparing to shake up the institutional chessboard. Donald Trump has announced that a change at the head of the Federal Reserve could be decided "very soon." From Air Force One, he is directly rekindling his standoff with Jerome Powell, against a backdrop of ongoing disagreements over rates. By threatening the independence of the Fed, Trump is reviving an old fracture with major economic and political implications.

Panetta believes that only a central digital currency can mitigate the risks posed by foreign platforms. Details here!

The traditional banking sector is making a historic shift towards stable cryptocurrencies. Discussions between Stripe and financial institutions reveal a massive interest in this technology. But will widespread adoption depend solely on the goodwill of regulators?

The European crypto landscape has just undergone a strategic turning point: Bybit, one of the global heavyweights in exchange platforms, has secured the valuable MiCA license in Austria and has established its European headquarters in Vienna. This is a dual-impact operation, both regulatory and geopolitical, which opens the doors of a market of nearly 500 million Europeans to Bybit. A bold maneuver at a critical moment for the global crypto industry.

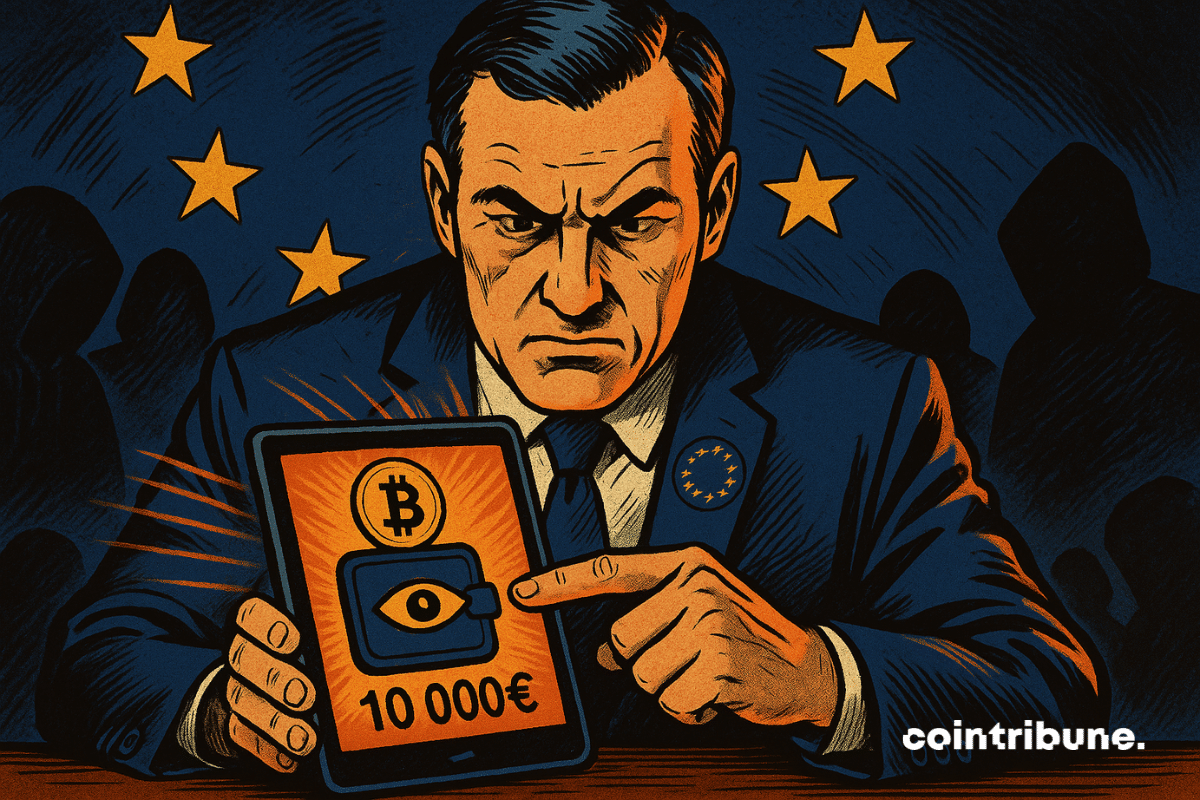

The European Union is ending anonymity in crypto transactions. Starting July 1, 2027, any transfer exceeding €1,000 will be required to reveal the precise identity of the sender and the recipient. According to Paschal Donohoe, president of the Eurogroup, these new anti-money laundering rules (AMLR) clearly place blockchain and digital assets under the direct oversight of European authorities. For crypto enthusiasts, this measure represents both a necessary revolution and a painful betrayal.

eToro will raise $500 million and targets a $4 billion valuation. We tell you everything about this IPO that is shaking up the crypto sector.

The European Data Protection Board (EDPB) has recently integrated the Bitcoin public key into the scope of the GDPR, turning every transaction into a legal issue. While not formally banning cryptocurrency, this approach creates a difficult gray area to navigate.

While Asia rushes and America funds, Europe shuffles paperwork, piles up regulations, and waits for innovation to knock at its door… with form B-27.

The global financial geography is experiencing a spectacular transformation. Far from the sanitized skyscrapers of Wall Street or the centuries-old Swiss banks, a new map is emerging: that of the cities that have embraced the blockchain revolution without complexes. Ljubljana, the Slovenian capital nestled between the Alps and the Balkans, embodies this metamorphosis. With regulatory boldness and a crypto culture already ingrained, it now outshines Hong Kong and Zurich. How has this city of 300,000 inhabitants managed to dominate the game? The answer lies in a subtle mix of legislative pragmatism, agile infrastructures, and an almost organic popular adoption.

The crypto scene could have marked a historic turning point. A partnership between Nvidia and a blockchain network, an official recognition of crypto by a giant in the semiconductor industry. Yet, as usual, hope turned into a mirage. Just a few hours before the announcement, Nvidia withdrew its support, leaving the project in uncertainty. A scenario that summarizes a tumultuous relationship: despite the technological advancements of blockchain, the Californian company sticks to a clear stance. Crypto remains persona non grata in its ecosystem.

Jerome Powell, the chairman of the Federal Reserve (Fed), is facing increasing political pressure from Donald Trump, who is calling for an immediate reduction in interest rates. But Powell has no intention of yielding. Loyal to the independence of the institution he leads, he prefers to base his decisions on economic data rather than political demands.

Paul Atkins officially takes the helm of the SEC and could change the game for the American crypto universe. Details here!

In a world where information often blends with misinformation, Telegram, the encrypted messaging app, found itself at the center of an unprecedented controversy. While France claims to have forced the platform to comply with European regulations following the arrest of its founder, Pavel Durov turns the accusation around: according to him, it was the French authorities who delayed implementing the procedures stipulated by the EU. A rhetorical duel that reveals deeper tensions over the control of tech giants.

Galaxy Research proposes a new voting mechanism to adjust the inflation of SOL on the Solana blockchain. This innovative system aims to surpass the limitations of binary voting by introducing a more representative decision-making method, thereby strengthening the decentralized governance of the Solana crypto ecosystem.

While Beijing maintains a strict ban on cryptocurrencies, a paradoxical reality is emerging: local governments are quietly selling off seized digital assets, filling their public coffers. Between opacity and financial urgency, this practice reveals the cracks in a system torn between repression and economic pragmatism. A tangle that reignites the debate on the legal framework for these assets, in a geopolitical context where China watches with suspicion the crypto-American advances.

France is struggling with a massive deficit, Bayrou calls for more work, but amid social cuts and political tensions, the reform risks triggering a governance crisis.

While economists count illusions, Bitcoiners sense the truth. False data, weakening dollar: a new monetary dogma is being born before our eyes, far from official reports.

In response to the turbulence in the financial markets amplified by Donald Trump's trade policies, Susan Collins, president of the Boston FED, announced that the Federal Reserve is preparing to intervene. Among the options considered to stabilize the markets, a reduction in interest rates could become inevitable if the situation deteriorates.

Is the XRP case coming to an end? Ripple and the SEC suspend their appeals. The crypto ecosystem could emerge stronger. Details!